Sui and Aptos Compete for Position as Next Solana

As SOL reached new all-time highs, the search for the “next Solana” intensifies.

Among the contenders are MoveVM-based chains Sui and Aptos. Developed by teams with backgrounds from Facebook, these chains utilize the Move programming language created for the Libra (later Diem) project.

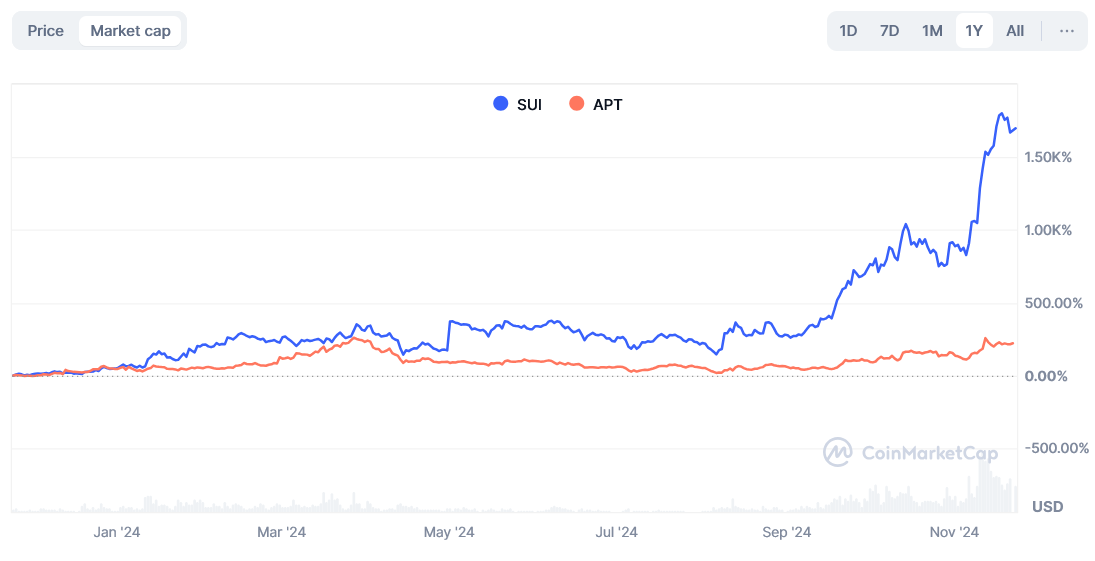

SUI has significantly outperformed APT on a year-to-date basis, overtaking Aptos in market cap in mid-September.

Despite experiencing a brief outage, SUI’s price rebounded, reinforcing its comparison to Solana due to similar outages.

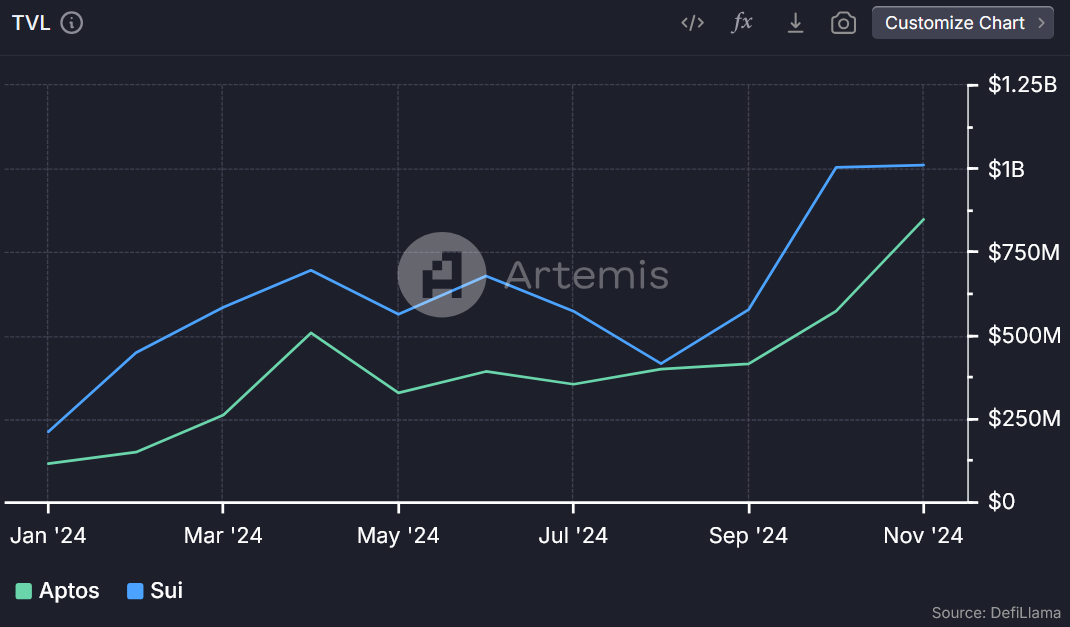

In terms of total value locked (TVL), both chains show comparable activity, aided by ongoing liquidity incentive campaigns. Currently, Sui hosts 44 active dapps while Aptos has 49, according to DefiLlama.

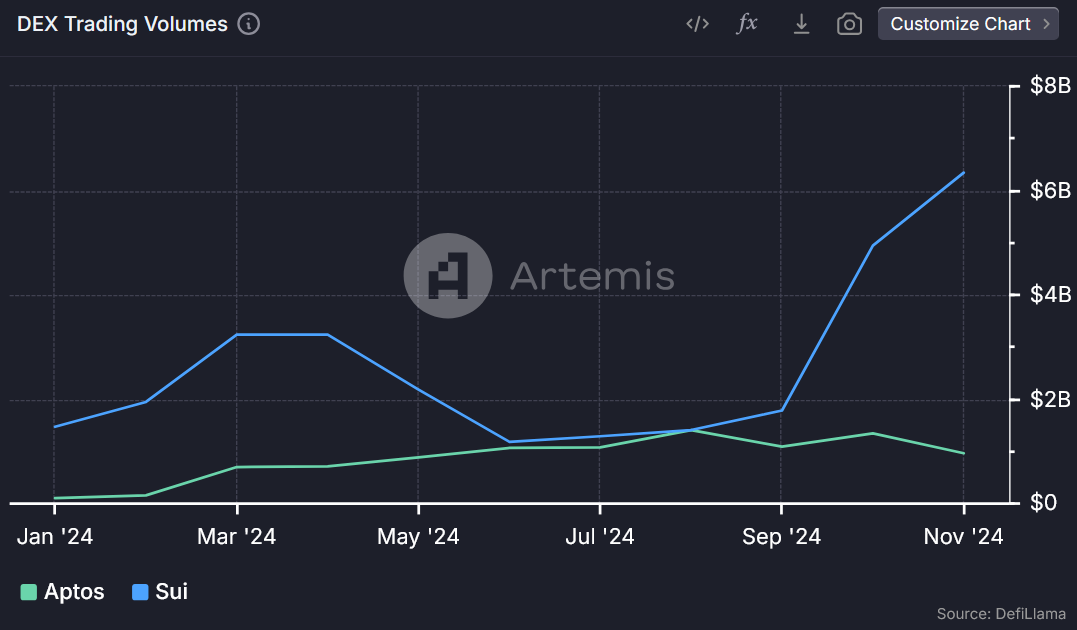

Sui’s decentralized exchange trading volumes have seen a threefold increase since September, surpassing Aptos significantly in the last month.

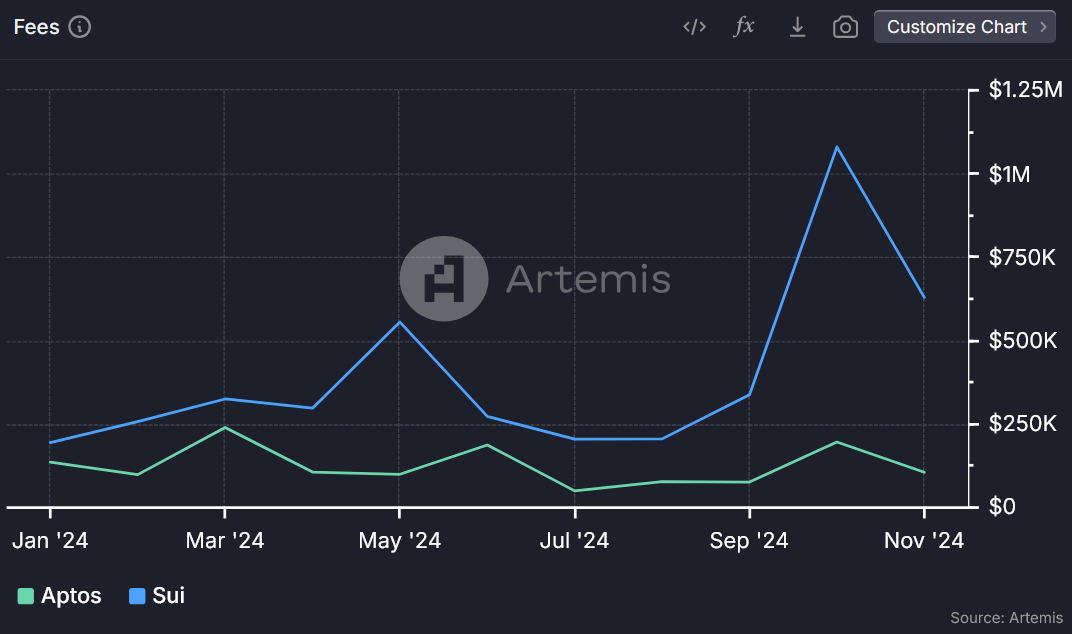

In October, Sui generated $1.1 million in fees compared to $196k for Aptos.

Both chains are engaging with real-world assets. Ondo has deployed its USDY tokenized Treasurys product on both platforms, with approximately $8.3 million on Sui and $15.7 million on Aptos.

Aptos recently announced BlackRock’s deployment of its tokenized RWA BUIDL fund, while Sui partnered with Franklin Templeton's digital assets division to enhance ecosystem growth.

Both Sui and Aptos are exploring hardware opportunities. Sui focuses on gaming with its handheld console SuiPlay0x1 and a partnership with esports team Team Liquid. Aptos is collaborating on a budget smartphone called the JamboPhone.