16 4

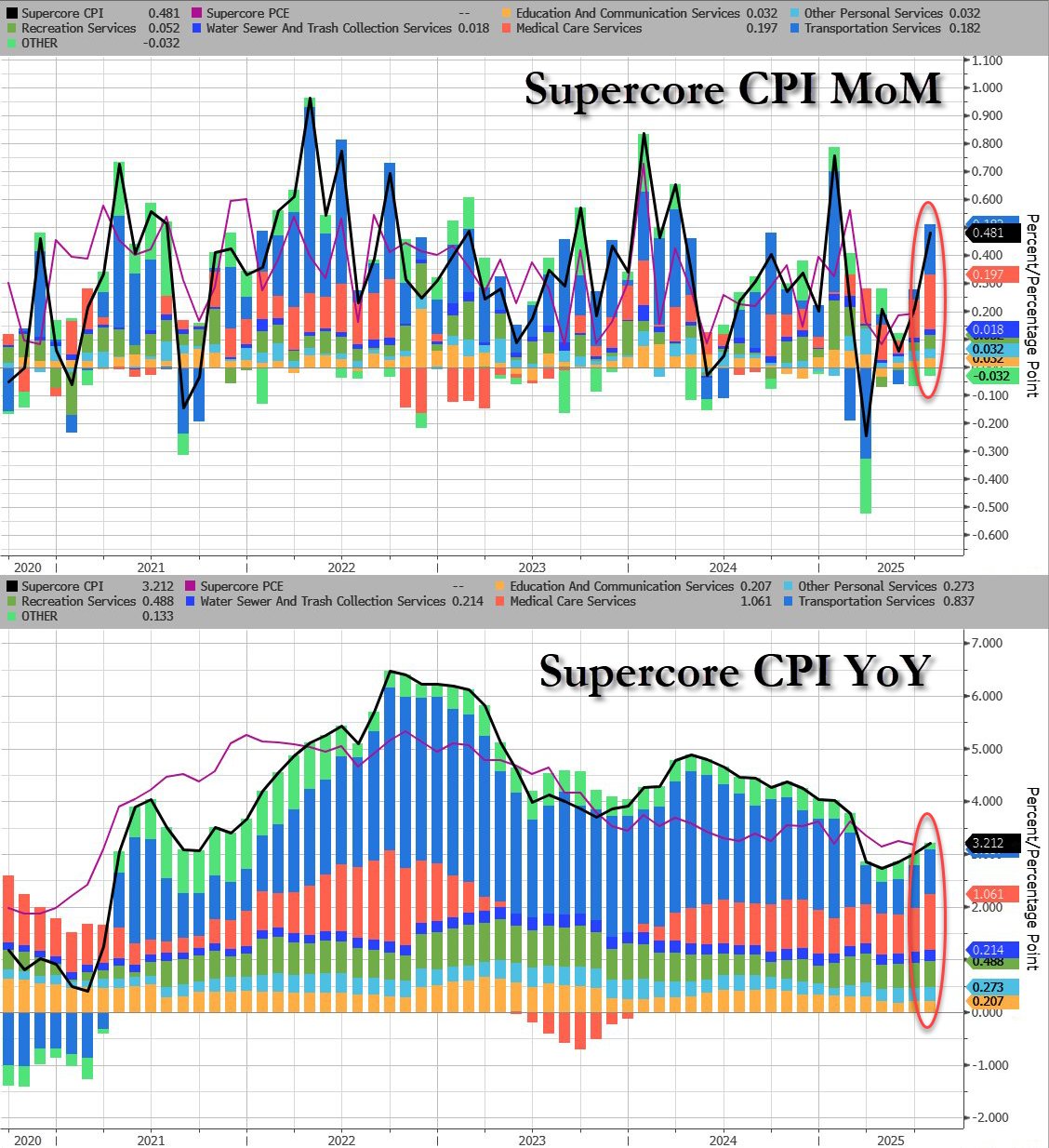

Supercore CPI Data Shows Rise in Service-Sector Inflation

The U.S. Supercore CPI data indicates a rise in service-sector inflation, with both month-over-month and year-over-year figures increasing. Supercore CPI excludes housing and energy, serving as an important metric for the Federal Reserve.

- The Fed may maintain elevated interest rates or consider hikes due to this increase.

- Higher rates result in more expensive borrowing, decreased spending, and potential negative impacts on risk assets.

- In crypto markets, sustained inflation and tight monetary policy typically lead to short-term volatility and reduced price momentum as investors prefer safer assets.

- If the spike is seen as temporary and the Fed adopts a patient stance, crypto could benefit from a softer rate outlook later this year.

- Inflation trends will significantly affect rate expectations and capital flows into digital assets in the coming months.