Swiss National Bank Declines to Hold Bitcoin Reserves Citing Volatility

The Swiss National Bank (SNB) will not hold bitcoin reserves due to concerns over market liquidity and volatility. SNB President Martin Schlegel stated that cryptocurrencies do not meet the bank's high requirements for currency reserves.

- Cryptocurrency liquidity is questioned during crises.

- High volatility poses risks for long-term value preservation.

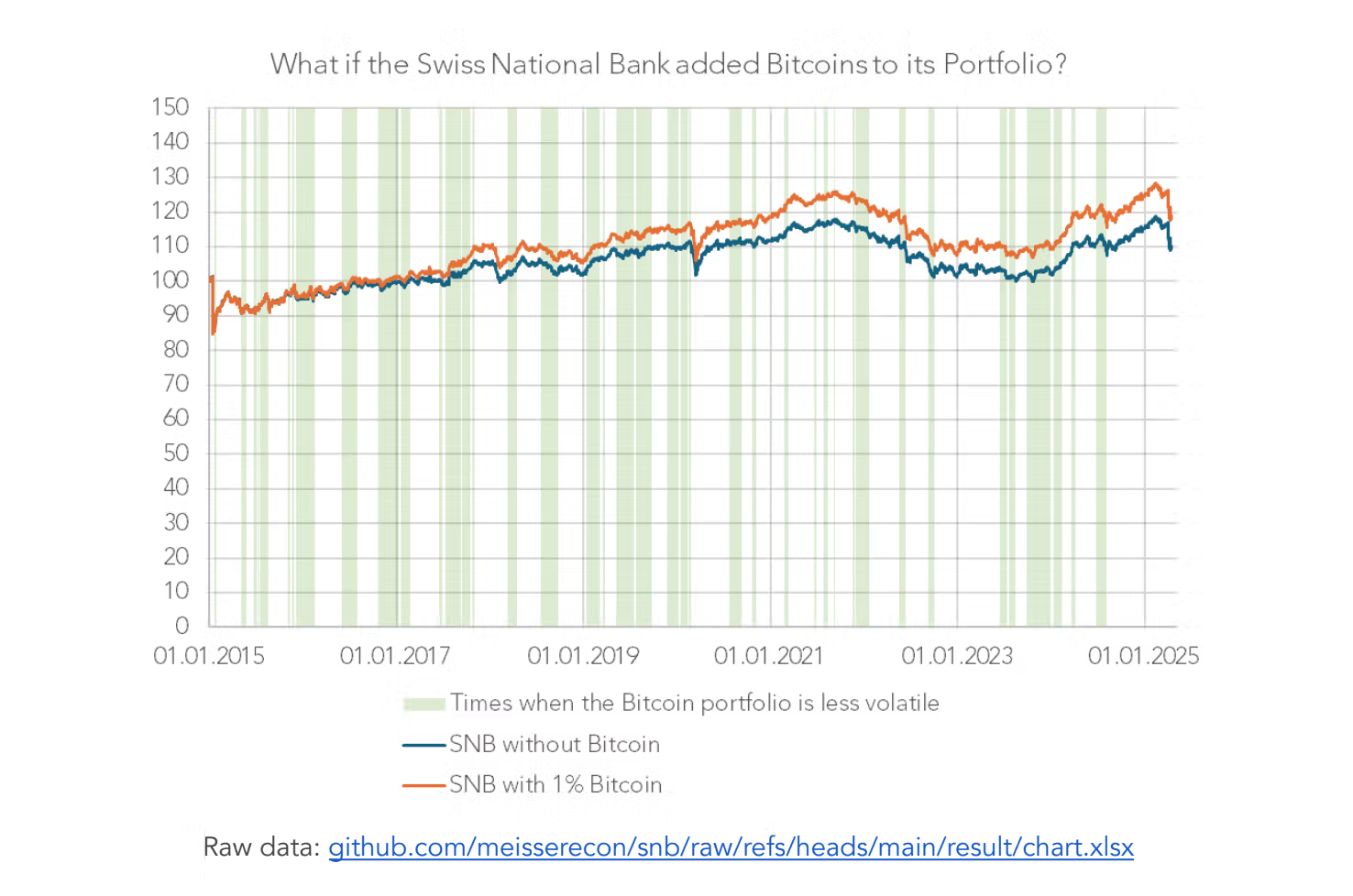

Comments from the SNB followed a proposal by the Bitcoin Initiative, which suggested that including bitcoin in Switzerland’s treasury would enhance portfolio returns with minimal added volatility. The initiative's simulation indicated:

- Without bitcoin, SNB investments grew by approximately 10% since 2015.

- A 1% allocation to bitcoin could have nearly doubled returns.

- Annualized volatility would see only a slight increase.

The Bitcoin Initiative argued that bitcoin’s volatility should be assessed in the context of overall investment dynamics. Luzius Meisser from the initiative noted:

- Bitcoin has reached new highs and shown resilience under market stress.

- It maintains high trading volumes daily, even on holidays.

- The Bitcoin network is one of the most reliable IT systems.

The initiative speculated that the SNB's stance against bitcoin might have political motives, potentially affecting Switzerland's relationship with the EU. European Central Bank President Christine Lagarde has criticized bitcoin as lacking value and being speculative.

Other central banks, such as Poland and Romania, have also ruled out holding bitcoin. The Federal Reserve stated it cannot own bitcoin under current law.

As of late 2024, the SNB has indirect bitcoin exposure through stocks in companies holding bitcoin treasuries. Schlegel previously dismissed public calls to add bitcoin to reserves and noted ongoing pilot projects related to central bank digital currencies.

In contrast, U.S. President Donald Trump recently signed an executive order establishing a strategic bitcoin reserve while prohibiting the promotion of a central bank digital currency for privacy reasons.