9 0

Tether Hires HSBC Traders to Expand Gold and Precious Metals Unit

Tether Expands into Precious Metals Market

- Tether has hired senior metals traders from HSBC to expand its gold reserves and precious metals trading operations.

- The company aims to diversify its balance sheet by increasing exposure to physical assets like gold, driven by volatile macroeconomic conditions and investor demand for tangible value.

- As of September 2025, Tether's gold reserves amount to over $12 billion, making it one of the largest private gold holders in the financial sector.

- New hires bring extensive experience in bullion trading and metals risk management, positioning Tether as a significant player in the global precious metals market.

- Gold prices have surged above $4,100, influenced by geopolitical uncertainty and the economic impact of the US government shutdown.

- Tether plans to enhance liquidity, improve storage efficiency, and explore new gold-backed financial instruments.

- Executives expected to join include Vincent Domien, HSBC’s Global Head of Metals Trading, and Mathew O’Neill, former Head of Precious Metals Origination for EMEA.

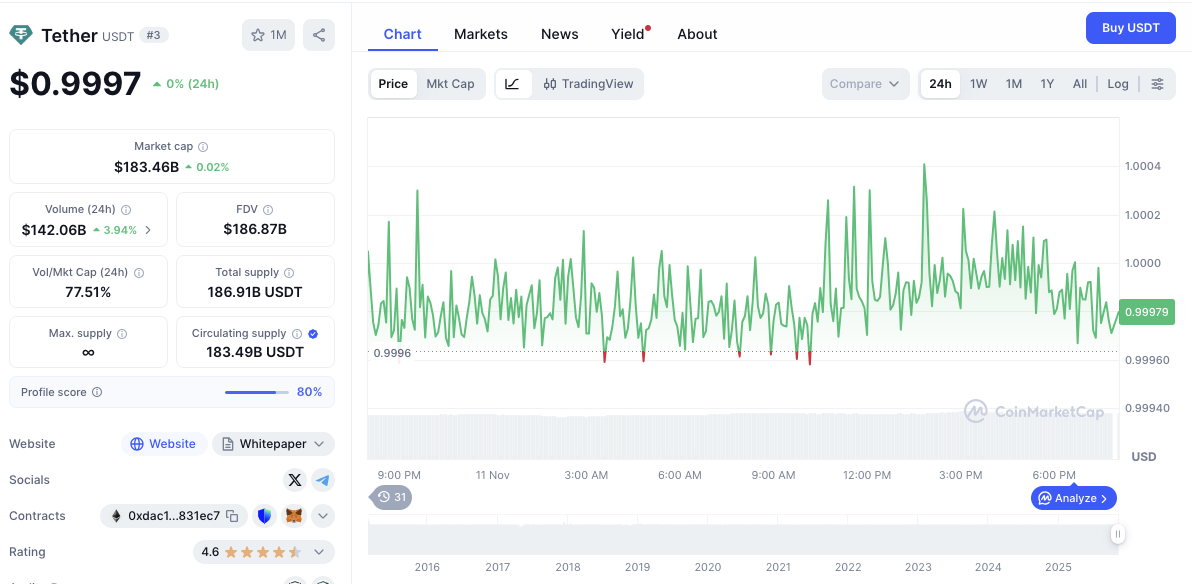

- Tether's USDT market capitalization has surpassed $183 billion, with a $17 billion increase in stablecoin supply in Q3 and $6.5 billion in excess reserves.