Tokenization of Real World Assets Surpasses $65 Billion Market Cap

The tokenization of real-world assets (RWAs) is gaining traction among institutions for enhanced collateral mobility and access to alternative investments. The market cap reached $50 billion by the end of 2024 and exceeded $65 billion by May 2025, excluding stablecoins.

At the recent TokenizeThis 2025 conference, industry leaders discussed key themes:

- Adding utility and enhancing collateral mobility for RWAs

- Impact of tokenization on investment strategies and workflows

Utility and Collateral Mobility

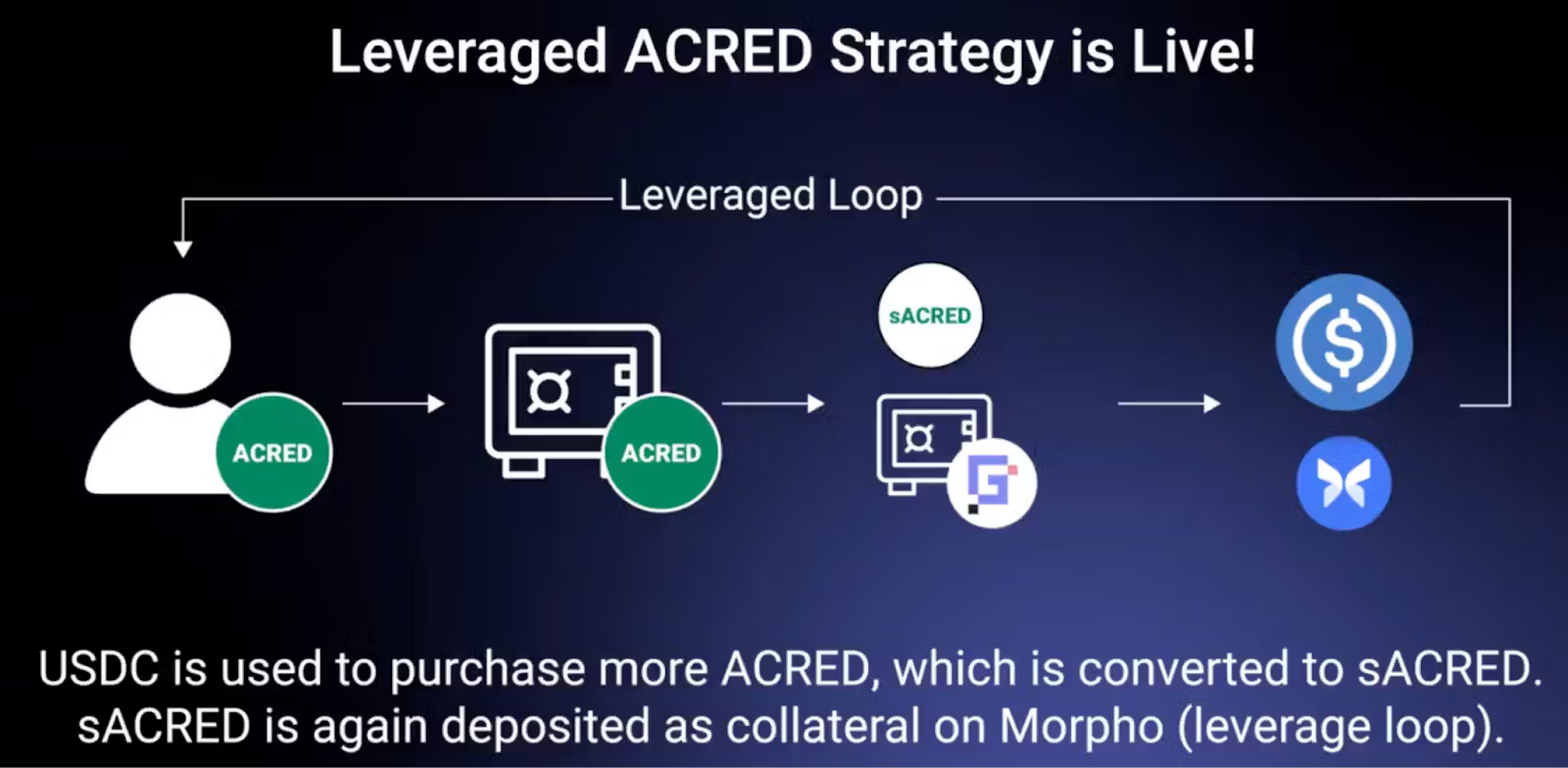

Maredith Hannon from WisdomTree emphasized the technology's versatility for different investors. Tokenization enables streamlined asset usage compared to traditional methods. For instance, tokenized money market funds can serve as collateral without exiting positions, still generating yields.

Tokenization is also disrupting lending processes. Jerome de Tychey from Cometh described a future where individuals can anonymously apply for mortgages directly from multiple lenders, simplifying borrowing. Figure utilizes blockchain for home equity lines of credit, achieving operational efficiencies by saving costs in the process.

Despite ongoing challenges—like high custody costs and limited liquidity—enthusiasm for tokenization remains strong.

Impact on Traditional Strategies

Kevin Miao from Steakhouse Financial highlighted how tokenization simplifies back-office operations, potentially reducing fees and intermediaries. This could ease the integration of higher-yielding, less liquid assets into investment strategies.

Cameron Drinkwater from S&P Dow Jones Indices discussed how blockchain can create new portfolio construction tools, allowing for hybrid strategies combining crypto and traditional assets for diversification.

To realize these benefits, interoperability between legacy and blockchain systems is crucial. Enhancing visibility and workflow alignment will facilitate the democratization of illiquid assets and improve financial efficiency. Tokenization is transitioning from theory to practical application in both traditional and decentralized finance.