10 0

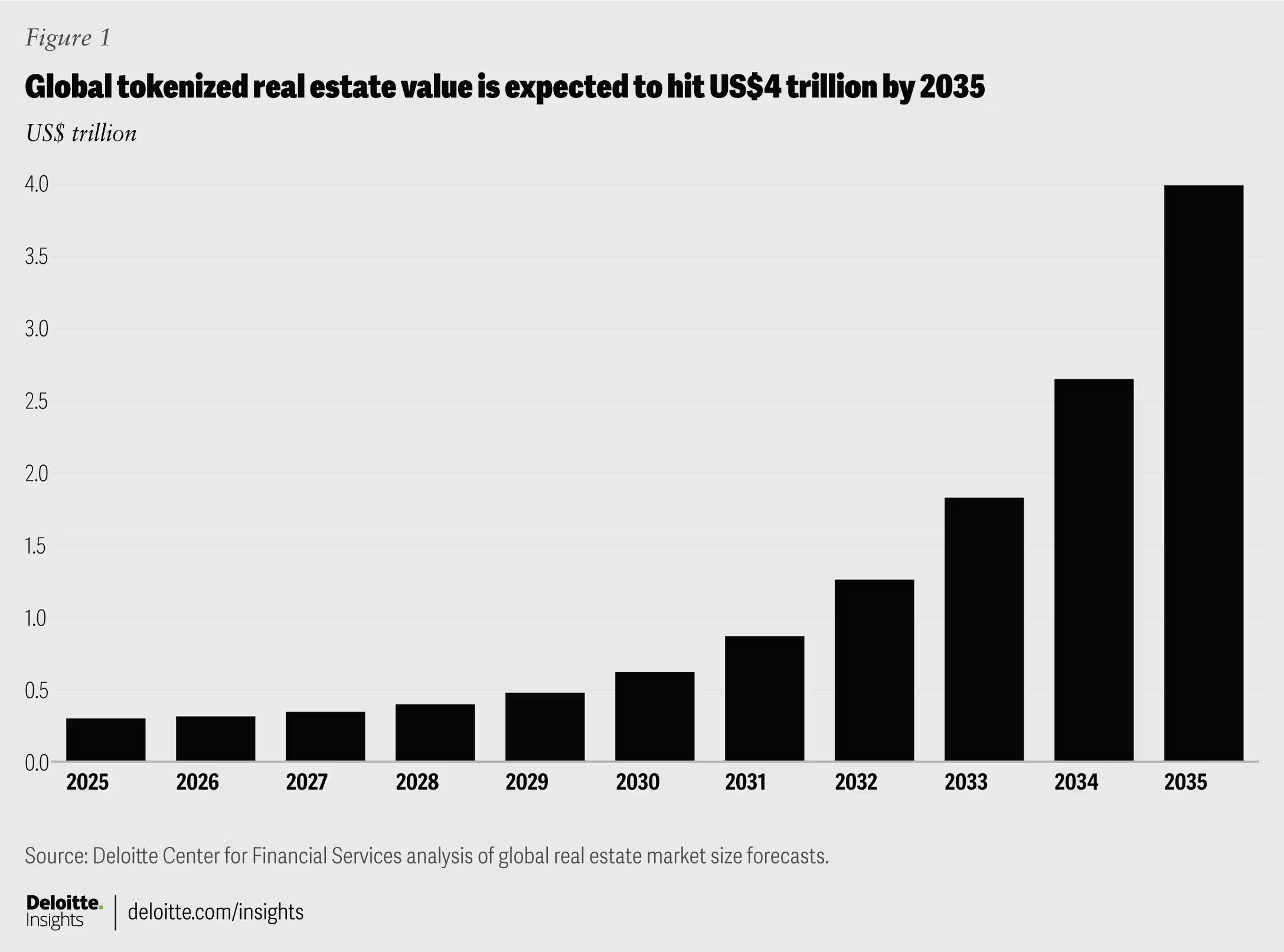

Tokenized Real Estate Market Projected to Reach $4 Trillion by 2035

Tokenization of real estate is poised to transform property financing and trading, as per a report by Deloitte Center for Financial Services. Key insights include:

- The tokenized real estate market may reach $4 trillion by 2035, growing at a compound annual rate of 27% from under $300 billion.

- Tokenization creates digital asset versions on blockchain, enhancing operational efficiency and providing broader investor access.

- It simplifies complex financial agreements, exemplified by Kin Capital's $100 million tokenized real estate debt fund on the Chintai platform.

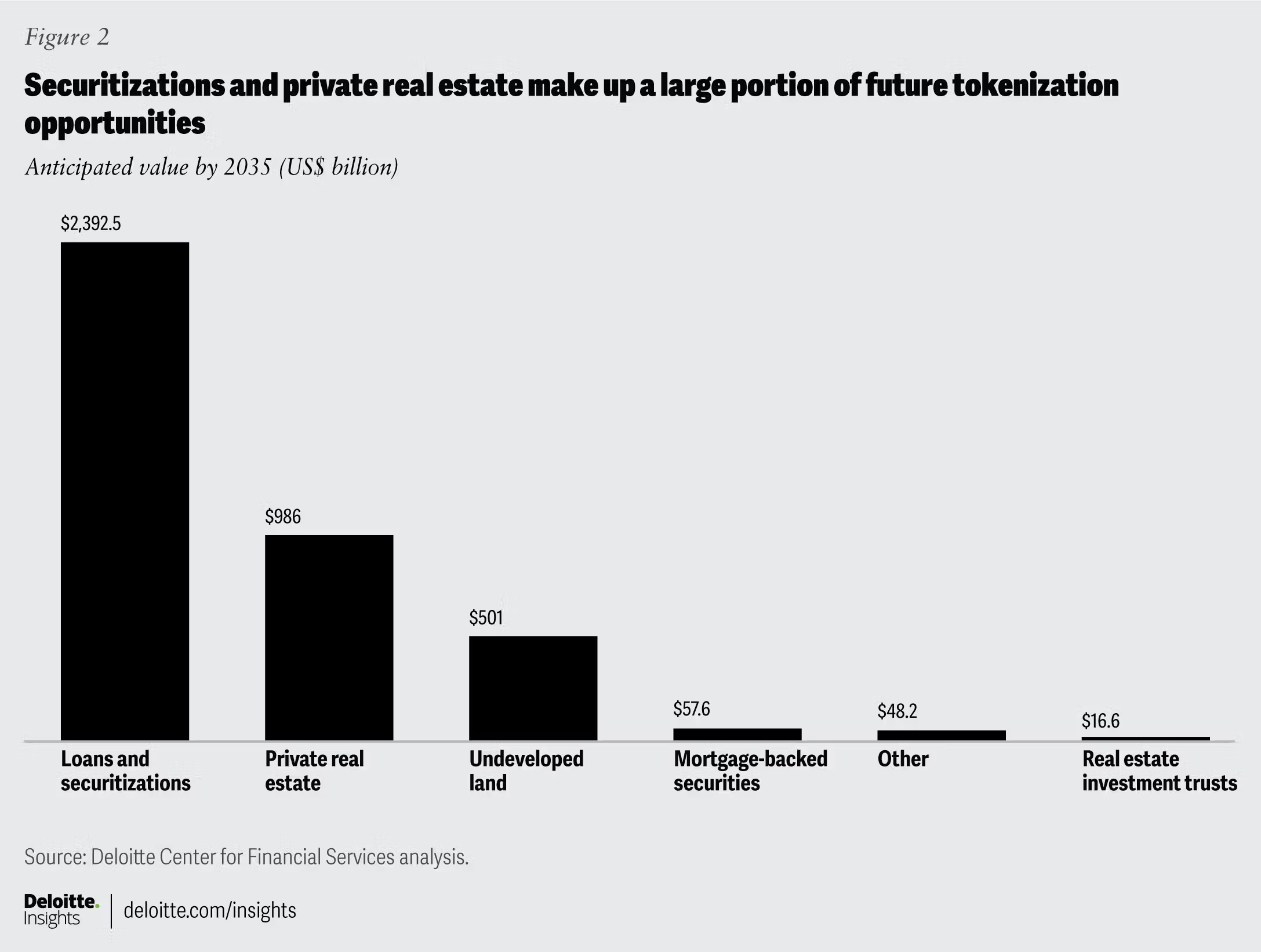

- The report forecasts three main areas for tokenized property: private real estate funds, securitized loan ownership, and undeveloped land projects.

- Tokenized debt securities are expected to dominate, valued at $2.39 trillion by 2035, with private funds around $1 trillion and land development assets at $500 billion.

Challenges remain in regulation, asset custody, cybersecurity, and default scenarios.