28 January 2025

0 0

Tom Lee Calls Monday’s Market Drop a Buying Opportunity for Investors

Tom Lee from Fundstrat Research characterized Monday's market sell-off as an "overreaction." He emphasized that the substantial decline in NVIDIA (https://holder.io/coins/nvda/) presents a significant buying opportunity.

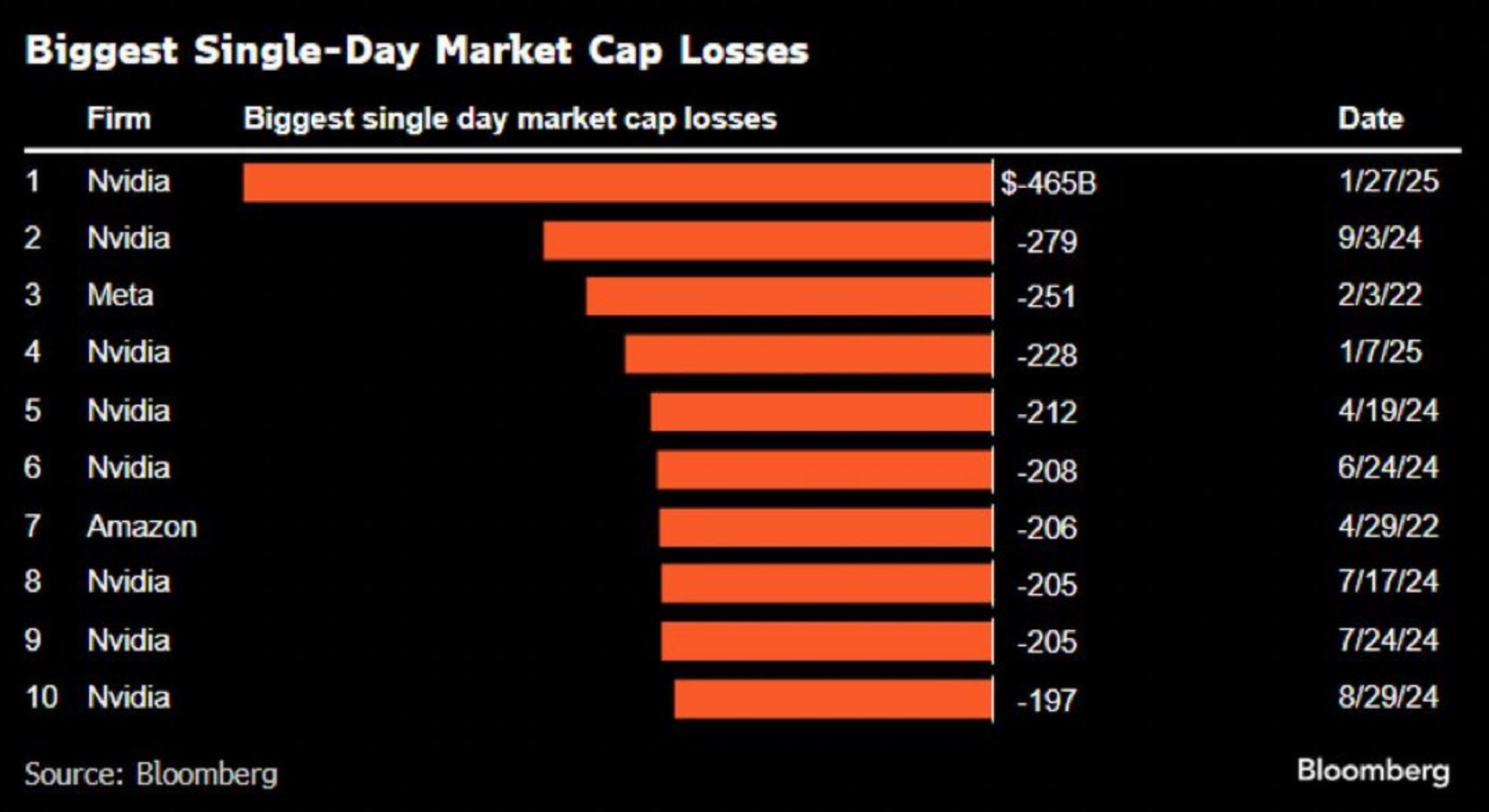

- NVIDIA experienced a historic single-day market cap loss of $465 billion.

- Nasdaq fell 3%, while NVIDIA dropped 17%; however, Nasdaq futures are up 1% and NVDA is 5% higher in pre-market trading.

- Bitcoin (https://holder.io/coins/btc/) dropped to $97,500 but rebounded above $103,000, with previous highs near $105,000.

- AI-related bitcoin mining stocks saw declines of up to 30%, including Core Scientific (https://holder.io/coins/corz/), which has slightly recovered in pre-market.

- Lee noted a strong market structure in U.S. equities, with bitcoin outperforming small caps and financials this year.

- The Federal Reserve policy meeting on Wednesday is expected to maintain the federal funds rate at 4:25-4:50. Lee suggested that the current market sentiment may be too hawkish regarding potential rate hikes in 2025.