18 February 2025

0 0

Toncoin Price Increases 1.7% Amid Signs of Accumulation

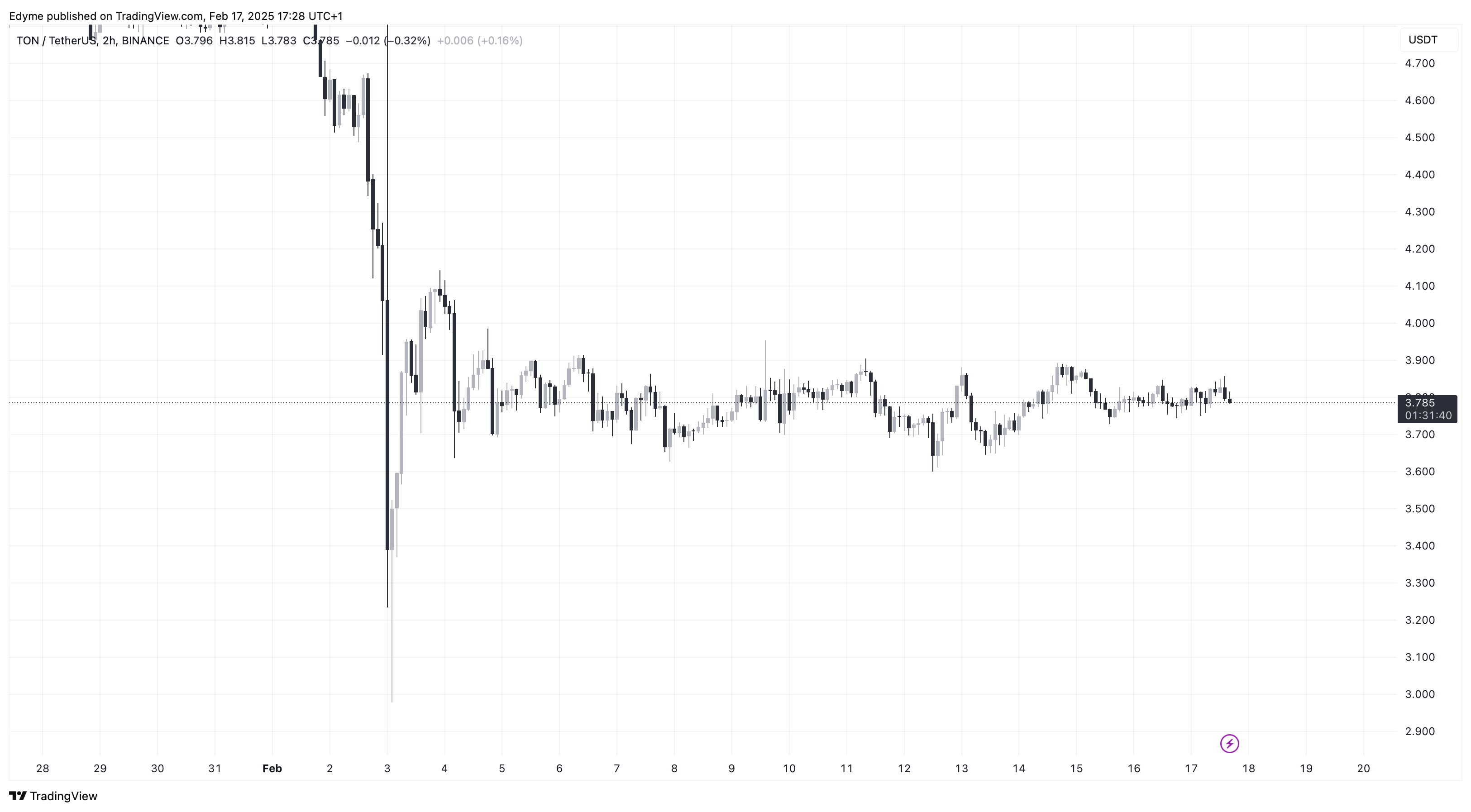

Toncoin (TON) has increased by 1.7% to $3.85 after a period of decline. Analysts suggest holders are preparing for a rebound, indicating potential accumulation despite recent price trends.

Key Insights on Toncoin

- The 180-day Sharpe Ratio indicates an accumulation phase.

- Stable Total Value Locked (TVL) in lending protocols and reduced speculative trading support this view.

- Decreased volatility may suggest diminishing selling pressure.

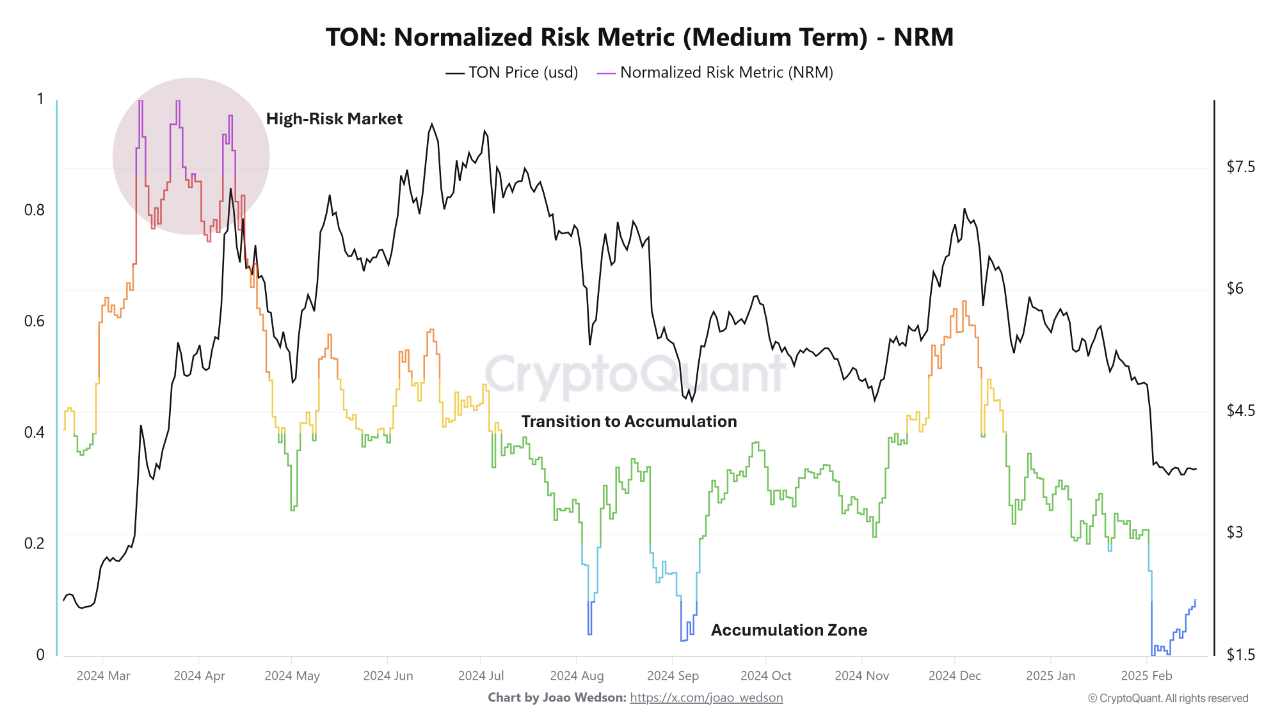

- Normalized Risk Metric (NRM) highlights accumulation at approximately $3.82.

- Record lows in Long-Term NRM indicate long-term holders are accumulating TON.

Analyst Shiven Moodley noted that the current environment could favor long-term accumulation traders while risk metrics show low-risk conditions.

On-Chain Metrics Indicate Long-Term Potential

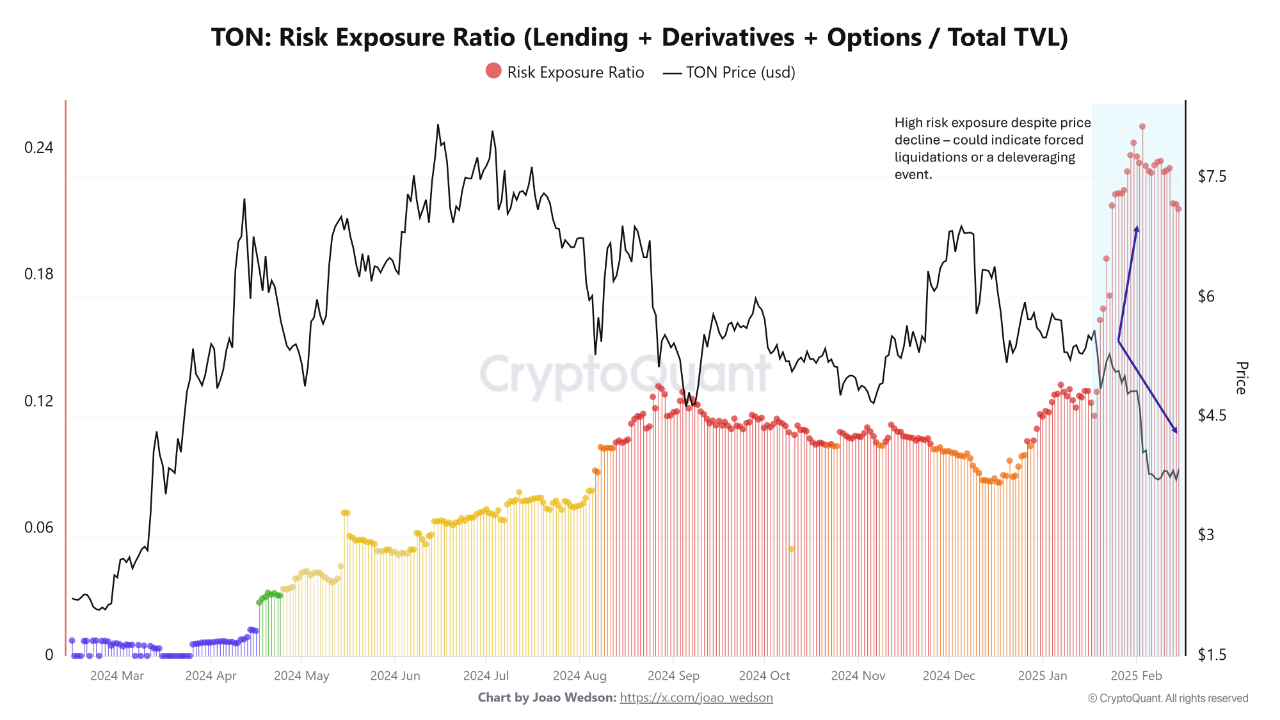

- Risk Exposure Ratio has reached over 0.24, indicating increased leveraged activity.

- A declining ratio may signal market stabilization.

- Probability of Spend metric shows coins older than 400 days are likely not moving, reflecting strong conviction among long-term holders.

- Short- to medium-term holders appear to be exiting, while long-term holders remain steady.

If selling pressure continues to ease, TON may benefit from macroeconomic shifts that could enhance its value.