3 0

Traders Eye Bitcoin Hyper, SUBBD Token, and Monero as Derivatives Stabilize

Key Insights:

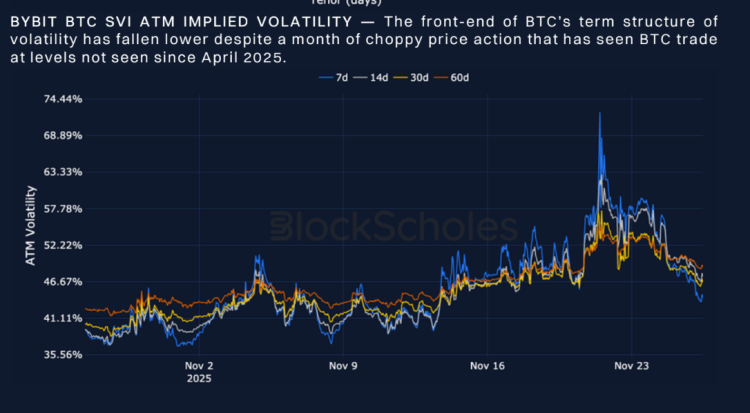

- Derivatives markets are stabilizing, with funding rates normalizing and implied volatility decreasing.

- This stability presents an opportunity for traders to pivot towards technology-driven investments before leverage-induced fear of missing out (FOMO) resurfaces.

- Bitcoin Hyper has raised over $28 million to integrate Solana-speed smart contracts with the Bitcoin network, potentially enhancing transaction efficiency and unlocking DeFi capabilities on Bitcoin.

- SUBBD Token offers AI tools aimed at empowering creators by decentralizing control and automating content production, with a presale raising over $1.3 million.

- Monero, known for its privacy features, continues to bolster its security with the FCMP++ upgrade, appealing to those valuing anonymity amid increasing surveillance.

The derivatives market's current state suggests a shift from fear to early accumulation phases. This environment benefits projects addressing key challenges like Bitcoin's transaction speed, creator monetization, and on-chain privacy.

These developments highlight strategic investment opportunities in transformative crypto projects amidst the ongoing market stabilization.