Treasury Borrowing Advisory Committee Releases New Debt Issuance Recommendations

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

The quarterly refunding announcements (QRA) from the Treasury Borrowing Advisory Committee (TBAC) have gained attention as market participants focus on government funding methods amid rising rates and fiscal deficits. The TBAC advises the Treasury on debt issuance strategy.

This week marked the last QRA before the election. Insights from the report are as follows:

Debt Issuance Quantity

The Treasury's plans for debt issuance in the upcoming quarters include:

For October – December 2024:

- Targeting a Treasury General Account (TGA) drawdown from $886 billion to $700 billion.

- Issuing $546 billion in net issuance.

For January – March 2025:

- Targeting a TGA balance of $850 billion.

- Net borrowing of $823 billion.

This reflects an increase of $277 billion in planned debt issuance over the next couple of quarters, with a $150 billion requirement attributed to the decrease in the TGA balance.

Debt Issuance Composition

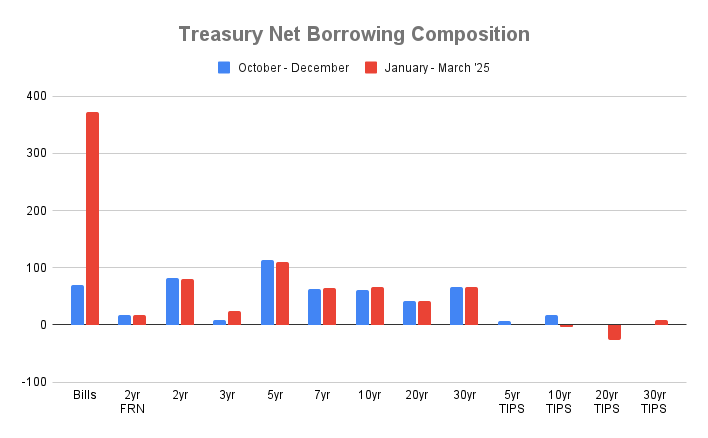

The maturity profile of debt issuance indicates how much of each maturity will comprise total borrowing. Key insights include:

- No changes in long-duration issuance composition are planned, as stated by Treasury Secretary Janet Yellen.

- If borrowing needs rise, short-term instruments (T-bills) will cover the additional issuance.

- A substantial increase in bill issuance is required due to the TGA drawdown to $700 billion and subsequent increase to $850 billion.

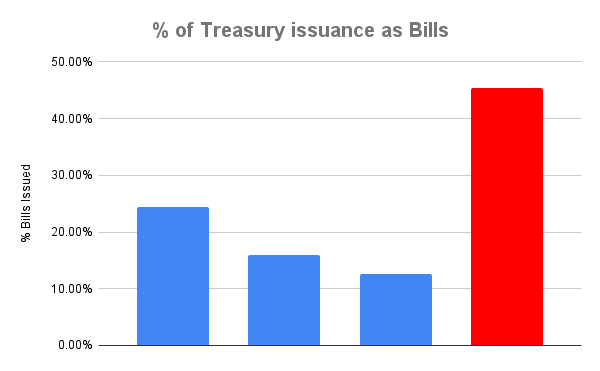

Recent proportions of net issuance reveal:

The Treasury forecasts an increase in T-bills from 13% to 45%, exceeding the historical target of 15% to 20%. This high proportion is expected to revert in Q2 2025 when tax receipts stabilize borrowing requirements.

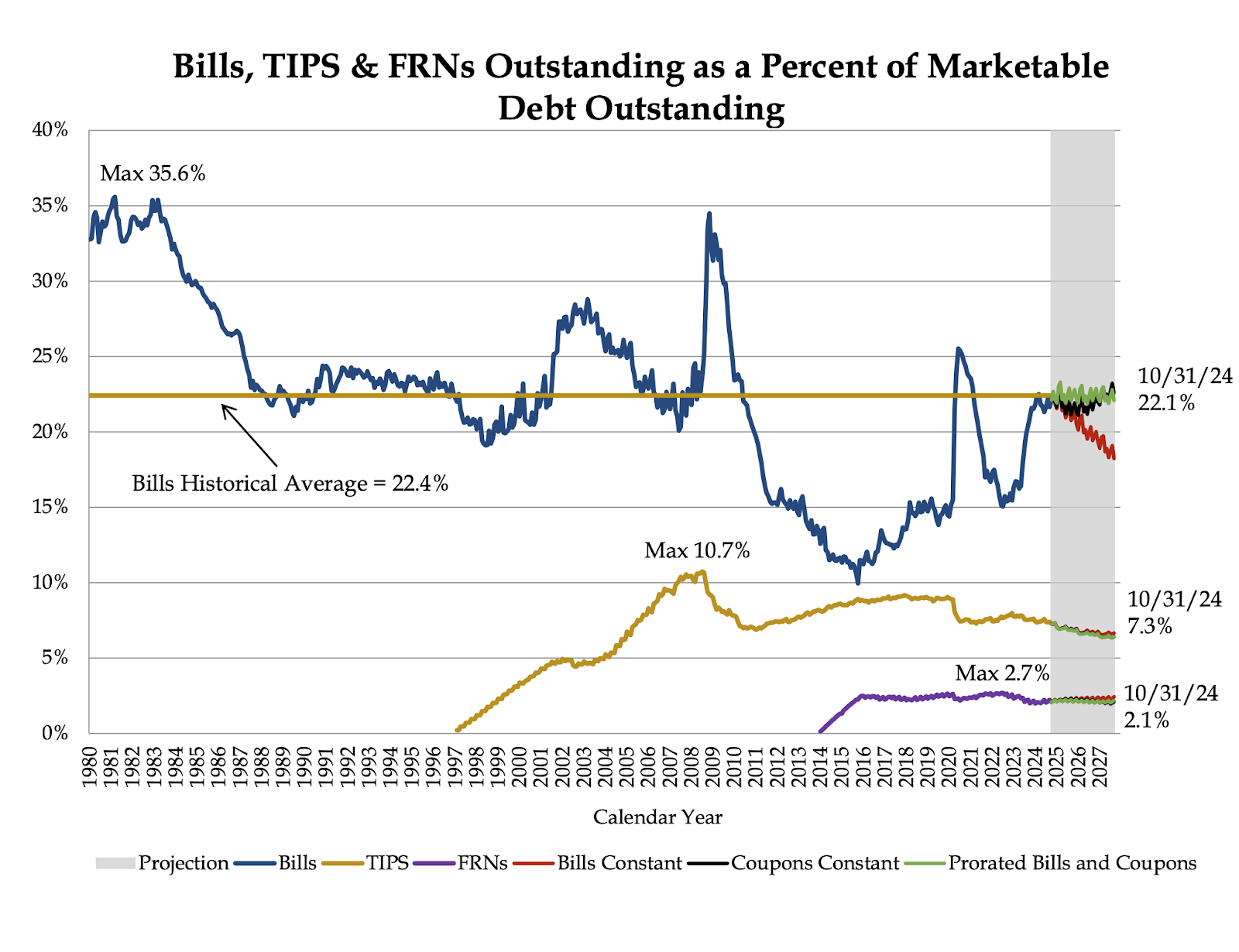

Concerns arise as total Treasury debt outstanding exceeds the upper limit of their target range at 22%:

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.

Explore the growing intersection between crypto, macroeconomics, policy, and finance with Ben Strack, Casey Wagner, and Felix Jauvin. Subscribe to the Forward Guidance newsletter.

Get alpha directly in your inbox with the 0xResearch newsletter — market highlights, charts, degen trade ideas, governance updates, and more.

The Lightspeed newsletter covers all things Solana. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.