4 1

Tron Reaches $80.2B Stablecoin Market Cap with New Tether Mint

Tron has demonstrated strength during the recent market downturn, limiting losses to 24% while many altcoins saw drops of 40% or more. This showcases Tron's resilience and unique market positioning.

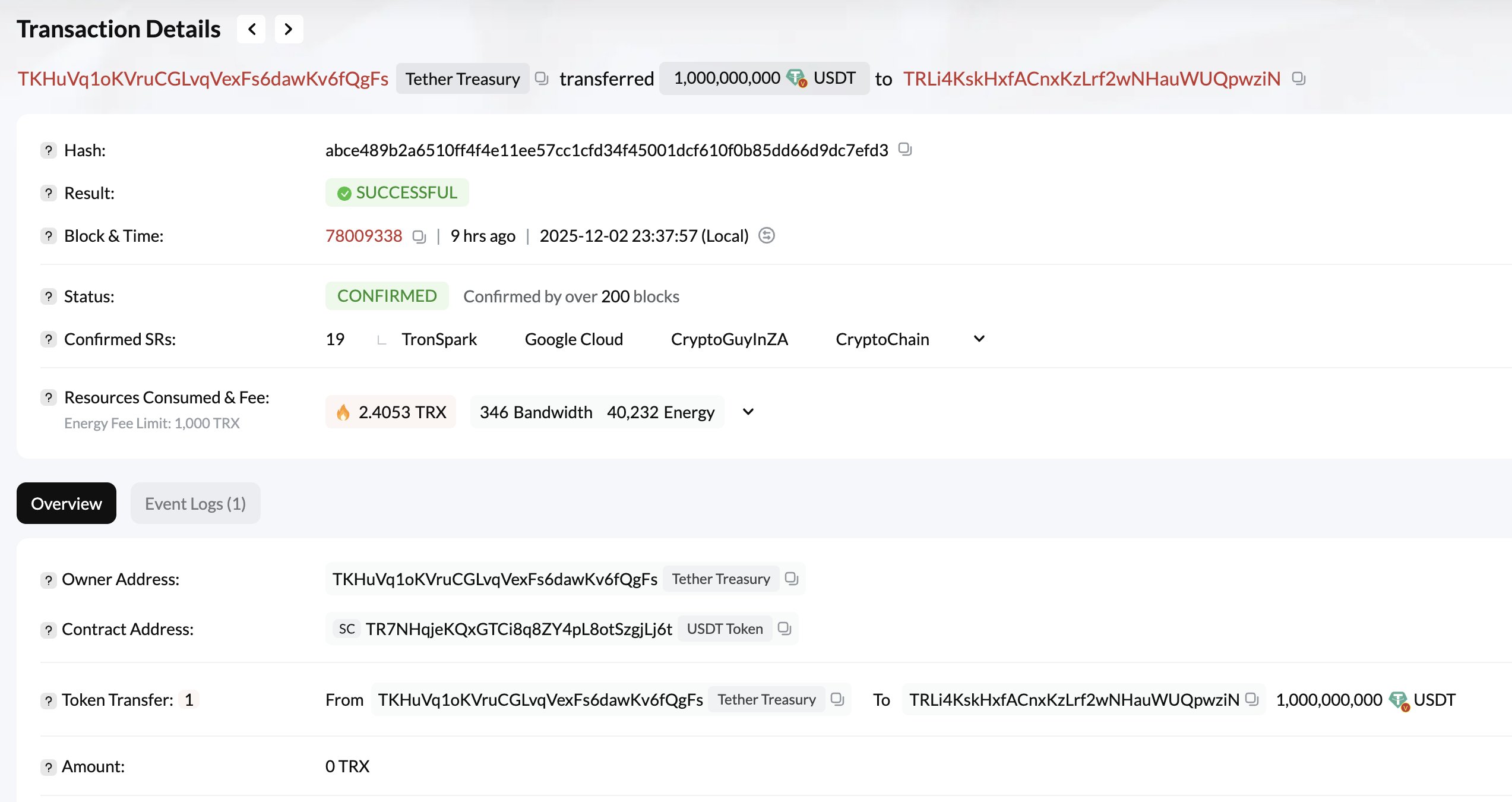

- Tron's dominance in the stablecoin sector is a key factor. Tether minted another 1 billion USDT on Tron, boosting its stablecoin market cap to over $80.2 billion.

- The network benefits as capital moves into stablecoins, maintaining stability amid market volatility.

- Tron is now the second-largest stablecoin network globally, known for fast transactions and low fees, making it popular for high-volume USDT transfers.

Despite Tron's growth, Ethereum remains the leader in the stablecoin space with a market cap of about $166 billion, driven by its DeFi ecosystem and institutional presence.

- Ethereum is preferred for liquidity in trading and yield strategies, while Tron focuses on settlement, payments, and exchange flows.

- Both ecosystems complement different market needs: Ethereum for DeFi depth and Tron for cost-efficient transactions.

Tron's TRX token shows resilience on weekly charts, holding above key support zones despite broader market volatility. The TRX price remains above the 50-week SMA, indicating structural strength.

- For bullish momentum, TRX needs to reclaim the $0.30–$0.32 region, potentially leading to a retest of the $0.34–$0.36 highs.

- TRX maintains its position as a stable performer with controlled downside risks.