TRON Reaches New High Amid Bearish Signals and Selling Volume Increase

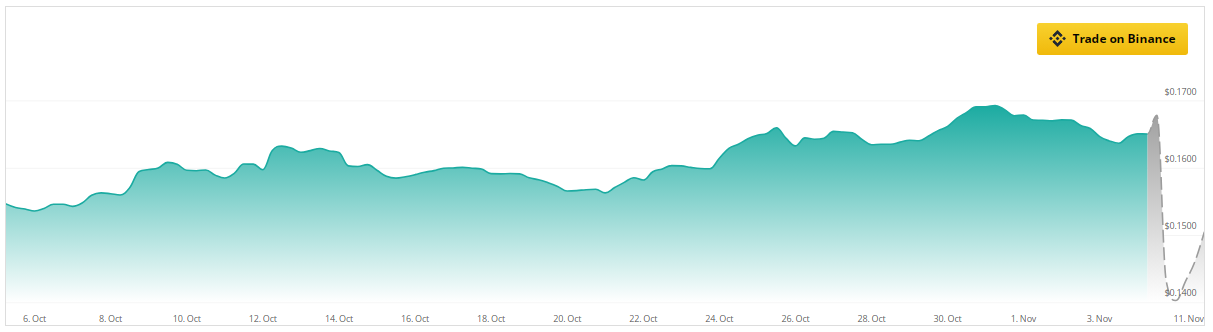

The price of TRON (TRX) has recently established a double-top technical formation, often used by analysts to predict trend reversals at peak prices. Currently trading at $0.1654, TRX is projected to increase by 67% over the next three months according to CoinCheckup data. However, market changes are causing trader concerns.

Increase In Sales Volume Raises Concerns

Analyst Alan Santana noted a significant rise in selling volume, indicating potential market pressure. High selling volume often signals waning upward momentum, especially amidst pessimistic sentiment.

#Altcoins | #TRX

Tron: New High & Double-Top (Full Trade-Numbers SHORT Incl.)

TRXUSDT (Tron) just produced a new high and double-top. This is one of the pairs that offers the best risk reward ratio because it trades so close near the All-Time High, near resistance.

Current… pic.twitter.com/aztSSGElGf

— Alan Santana (@lamatrades1111) November 3, 2024

This pattern may indicate an imminent decline for TRX traders, with experts suggesting a possible reduction in the coming weeks or months. Additionally, insufficient buying volume further complicates the outlook, as robust purchasing activity typically precedes price growth. The current trading activity shows a lack of buyer enthusiasm, which could negatively impact TRON investors.

TRON Holding Period Down

TRX investors are holding coins for shorter durations, with the holding period decreasing by 70%. This decline reflects diminished confidence in TRON's future value. The number of long-term holders has also decreased as more investors choose to sell, supported by the CMF indicator that measures market activity.

Future Projections

TRX has declined by 2.02% over the past day, attributed to cautious trading behavior. Given the double top and increased selling volume, traders should remain vigilant for potential trend reversals and declines.

Despite these short-term challenges, TRON has long-term growth potential. Experts project a 141% increase in six months and a 180% growth over the year, contingent on external market conditions affecting investments.

Featured image from Coins.ph, chart from TradingView