Trump’s Economic Policies Focus on Tariffs and Currency Recalibration

As investors analyze the implications of Donald Trump’s election and the Republican Congressional sweep, attention shifts to how his economic views will influence policies on global trade and American security.

Assessing the realism of campaign promises is now a priority. This week, Dr. Stephen Miran, a fellow at the Manhattan Institute and strategist at Hudson Bay Capital, shared insights from his tenure at the US Treasury during Trump’s first term.

Dr. Miran's recent paper, titled “A User’s Guide to Restructuring the Global Trading System”, serves as a framework for understanding the effects of increased tariffs and protectionist measures. A central question discussed is whether such a tariff policy will lead to inflation.

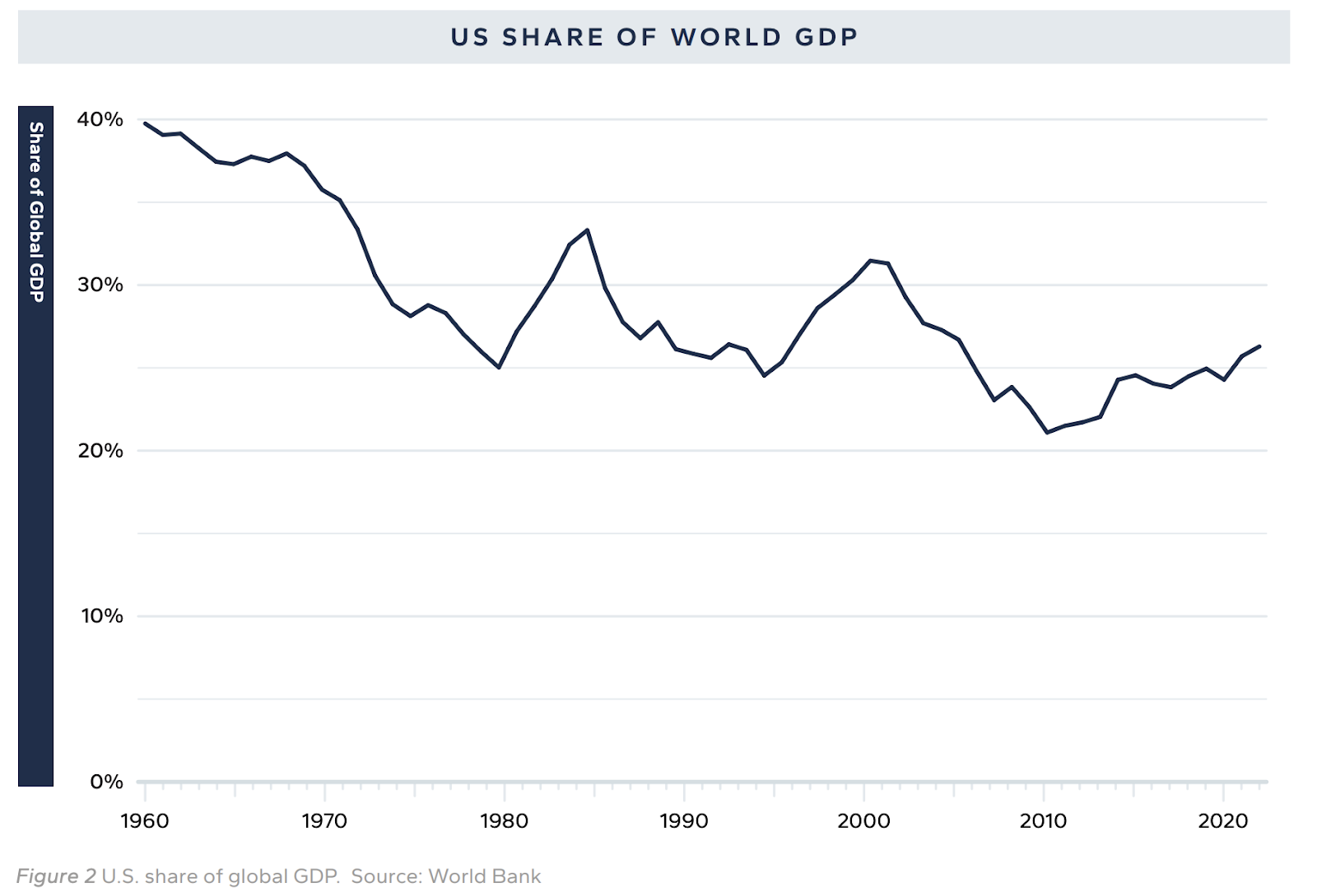

Dr. Miran introduced the concept of a "Triffin world," which arises from the challenges faced by a global reserve currency. The US dollar's status has historically resulted in an overvalued currency alongside rising fiscal and trade deficits. This situation can evolve into a crisis, known as Triffin's dilemma, particularly as the US share of global GDP declines.

Widening deficits can create tension between domestic and international priorities. To address this, Dr. Miran suggests that tariffs may help rebalance trade imbalances or that a currency devaluation could align the dollar with interest rate differentials.

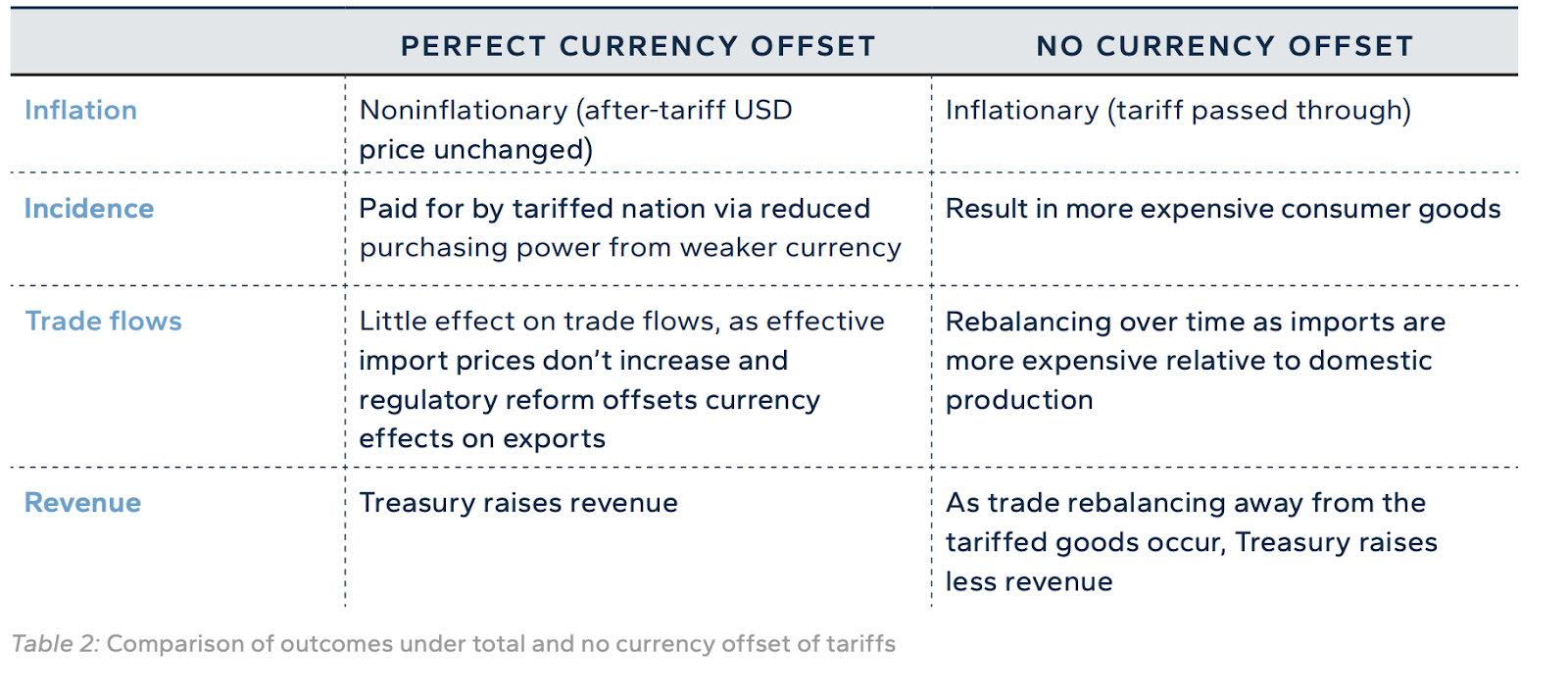

A critical inquiry remains: How will tariff-heavy policies impact domestic inflation? The extent to which price increases are transferred to consumers depends on how currency fluctuations offset these changes.

The success of implementing tariffs also hinges on the current business cycle context. The discussion extends to potential multilateral and unilateral currency agreements as strategies to prevent the US from facing a Triffin dilemma.

For details on effective currency agreements, refer to the full interview with Dr. Miran.