Markets React to Trump’s Election Win with Rising Long Bond Yields

After Trump’s election win was confirmed, markets began to react.

Market Response

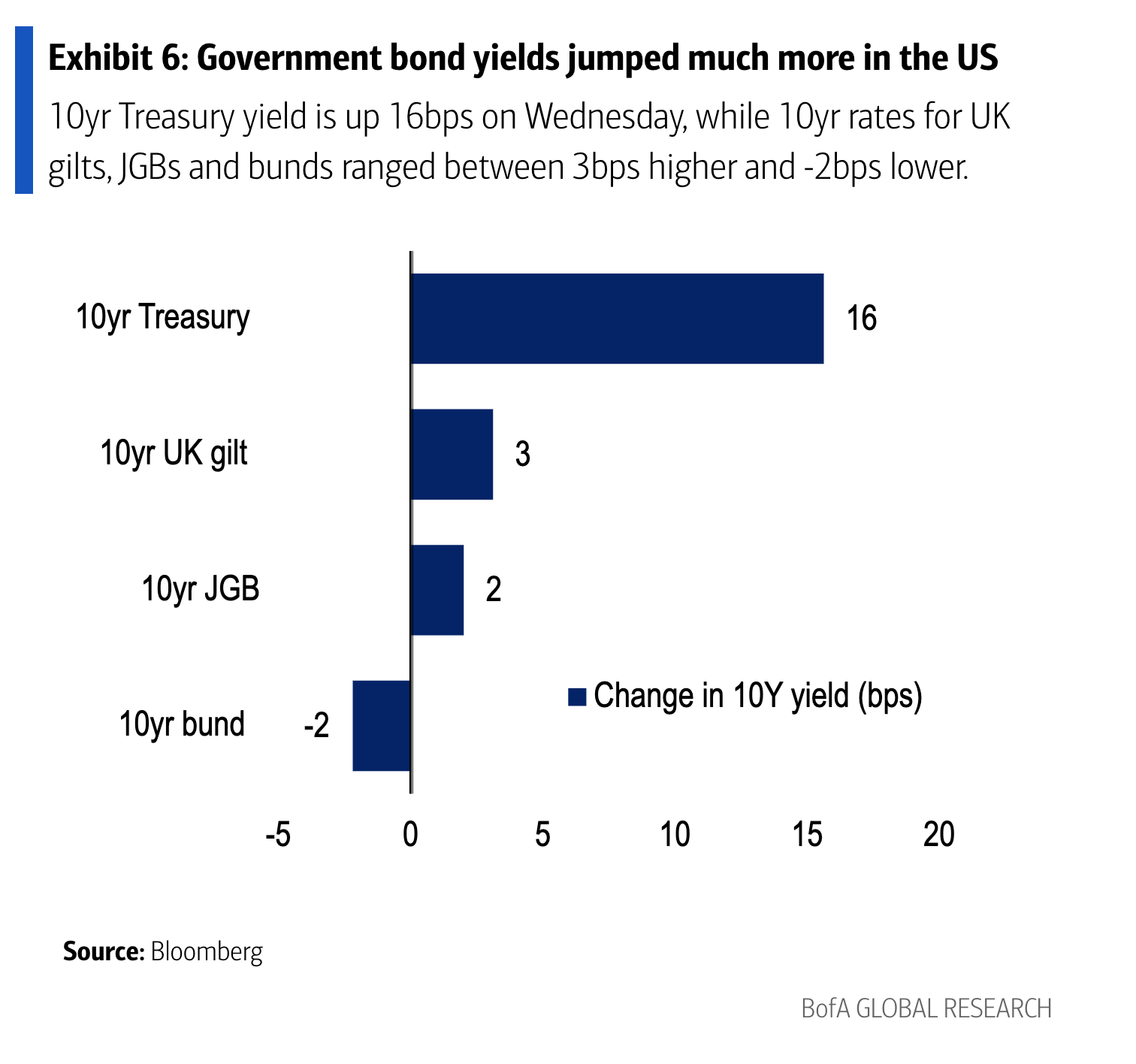

In bond markets, a Republican Congress sweep is expected to enable unrestrained legislation. Concerns about a re-accelerating economy and potential inflationary policies, such as Trump's tariffs, led to significant increases in long bond yields globally:

Simultaneously, the DXY index rose as investors anticipated higher nominal growth in the US. However, some of this increase reversed with a decrease in long bond yields.

Implications for the Fed

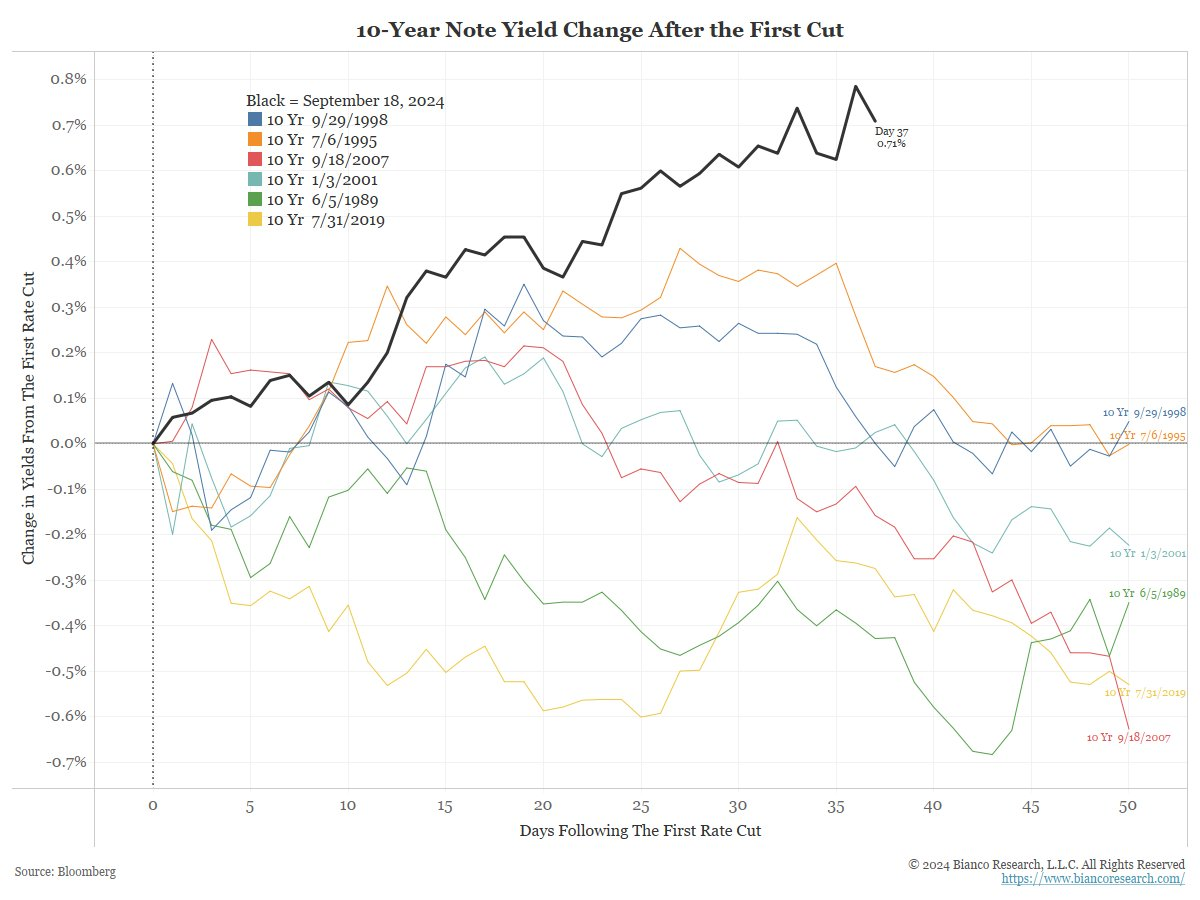

As shown by Jim Bianco, the reverse in long-term yields since the Fed's first rate cut is historic:

The majority of borrowing and lending occurs at the long end of the yield curve, affecting mortgages and other loans. Thus, rising long bond yields tighten financial conditions regardless of short-term rate changes.

FOMC Meeting Considerations

During today's FOMC meeting, Powell faces two approaches regarding yield management:

- Andy Constan from Damped Spring Advisors argues that a hawkish stance could lower yields and ease financial conditions. He suggests that further rate cuts might inadvertently tighten conditions as bond vigilantes push yields higher.

- Conversely, Tom Lee believes the Fed should adopt a more dovish approach, emphasizing that long bond yields are influenced by expectations of short rates during the bond's maturity.

With a 25bps cut today and no indication of ending quantitative tightening (QT), the Fed is likely to continue monitoring the effects of its current rate-cutting strategy on markets.