Updated 21 December

Trump’s World Liberty Financial Acquires 722 Ether for $2.5 Million

World Liberty Financial (WLFI), led by incoming US President Donald Trump, is focusing on decentralized finance projects and has quickly garnered attention in the cryptocurrency sector. The venture is actively acquiring digital assets, appealing to both skeptics and enthusiasts.

Trump, WLFI Add 722 Ether To Its Inventory

WLFI recently acquired 722 Ether, valued at approximately $2.5 million, during a market downturn. This purchase increased their total Ethereum holdings to about 15,598 tokens, valued at roughly $53 million. This acquisition signals WLFI's ambition to become a significant player in the DeFi landscape.

The project's primary goal is to democratize crypto loans, challenging traditional financial institutions. This focus resonates with investors seeking alternatives to conventional banking amid current uncertainties.

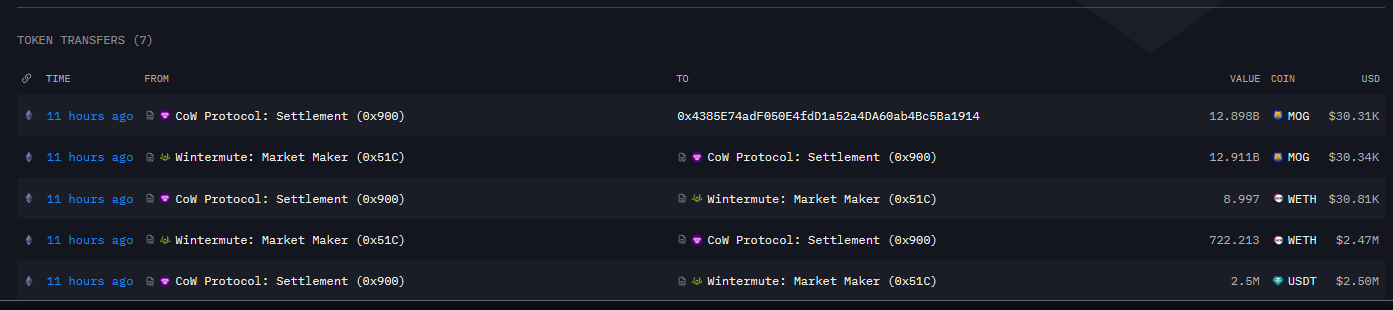

According to Arkham, the Trump family crypto project, World Liberty, purchased 722.213 ETH for 2.5M USDC via Cow Protocol on December 20 at 6:54 UTC+8. The project now holds a total of 15.595K ETH, valued at approximately $53.61M. https://t.co/CklEuO9IEH

— Wu Blockchain (@WuBlockchain) December 20, 2024

Diversifying To Other Coins

WLFI is also investing in other cryptocurrencies, including Aave and Chainlink, indicating a strategic approach to building a diverse portfolio aligned with Trump's vision of a "financial revolution."

Justin Sun, founder of TRON, has committed $30 million to WLFI as its leading investor and advisor. His involvement brings substantial cryptocurrency expertise, while Trump's brand recognition attracts interest from retail and institutional investors.

Questions Linger

Criticism surrounds WLFI concerning potential conflicts of interest and political patronage. Market observers are closely watching WLFI as it refines its offerings and expands its asset base. While those uncomfortable with traditional banks may find value in WLFI's approach, questions remain about how it will differentiate itself in an increasingly crowded DeFi market.

Sun's financial backing and Trump's leadership have generated significant momentum in the crypto sector. However, WLFI's success will depend on its ability to meet expectations amidst legal challenges and market volatility.

Featured image from Evan Vucci/AP via CNN Newsource, chart from TradingView