U.S. Court Overturns Sanctions on Tornado Cash Crypto-Mixing Service

A U.S. federal appeals court has overturned sanctions on Tornado Cash, a crypto-mixing service, ruling that its smart contracts cannot be classified as property. The Fifth Circuit Court of Appeals' decision is significant for advocates of decentralization and privacy, sparking renewed discussions about the regulation of blockchain tools linked to illegal activities.

The Treasury Department's Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash in 2022, claiming it facilitated money laundering by groups such as North Korea's Lazarus Group. However, the court concluded that OFAC exceeded its authority. The court stated that Tornado Cash operates through immutable smart contracts on the Ethereum blockchain, which function autonomously and cannot be owned or restricted under the International Emergency Economic Powers Act (IEEPA).

The judges noted that while sanctions can restrict specific users from accessing Tornado Cash, its decentralized nature prevents total exclusion of any user, including malicious actors. Coinbase Chief Legal Officer Paul Grewal described the ruling as a "historic win" for crypto and individual freedoms, arguing that sanctioning open-source technology due to misuse by a minority represents government overreach. Coinbase and other organizations had contested the sanctions, claiming they unfairly targeted decentralized tools rather than addressing misuse directly.

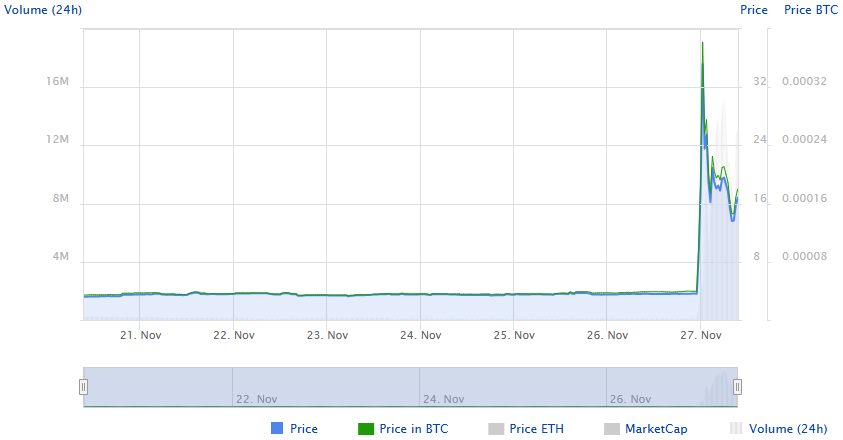

In response to the court’s ruling, Tornado Cash's native token, TORN, experienced a nearly 400% increase, reflecting optimism among decentralized finance (DeFi) supporters regarding the resilience of privacy-focused blockchain technologies.

This ruling also raises questions about the legal status of decentralized systems. Tornado Cash and similar services exist in a legal gray area, operating independently of traditional financial institutions and centralized control. Critics express concern that this decision might encourage criminal exploitation of blockchain tools, posing challenges for regulators.

Proponents argue that technology should not be held accountable for misuse. The court's distinction between tools and bad actors could influence future treatment of decentralized technologies. Nonetheless, lawmakers and regulators are expected to intensify scrutiny of these services to balance innovation with security concerns.

In summary, the court's decision reinforces the decentralized nature of smart contracts while highlighting deficiencies in current laws regarding emerging blockchain technologies. As discussions on crypto regulation evolve, the Tornado Cash ruling illustrates the ongoing tension between fostering innovation and preventing criminal misuse.