UBS Launches uMINT Fund to Capitalize on Tokenized Investment Demand

It has been some time since we reviewed the tokenized fund activity.

Late Friday, UBS, a Swiss bank managing $5.7 trillion in assets, announced the launch of uMINT, or the UBS USD Investment Fund on Ethereum. The fund offers institutional-grade cash management solutions backed by high-quality money market instruments within a conservative risk-managed framework. Specific financial instruments included in the fund remain unclear, while other popular funds currently hold US Treasurys.

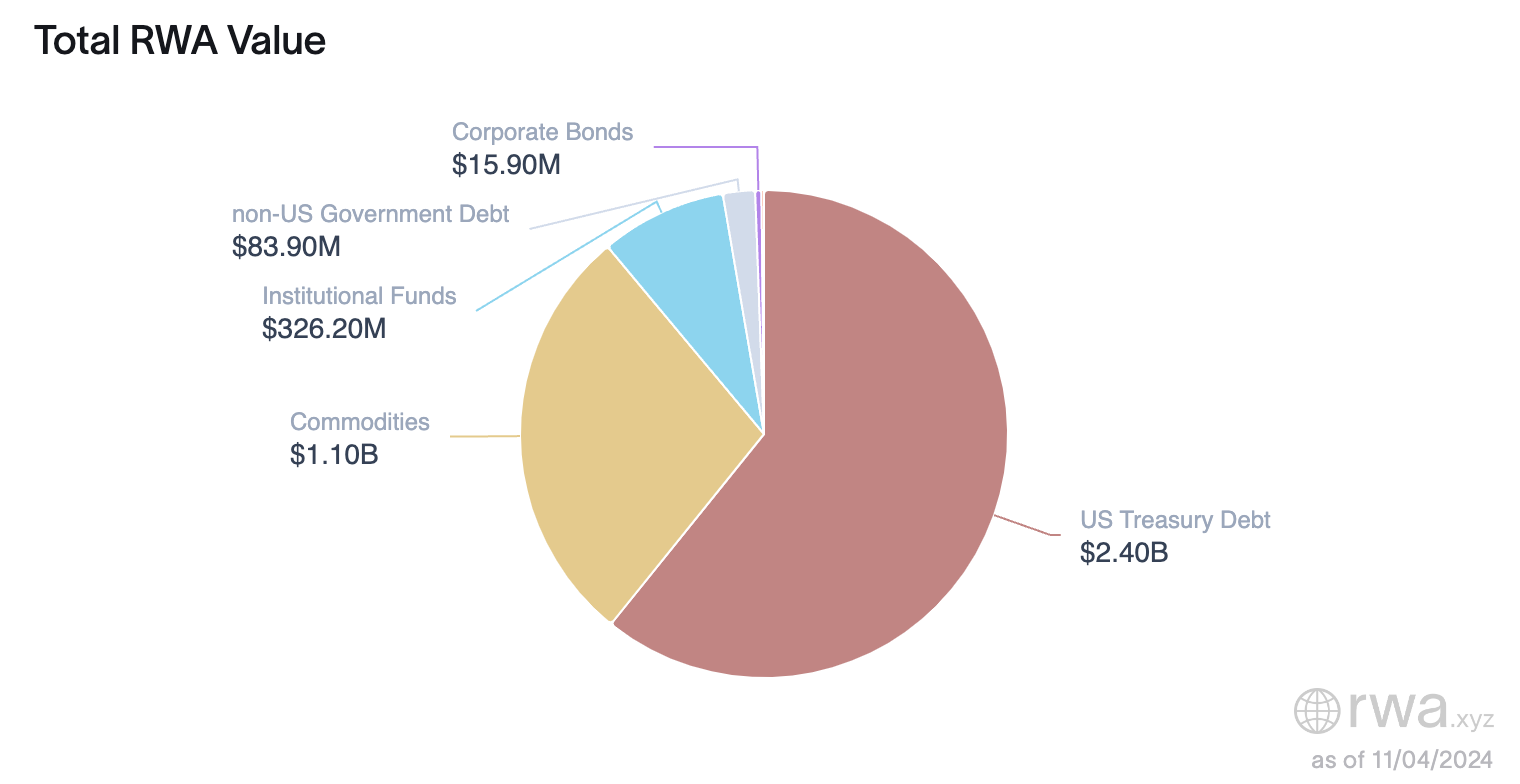

According to RWA.xyz data, total real-world asset value amounts to approximately $2.4 billion in US Treasury debt, with commodities at $1.1 billion. Notably, this data excludes Treasurys held by stablecoin issuers like Circle and Tether.

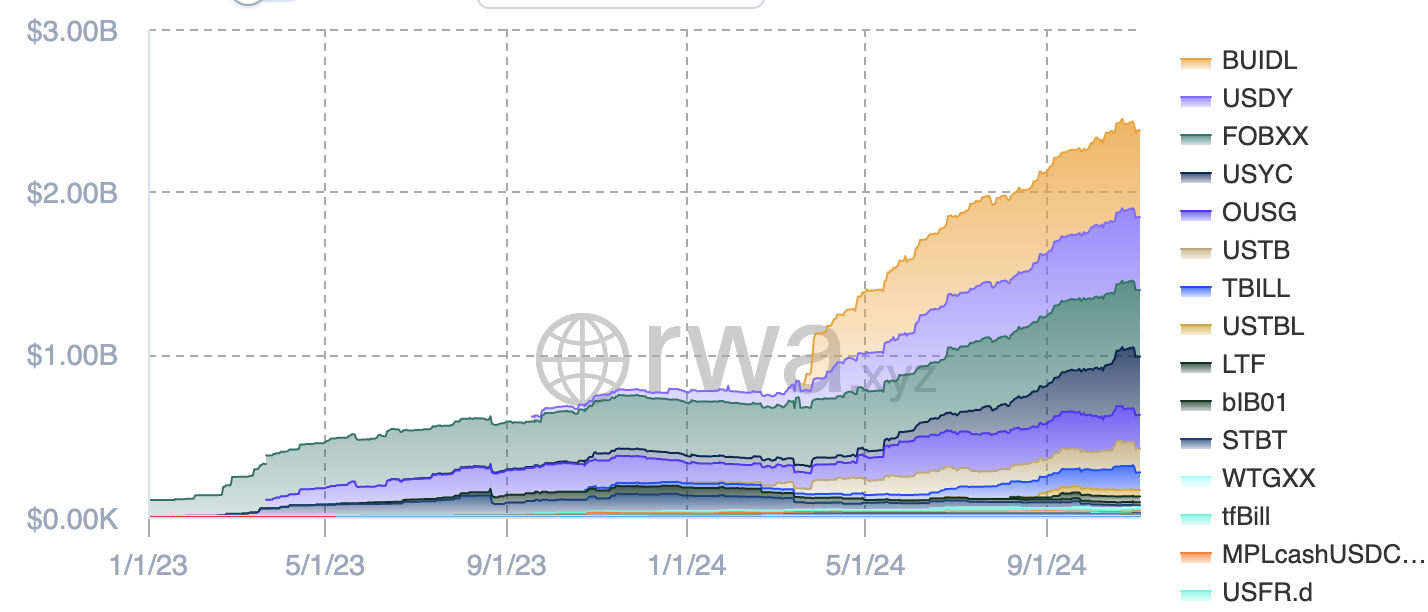

Thomas Kaegi, co-head of UBS Asset Management APAC, indicated a growing investor appetite in the tokenized fund space. Currently, three firms dominate this sector: BlackRock through its Securitize partnership, Franklin Templeton, and Ondo. While BlackRock’s BUIDL and Franklin's funds are well-known, Ondo leads with a market cap of $655 million, followed closely by Securitize at approximately $533 million, and Franklin Templeton at roughly $408 million.

UBS views this launch as a serious commitment to tokenization, evidenced by its participation in the Project Guardian initiative, Singapore’s tokenization pilot, and previous partnerships to issue tokenized notes in China.

Additionally, Securitize recently surpassed $1 billion in tokenized real-world assets on-chain. The success of BlackRock’s tokenized fund contributed to this growth. Franklin Templeton also launched its OnChain US Government Money Market Fund on Base.

While tokenization may not be a prominent topic in crypto discussions, significant developments are occurring in this area.