UK FCA Prioritizes Regulation for Crypto Assets and Market Safety

New research by the UK's Financial Conduct Authority (FCA) indicates that 93% of UK adults are aware of crypto assets, with about 12% owning them, equating to roughly 7 million individuals.

Matthew Long, FCA's director of payments and digital assets, emphasized the necessity for clear regulation to foster a safe, competitive, and sustainable crypto sector.

On Tuesday, Long provided an update on the FCA's regulatory approach following discussions this year with crypto companies, law firms, government officials, and other regulators, including insights from the US SEC.

Key Takeaways from FCA Discussions

- Support for an industry-led disclosures regime tailored to various business models, such as institutional and retail.

- Some participants favor disclosure rules similar to traditional finance (TradFi), while others express concern about applying these standards to crypto.

- Talks included “best execution” criteria for client orders, highlighting factors beyond price like custody arrangements and asset safety.

- Concerns were raised regarding conflicts of interest for exchanges issuing their own tokens or providing brokerage and market-making services.

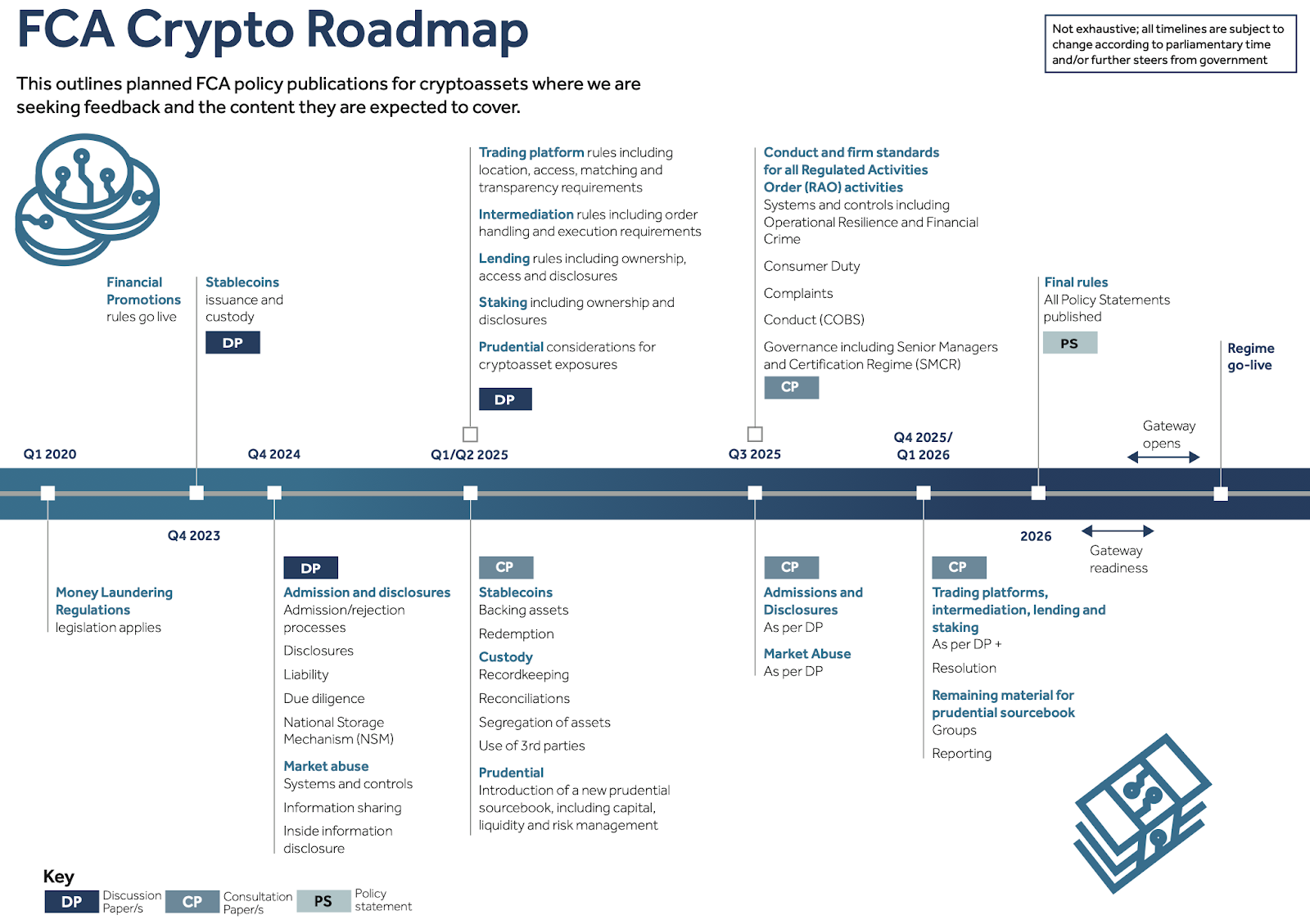

The FCA's roadmap indicates a target launch date for the new regime in 2026, along with interim steps leading up to it.

Additionally, the FCA is developing a market-abuse information sharing platform to address challenges posed by data privacy laws across jurisdictions.

UK Economic Secretary to the Treasury Tulip Siddiq recently announced upcoming legislation regarding stablecoins and staking services expected early in 2025.

The UK aims to align its regulations with the EU, while further regulatory actions are anticipated in the US under a more supportive presidential and congressional environment next year.