10 0

Uniswap Proposes Protocol Fees Activation, UNI Token Surges Over 50%

Uniswap founder Hayden Adams announced a major governance proposal to activate protocol fees, significantly impacting the market. UNI's price surged over 50% after the announcement, indicating renewed investor optimism.

Key Points of the Governance Proposal

- Activate protocol fees directing them towards UNI burns to create a sustainable value mechanism.

- Send Unichain sequencer fees to the UNI burn and burn 100 million UNI from the treasury.

- Introduce Protocol Fee Discount Auctions to enhance liquidity provider outcomes and capture miner extractable value (MEV) for the protocol.

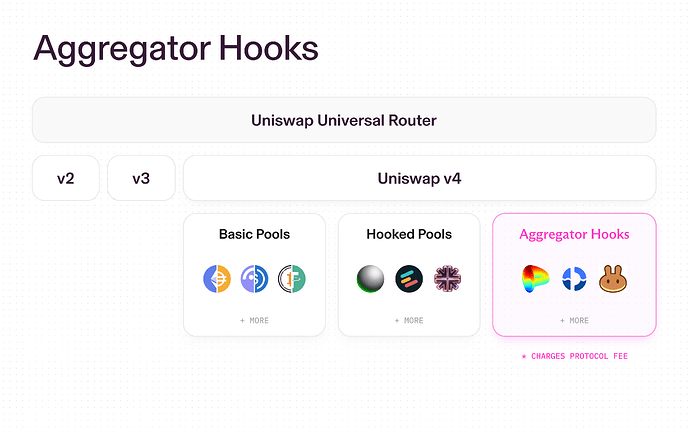

- Implement "aggregator hooks" in Uniswap v4 to collect fees from external liquidity sources.

- Uniswap Labs will focus solely on protocol growth and governance initiatives, ceasing fee collection on its interface, wallet, and API.

- Merge Foundation employees into Labs under a new growth fund and move governance-owned Unisocks liquidity to v4 on Unichain.

Some analysts view the proposal as a response to competition from rivals like Aerodrome Finance, marking both a strategic pivot and a defensive measure to maintain Uniswap’s dominance in DeFi.

UNI Price Surge Analysis

- UNI token surged nearly 50%, climbing from $5.80 to above $10.30, stabilizing near $8.20.

- Trading volume increased sharply, reflecting strong market participation and investor confidence.

- UNI reclaimed the 50-day and 100-day moving averages, but faces resistance at the 200-day moving average near $9.50–$10.00.

- The volume profile indicates significant accumulation pressure beneath $6, suggesting a potential medium-term accumulation phase.