Updated 13 December

US and Canadian Economies Respond Differently to Rate Changes

This is a segment from the Forward Guidance newsletter.

US and Canadian Economic Perspectives

The author, a Canadian, analyzes macroeconomic trends primarily from a US perspective, noting the centrality of the US in global markets.

Current Economic Indicators

Canada's unemployment rate has reached a cycle high of 6.8%, while the US rate remains stable. Both economies are affected by increased labor supply due to immigration; however, Canada's labor market shows weaker performance overall.

Canada has achieved an inflation rate of 2% year-over-year, contrasting with the US, which continues to exceed its target:

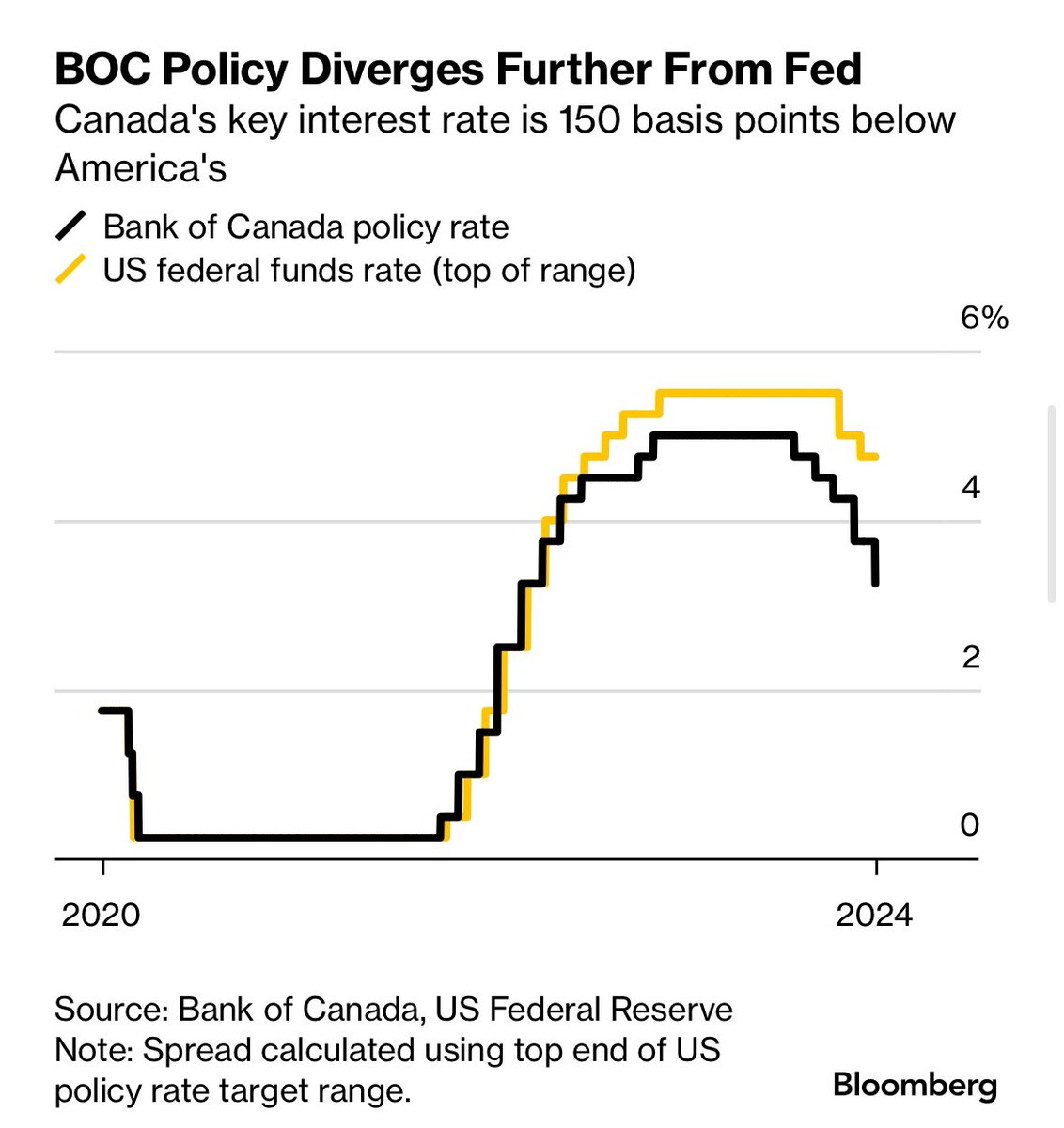

The Bank of Canada recently surprised the market with a 50-basis point rate cut, while the US anticipates one more rate cut before pausing due to stronger-than-expected economic performance.

Discrepancy Between US and Canadian Economies

The difference in responsiveness to changes in short-term interest rates between the two countries explains the economic divergence:

Corporations

US companies access the largest debt markets globally, allowing them to issue fixed-rate bonds at narrow spreads. Conversely, Canadian firms predominantly issue floating-rate debt, which is immediately impacted by central bank policy changes.

Households

In the US, homeowners often hold 30-year fixed-rate mortgages, insulating them from rising rates as long as they remain in their homes. Many refinanced during the low rates of the pandemic. In contrast, Canadian homeowners typically face rate resets every five years, making them vulnerable to interest rate increases even if they do not move.

These factors illustrate the challenges the Fed faces in maintaining a consistent policy path, as its primary tool affects less of the economy compared to other nations, highlighting increasing economic dispersion between the US and other countries.