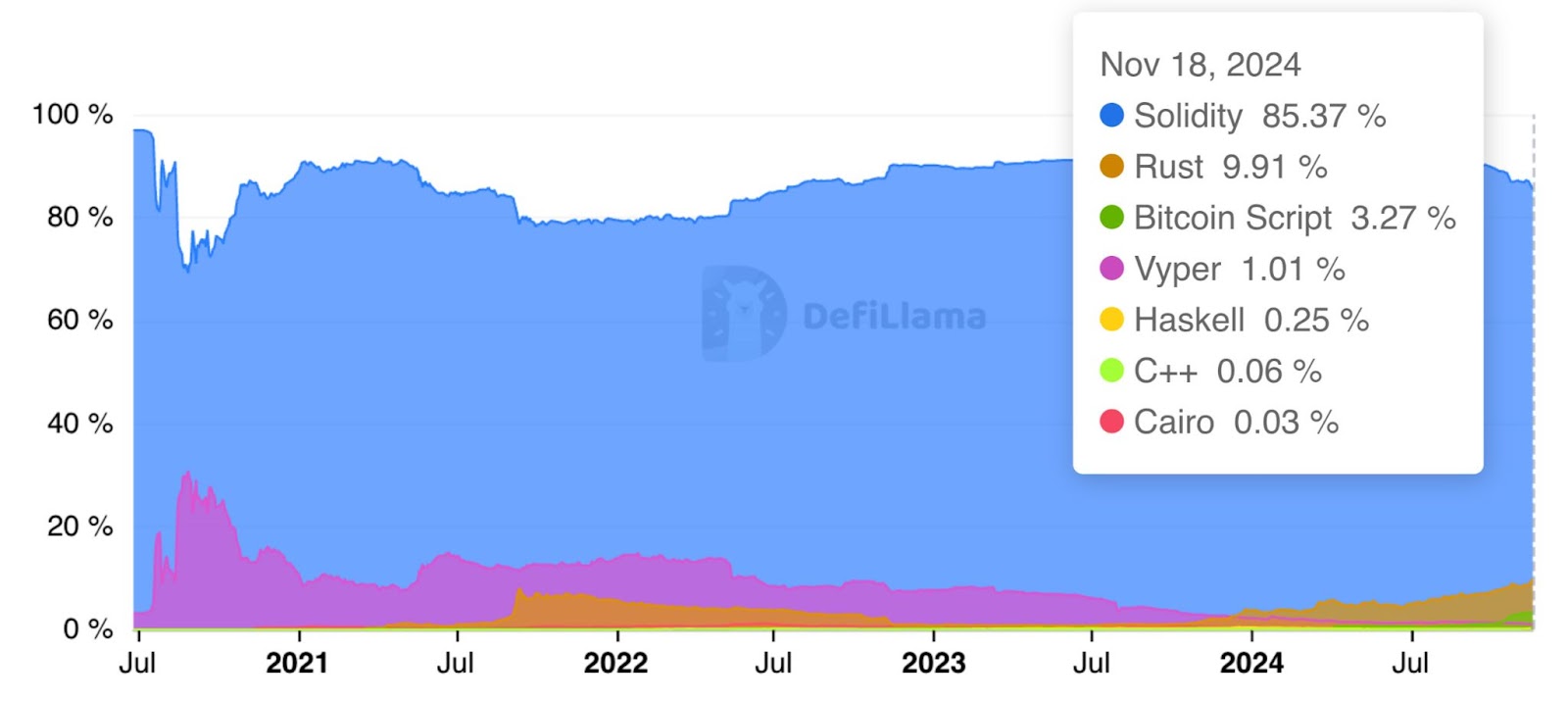

Vyper’s Share of DeFi Total Value Locked Drops to 1%

Vyper, Ethereum’s Python-inspired smart contract language for the Ethereum Virtual Machine (EVM), recently celebrated an anniversary amid reports of underfunding from its development team.

Created by Ethereum co-founder Vitalik Buterin in November 2016, Vyper aims to provide a simpler, more secure alternative to Solidity.

Vyper features a clean syntax prioritizing readability and restricting complex functionalities to reduce vulnerabilities, benefiting developers focused on secure and robust smart contracts.

Curve Finance has utilized Vyper, with founder Michael Egorov sharing his early experiences using the language since 2019. He praised Vyper as an effective tool for writing safe smart contracts within the Ethereum ecosystem.

Security is central to Vyper's philosophy, which has maintained a generally positive track record, though a high-profile exploit in 2023 significantly impacted Curve.

Egorov highlighted that Vyper has a documented history of audits, all publicly available on its GitHub repository. The development team has implemented processes to manage vulnerabilities, aligning with Ethereum’s ethos of decentralization and community trust.

Vyper's influence within the Ethereum ecosystem has declined over recent years. Once holding a notable share of total value locked (TVL) in DeFi at 30% in August 2020, it decreased to 13.8% by early 2022, 7.6% at the start of 2023, and just 2.2% at the beginning of 2024. Currently, Vyper accounts for about 1% of DeFi TVL, reflecting challenges against Solidity’s dominance.

The design philosophies of Vyper and Solidity differ significantly. Solidity, with its JavaScript-like syntax, offers greater complexity and flexibility, appealing to developers familiar with traditional programming languages. Its mature ecosystem includes extensive tools and community support, establishing it as the standard for most Ethereum projects.

Despite its diminishing market share, Vyper remains relevant for security-focused projects. Egorov draws parallels between Vyper's potential resurgence and Python's rise from niche status in 2005 to its current dominance in fields like AI and data science, suggesting that Vyper’s emphasis on security and readability could lead to renewed interest.

With many Python developers globally, there is potential for increased engagement in blockchain development, similar to Algorand's adoption of Python as its canonical language earlier this year.

For Ethereum developers, Vyper now caters to a niche audience that values security and simplicity. It remains a compelling option for projects requiring concise and secure smart contracts.