6 0

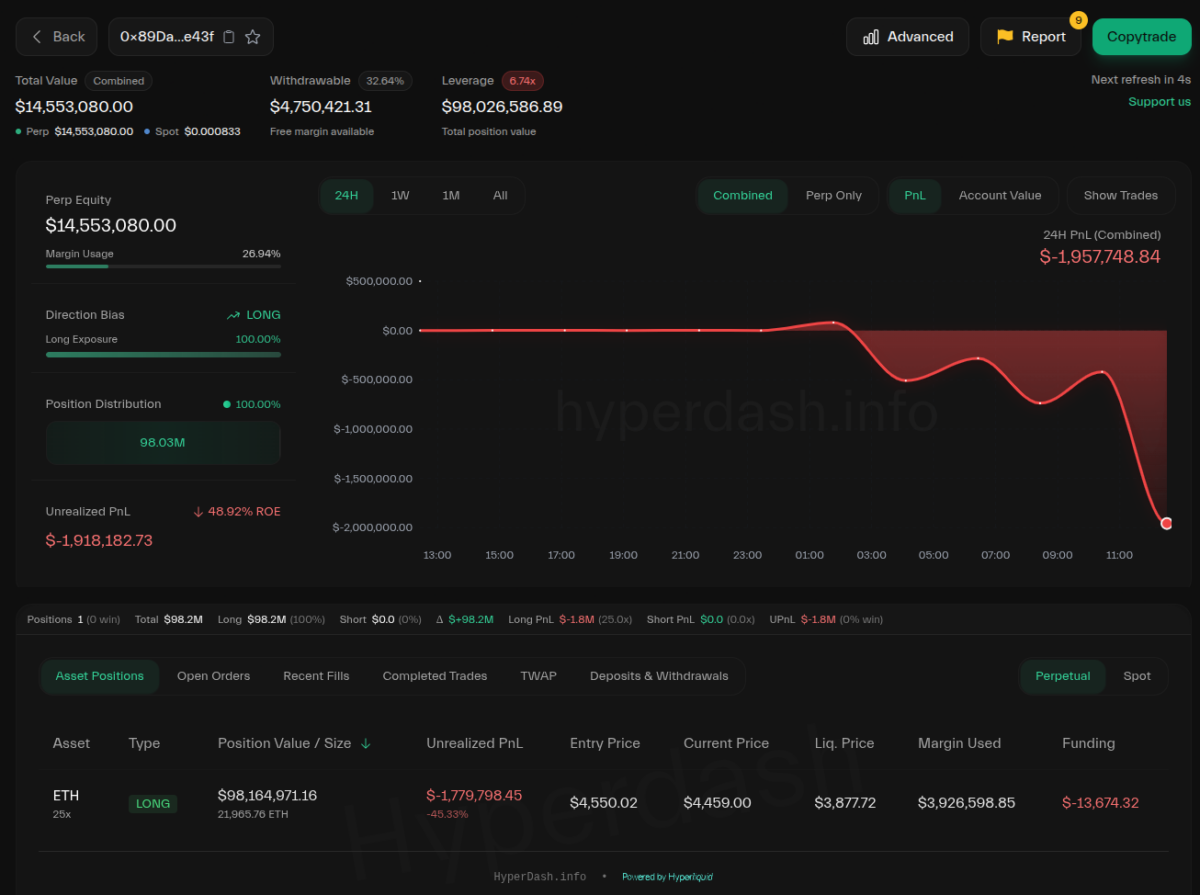

Smart Whale Opens $100M Long on Ethereum, Faces $2M Loss

A large trader, known as a smart whale, has placed a significant long position on Ethereum using 25x leverage via HyperLiquid. The position is worth nearly $100 million but is currently at a $2 million loss due to a price drop.

- The trader's historical performance includes 53 trades with an 81.13% win rate.

- Recent trades involve purchasing 21,966 ETH at $4,550.02 each, totaling $99.95 million, using a $3.99 million margin.

- The trader is reportedly a "Delta Neutral Trader," focusing on strategies that maintain a net delta close to zero to hedge risks.

Copying this trader's strategy can be risky for others due to the complexity and potential incomplete understanding of the reasoning behind their moves.

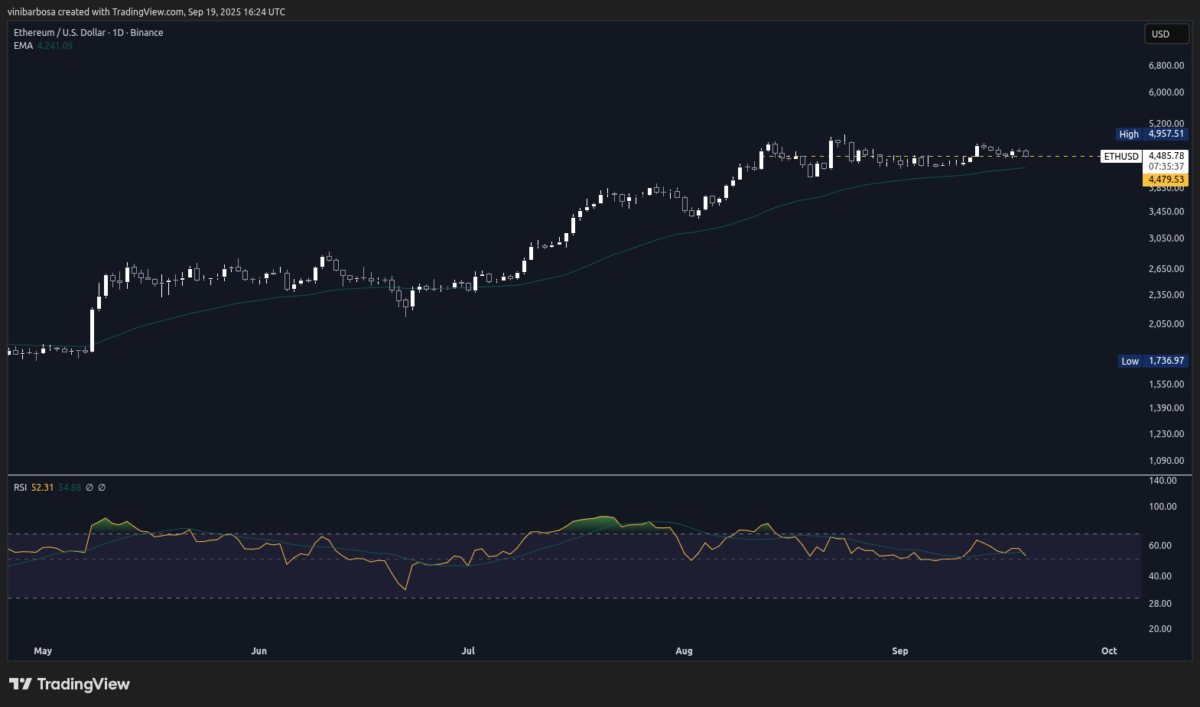

Ethereum (ETH) Price Analysis

- Currently trading at $4,485, Ethereum maintains a market cap of $540 billion with a 24-hour volume of $33 billion.

- The daily RSI stands at 52.24 points, suggesting cooling momentum as it heads toward the neutral zone.

- Despite some bearish indicators like whale selling and Citigroup's neutral-to-bearish year-end target of $4,300, Ethereum remains above the 50-day exponential moving average, indicating continued bullish levels.