Whale Activity Drives AAVE Market Cap to $3.622 Billion

As the DeFi segment grows, reaching a market cap of $160 billion, AAVE is emerging as a favored option for crypto whales. AAVE is a decentralized finance protocol focused on lending and borrowing services.

AAVE provides liquidity pools and flash loans in the crypto market. The AAVE token is gaining traction as altcoin season progresses.

Whales Boost On-chain Numbers

In the last 14 days, the market cap of the DeFi protocol has risen by nearly 53%. Increased interest driven by pro-crypto policies from the Trump administration contributes to this bull run.

The AAVE token's market cap has reached $3.622 billion, with a ~90% increase over the past 30 days and trading volume approaching $1 billion. Currently, AAVE trades at $248, down slightly from a 24-hour high of $252.59.

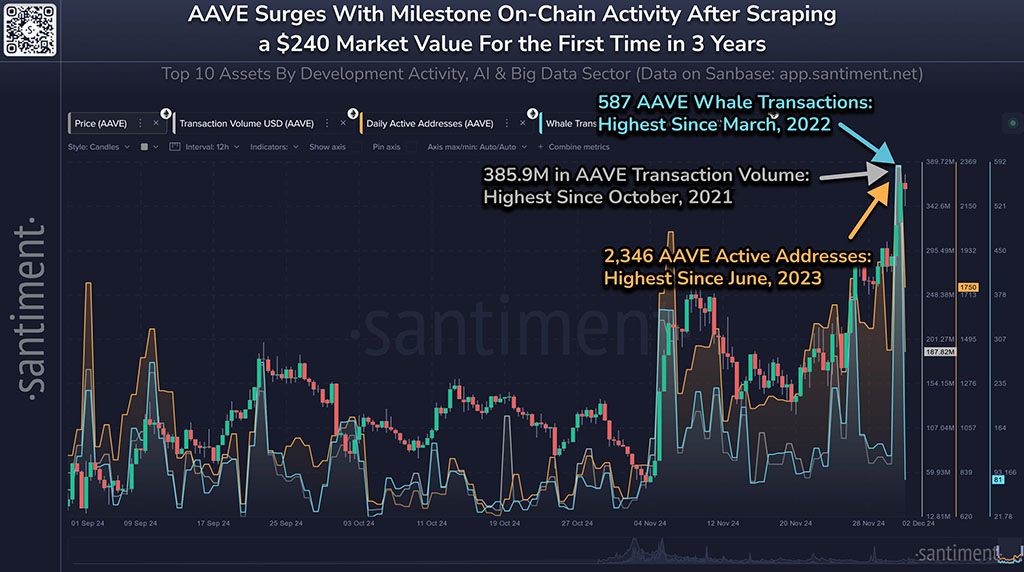

Whale interest in AAVE has surged, with 587 whale transactions recorded in the last 24 hours, marking the highest activity since March 2022.

This whale activity has driven on-chain transaction volumes to $385.9 million, the largest since October 2021. Additionally, 2,346 unique addresses were active, the highest since June 2023.

With increasing demand and network activity, AAVE may trend towards a new all-time high. Trading at a 63.88% discount from its previous peak of $670 indicates significant potential for growth.

AAVE Investors Turn Green as TVL Crosses $35B

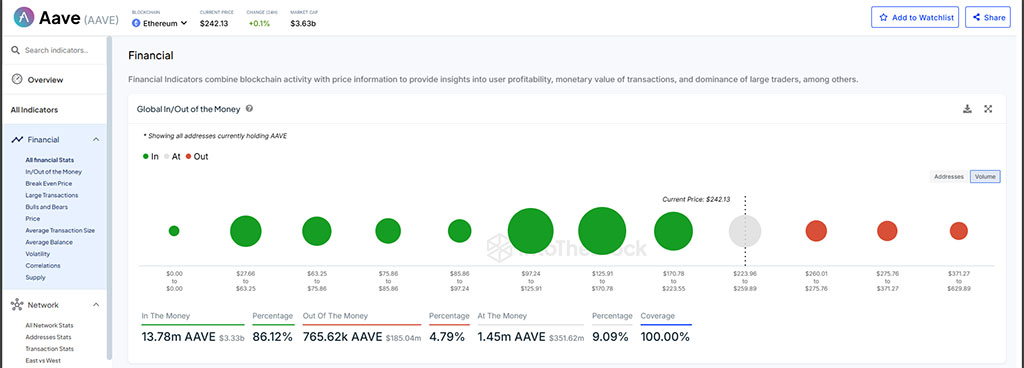

The global in-and-out-of-the-money indicator from IntotheBlock reveals that 86.12% of AAVE volume is “in the money,” with profitable investors holding $3.33 billion worth of 13.78 million AAVE tokens.

The “out-of-the-money” segment comprises 4.79% of the volume, equivalent to 765.62K AAVE tokens valued at $185.04 million. The remaining 9.09% is classified as “at-the-money,” ranging from $223.96 to $259.89, accounting for 1.45 million AAVE tokens worth $351.62 million.

The total value locked (TVL) on the network has achieved a new all-time high of $35.539 billion, surpassing the $33 billion peak seen during the 2021 bull run.

In summary, rising whale interest and an expanding DeFi sector are pivotal in driving the AAVE rally. Additionally, crypto-friendly policies from the Trump administration may contribute to further price increases for AAVE, potentially leading to a new all-time high in early 2025 if current trends persist.