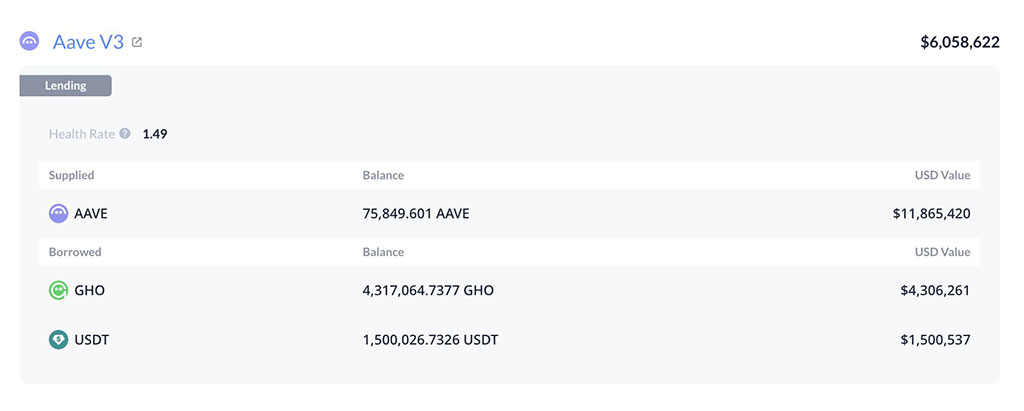

Whale Investor Buys 9K AAVE for $1.5 Million, Totaling $11.57 Million

A whale investor has utilized the mid-week pullback to establish a significant long position on AAVE. Blockchain analytics firm Lookonchain reported that the investor borrowed $1.5 million and acquired over 9,000 AAVE tokens. This purchase increased the investor's portfolio, accumulated since October, to 75.4K AAVE, valued at $11.57 million.

Source: LookOnChain

Such large whale investments typically indicate bullish sentiment, suggesting a potential price rally. However, it is essential to evaluate the risk-to-reward (RR) ratio and whether the current valuation of AAVE presents a favorable market entry for buyers.

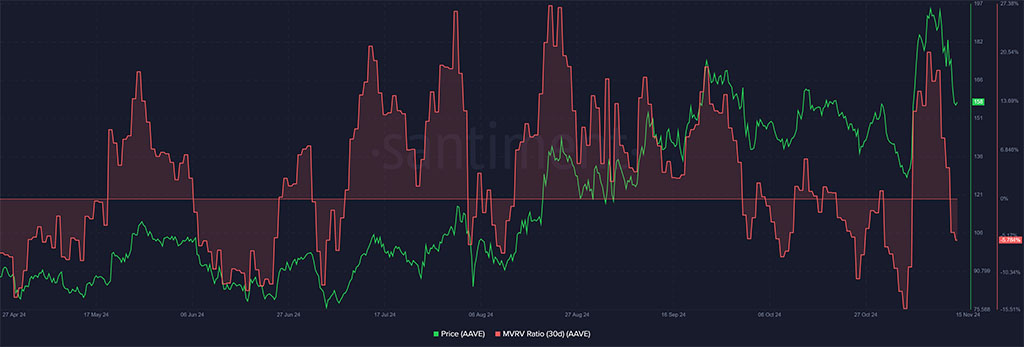

Is AAVE Cheap or Expensive?

As of the latest data, AAVE appears undervalued based on the 30-day MVRV (Market Value to Realized Value) ratio. This ratio compares the current price of an asset with the average cost of all tokens purchased. A spike in the ratio indicates high unrealized profits, which may lead to profit-taking and price stagnation.

Source: Santiment

A high MVRV suggests an asset is overvalued, while a lower or negative value indicates it is relatively undervalued. Currently, the 30-day MVRV ratio for AAVE is at -4%, indicating it may be a good buy at present prices.

However, large traders on the Binance exchange have not significantly increased their long positions on AAVE in the perpetual markets.

Source: Hyblock

Whales adjusted their positions following the US election, notably reducing exposure after Trump's victory. The Whale vs. Retail Delta indicator reflected this behavior.

A substantial price recovery for AAVE could occur if more large players initiate positions at $160 or the Q4 support level of $120.

Source: AAVE/USDT, TradingView

The recent pullback has created a favorable market entry point for swing traders, particularly if there is a rebound in the coming days. The price has retraced to a critical confluence area at $160, identified by moving averages and breaker blocks.

Additionally, the next support zone and bullish order block between $125-$135 represent another crucial level that could catalyze a strong market rebound for AAVE. Therefore, $160 and $125 are key levels to monitor for market entries, with immediate bullish targets set at $180 and $200.

AAVE is currently undervalued and presents a strong buying opportunity. Nonetheless, the bullish outlook may be compromised if Bitcoin experiences further losses in the upcoming days or weeks.