8 0

Whale Inflows Dampen XRP ETF Optimism As Selling Pressure Persists

XRP exchange-traded funds (ETFs) were anticipated to boost institutional demand and positively affect XRP's price. However, recent data indicates a different scenario unfolding.

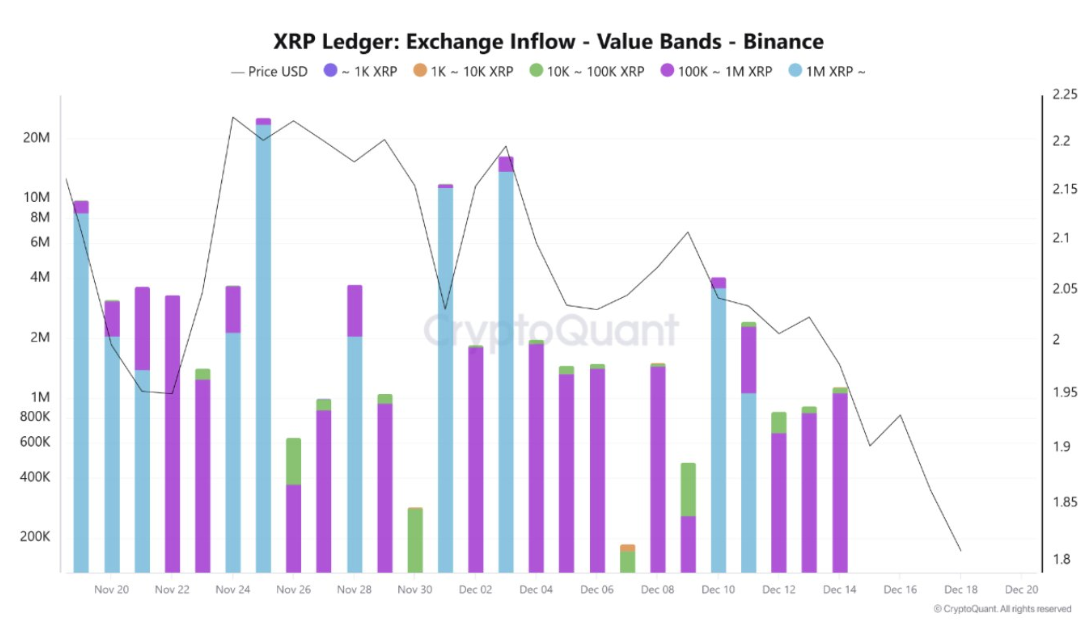

- On-chain analytics from CryptoQuant reveal significant XRP inflows into exchanges, particularly in the 100,000 to 1 million XRP range, signaling potential selling pressure from large holders.

- This activity is primarily attributed to whale addresses moving substantial volumes onto Binance, highlighting distribution or preparation for selling.

- The market's inability to absorb these large supply additions has prevented Spot XRP ETFs from positively impacting XRP's price.

- XRP's price action shows a trend of lower highs and lows, indicating that even moderate selling is sufficient to cap rallies due to few new spot buyers.

- Selling pressure occurs near $1.95, with support zones identified between $1.82-$1.87 and potentially declining further to $1.50-$1.66 if large inflows continue.

- Despite ETF inflows totaling $82.04 million, the expected sustained demand increase did not materialize as whales possibly sold off their holdings during the attention surge.

Overall, while ETF inflows have helped prevent deeper price declines, the current supply dynamics driven by large holders challenge the positive impact on XRP's market performance.