19 0

Whales Accumulate Hyperliquid Amid Volatility, Signaling Potential Rebound

Hyperliquid (HYPE) Market Update

- Hyperliquid (HYPE) is experiencing a turbulent period due to intense selling pressure in the altcoin market.

- The token is testing critical support levels as bulls attempt to regain control.

- Despite mixed sentiment, whale investors are showing renewed confidence by going long on HYPE, indicating potential for market recovery.

Big Players and Market Trends

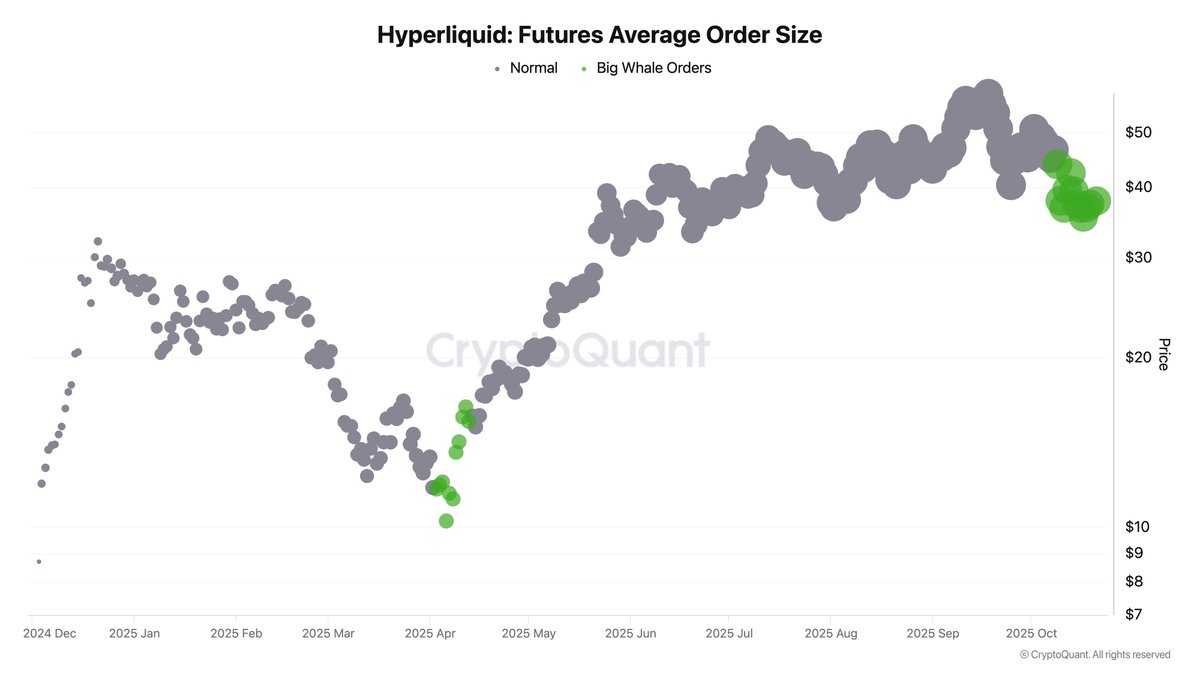

- Data from CryptoQuant highlights increased average order sizes, suggesting large investors are positioning for a price surge.

- Institutional-scale orders have become more frequent, indicating calculated long positions despite ongoing volatility.

- Hyperliquid has seen significant growth in trading volumes, supported by features like zero gas fees and fast settlement.

- The increase in futures order size may signal a potential shift in momentum.

Price Action and Key Support Levels

- HYPE is trading around $35.6, down over 6% for the day.

- The 200-day moving average, around $34–$35, serves as a crucial support zone.

- A failure to reclaim the 50-day moving average near $42 has turned it into short-term resistance.

- If the price consolidates above $35, buyers might push towards $40–$42. However, a drop below $34 could lead to further losses toward $28.

The current investor focus is on whale behavior and its implications for future market trends.