4 0

BEARISH 📉 : XRP risks macro bear trend with potential breakdown below $1.60

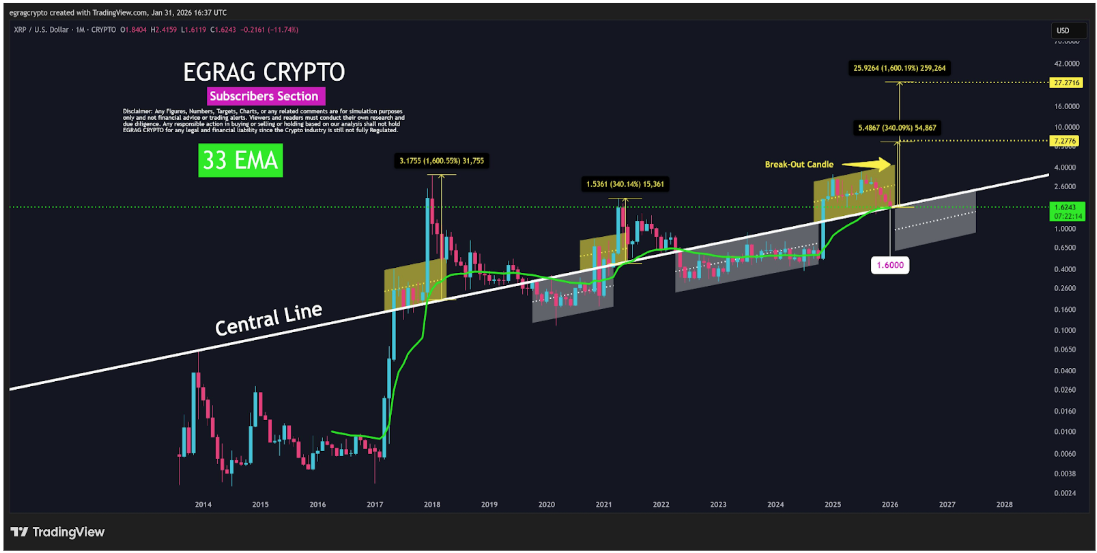

The recent crypto market selloff impacted XRP, dropping its price to an intraday low of $1.57. The focus is now on XRP's position relative to the 33-month exponential moving average (EMA), a critical indicator for its long-term trend.

33 EMA Breakdown Signal

- XRP recently traded around $1.65, stabilizing after volatile movements.

- Technical analysis by Egrag Crypto indicates that a monthly close below $1.60 and the 33 EMA could confirm a macro bearish trend.

- XRP has historically used the 33 EMA as a reference point, with breaches often leading to extended corrections.

Implications for XRP’s Price Structure

- XRP risks entering a macro bear structure, though historical data suggests potential for upside without a clear bull-market environment.

- Two historical analogs are considered:

- A repeat of the 2021-style move could see a 340% upside expansion, targeting around $7.

- A repeat of the 2017 cycle might project a larger expansion of 1,600%, aligning with the $27 zone.

- Both scenarios originate from oversold conditions rather than strong bullish confirmations.

- A breakdown below $1.60 may trigger panic selling but could also be where volatility expands upward before late sellers exit.