3 0

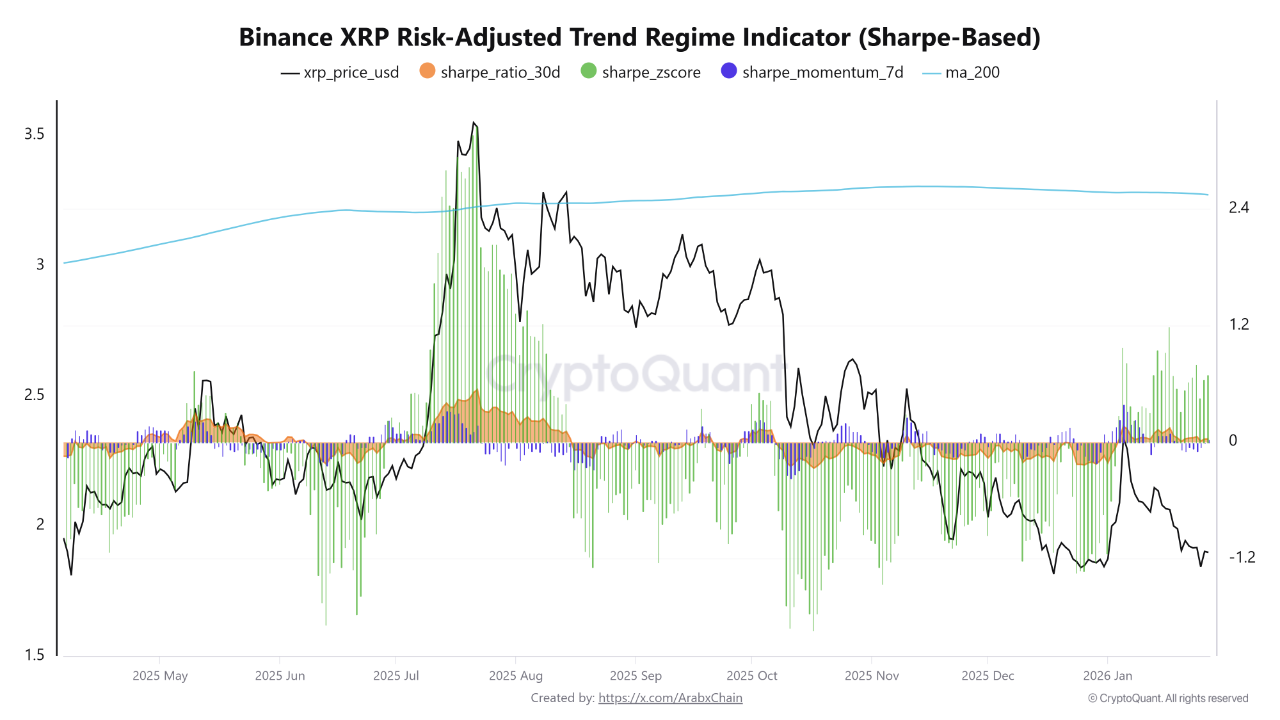

BEARISH 📉 : XRP Remains Below Key Moving Averages Amid Selling Pressure

XRP's price has fallen below $1.90, indicating persistent selling pressure. Attempts at stabilization lack momentum, and the market is in a cautious state.

- Current trading around $1.89 with the 200-day moving average at $2.54.

- Approximately 25% below long-term trend, signaling structural weakness.

- Reclaiming the 200-day average is critical for bullish phases.

Risk-Adjusted Metrics Indicate Consolidation

- The 30-day Sharpe Ratio is 0.034, suggesting minimal risk compensation.

- The Sharpe Z-Score is positive at 0.70, but below significant trend thresholds.

- 7-day Sharpe Momentum at 0.03 shows weak positive momentum.

The market is balanced, not under aggressive pressure but lacking strong uptrend signals.

XRP Below Key Moving Averages

- Trading near $1.87–$1.90, below major moving averages.

- 50-day MA acts as resistance; 100-day and 200-day MAs are above the price.

- Price remains roughly 25% below the 200-day MA.

- Clear pattern of lower highs and lows since October breakdown.

- Failed attempts to reclaim $2.10–$2.20 indicate weak buyer follow-through.

- Selling volume higher than buying during rebounds.

XRP remains in a corrective phase, with current behavior indicating consolidation rather than trend recovery.