XRP Binance Inflows Spike Signals Potential Selling Pressure

On-chain data indicates that the XRP Binance Netflow has recently increased to positive levels, signaling potential implications for the asset's price.

XRP Deposits to Binance Increase

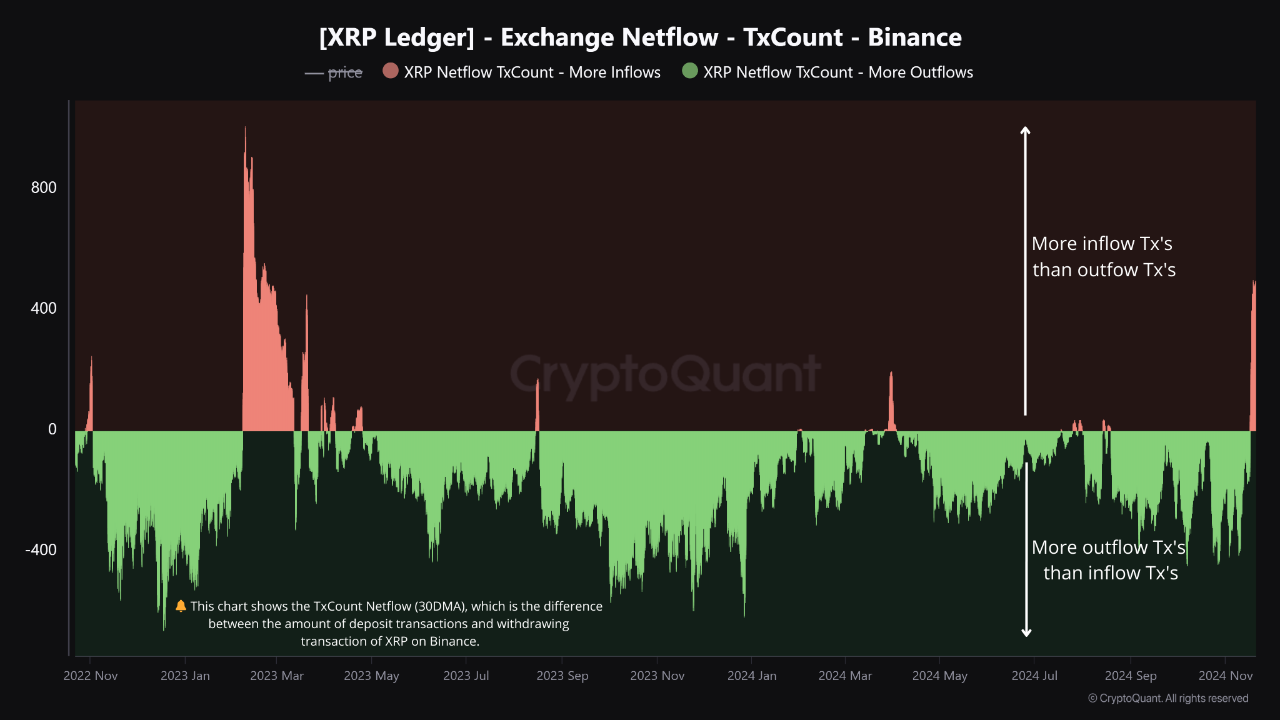

An analyst from CryptoQuant reports a significant rise in XRP deposit transactions to Binance. The relevant metric is the "Exchange Netflow," which tracks net transfers to and from centralized exchanges.

This metric traditionally measures the difference between inflow and outflow volumes. However, the focus here is on a variant that counts net deposit and withdrawal transactions. A positive value indicates more deposits than withdrawals, suggesting potential selling pressure, while a negative value implies dominance of withdrawals, indicating holders may be HODLing, potentially providing bullish support for prices.

The chart below illustrates the 30-day moving average (MA) of the XRP Exchange Netflow for Binance over two years:

The graph shows that the XRP Exchange Netflow for Binance has predominantly remained positive, indicating ongoing withdrawal activity by investors. Recently, however, there has been a sharp increase, coinciding with a 54% rally in XRP's price over the past week, suggesting traders might be looking to sell for profit realization.

The current indicator value is at 470, reflecting significantly more inflows than outflows, with potential peak values even higher due to it being a 30-day MA.

Despite initial concerns about high inflow volumes, this activity primarily involves retail investors. Whale transactions are typically fewer and involve larger amounts per transaction. Thus, spikes in this version of Exchange Netflow often indicate increased deposits from smaller holders.

While some whale activity could still influence XRP's price negatively, the overall impact remains uncertain.

XRP Price Overview

XRP has experienced significant market movement, achieving a price of $1.09 following its recent rally.