7 0

XRP Faces Critical Support Test Amid Divergence in Price and Volume

XRP is currently at a critical level, struggling below $2.5 amid heavy selling pressure. The market sentiment remains weak after declines in major altcoins, but some analysts see this as a potential local bottom before a rebound.

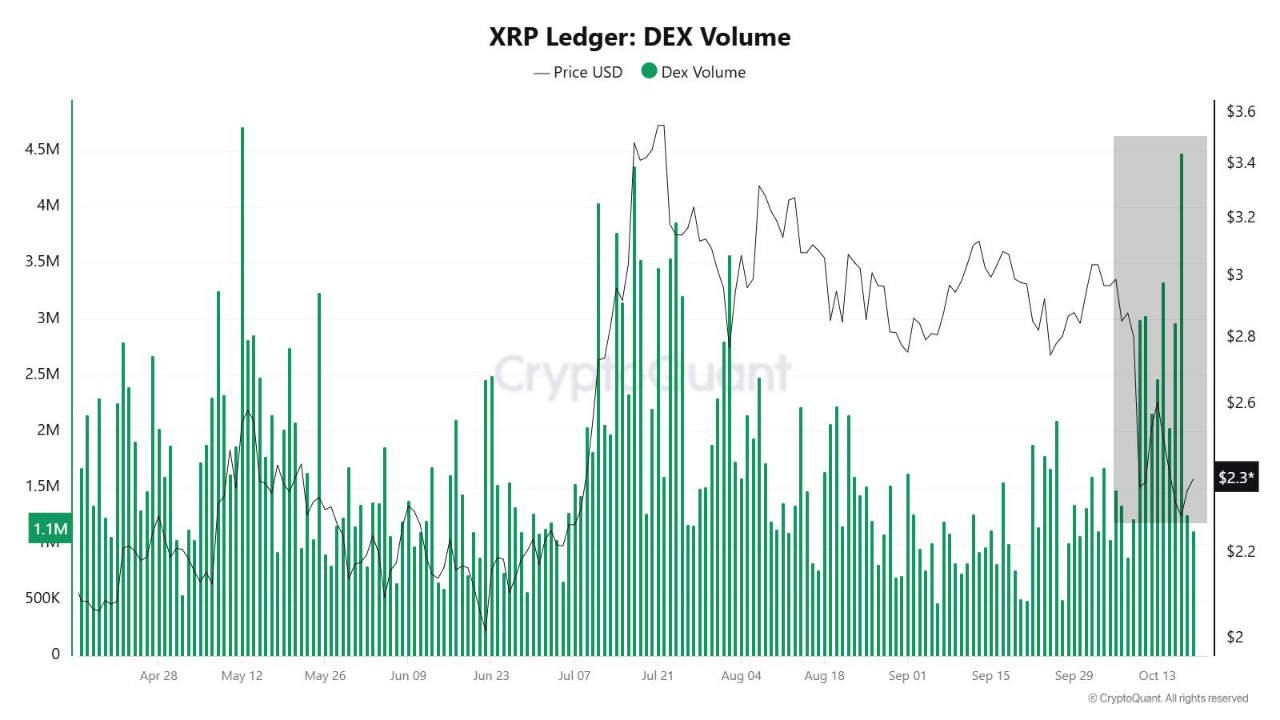

- Between October 8th and 17th, XRP's price fell from $3.0 to $2.3, while DEX trading volume reached a multi-month high.

- This divergence in price and activity suggests either capitulation or accumulation.

- Capitulation indicates panic selling and bearish momentum, potentially leading to temporary breakdowns.

- Accumulation implies strategic buying by large investors, possibly preceding a market reversal.

The current battle between buyers and sellers suggests underlying strength if demand absorbs selling pressure. The $2.3–$2.5 zone is crucial for signs of accumulation and potential rebound.

XRP Attempts to Stabilize After Sharp Sell-Off

After a significant correction, XRP shows signs of stabilization, rebounding from lows near $2.3, aligning with the 100-day moving average acting as support. Despite recovery to around $2.47, the structure remains fragile.

- The 50-day moving average trends downward, with resistance at $2.6–$2.7.

- A break below $2.3 could lead to a drop towards the 200-day moving average near $1.8.

- If XRP holds above $2.3, it may consolidate and retest $2.6.

Overall, XRP’s outlook hinges on whether bulls can turn the current bounce into a confirmed recovery.