0 0

XRP Dips Below $2 as Volatility Rises and Open Interest Grows

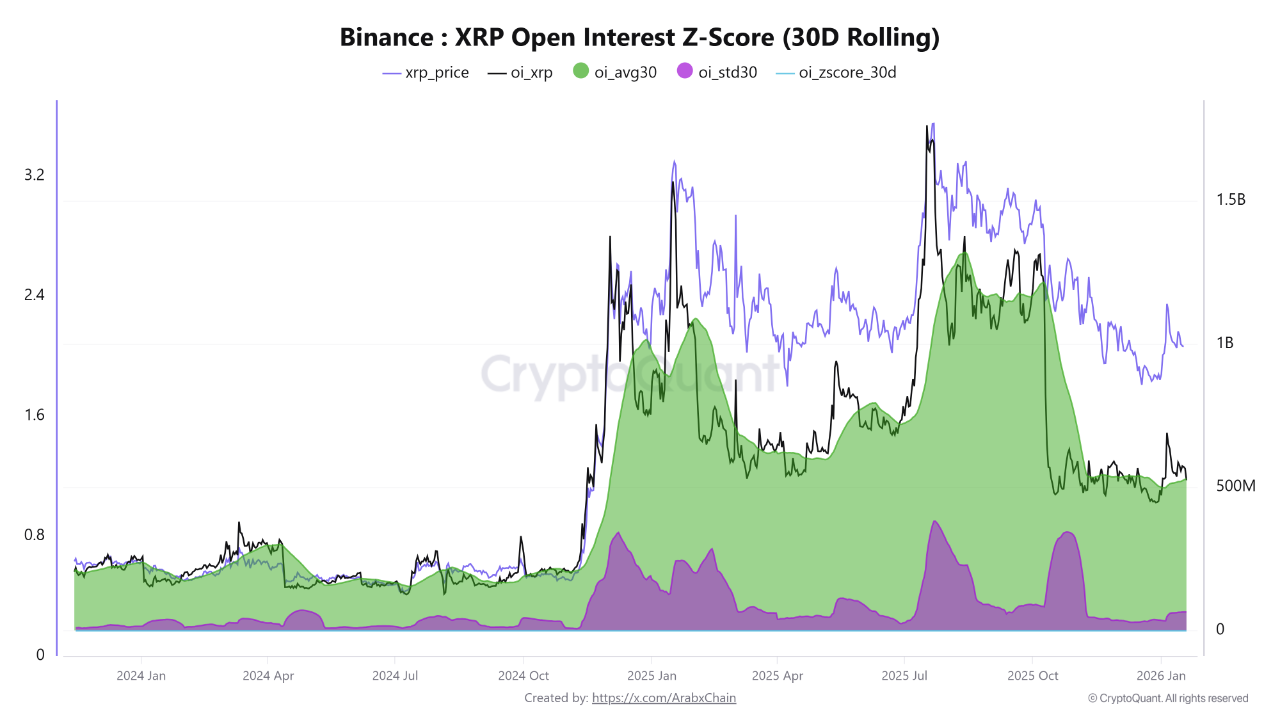

XRP's price fell below the $2 level due to a broader crypto market decline, placing it in a vulnerable position. Despite the downturn, Binance derivatives data shows that extreme leverage unwinding hasn't occurred yet.

- XRP open interest on Binance increased to about $566.48 million, above the 30-day average of $528.84 million, indicating new positions are cautiously added.

- The 30-day rolling Z-Score framework suggests potential for a larger move, with open interest growing while volatility remains controlled.

- Arab Chain’s CryptoQuant notes an increase in the 30-day standard deviation of XRP open interest, now at its highest since November, signaling potential for price expansion.

Currently, XRP is in a "risk-on, but cautious" state, where exposure is increasing and volatility is rising without a clear direction. Traders should watch the oi_std30 metric alongside price movements for future shifts.

XRP Slides Back Toward $1.90 as Bears Keep Control

- XRP's price is under pressure, slipping towards $1.90 after failing to hold the $2 level, with a pattern of lower highs and lows confirming a bearish trend.

- Recent attempts to recover have been capped by sellers, with the $2 region now acting as overhead resistance.

- The support area around $1.85–$1.90 serves as a short-term floor during consolidation; failure here could lead to lower liquidity zones and extend the downtrend.

- Volume reflects uncertainty with erratic activity, driven by fear rather than steady accumulation.

Bulls need to reclaim levels above $2 to change the short-term narrative back in their favor.