XRP Faces Dual Liquidation Events Amid Market Volatility on Binance

XRP is trading above $2.20 after a period of relief-driven price action, providing a temporary pause following prolonged selling pressure. Analysts are divided on the future outlook:

- Some believe the market structure still suggests a bearish phase.

- Others think XRP could be in early recovery if key levels hold.

Recent derivatives data adds complexity to this scenario:

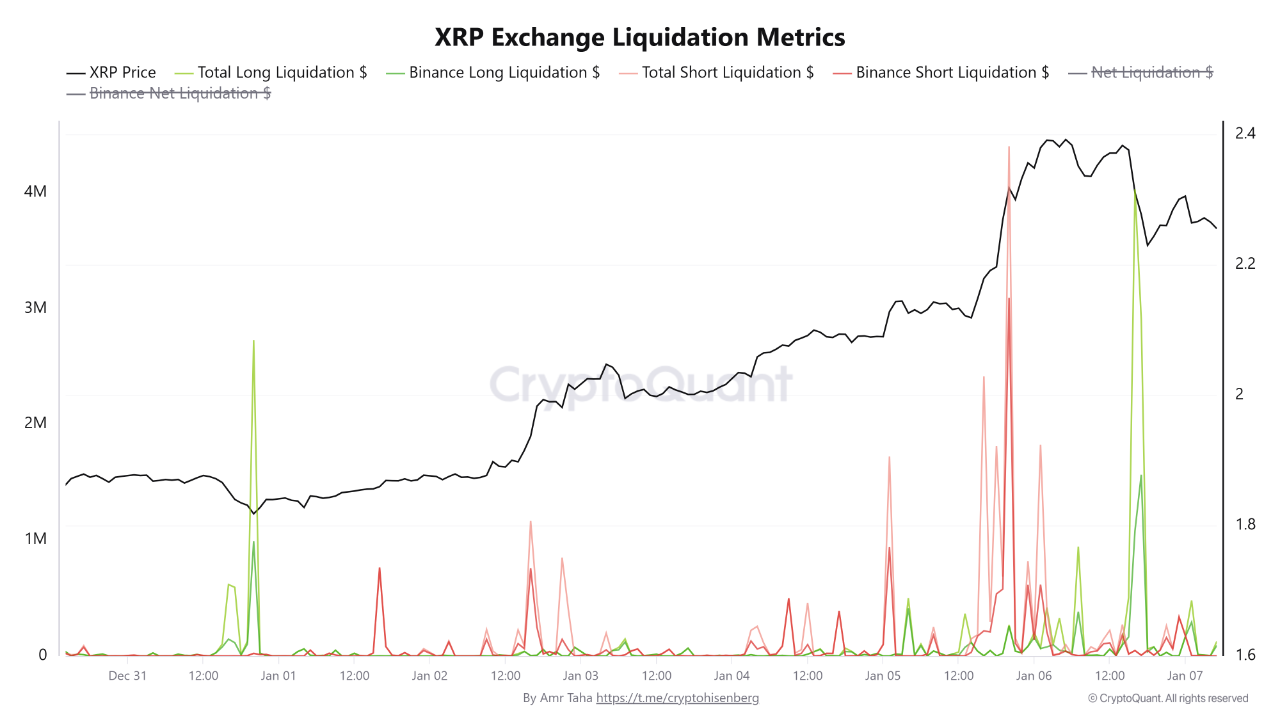

- CryptoQuant analysis shows intense turbulence in XRP's futures market with aggressive leverage repositioning.

- Unusual two-sided liquidation events indicate heightened uncertainty and traders misaligned with short-term movements.

- This pattern suggests XRP is transitioning into a balanced but volatile phase.

Binance Futures Activity

- On January 5, a sharp short squeeze led to over $4.4 million in short liquidations, primarily on Binance, pushing prices higher towards $2.40.

- By January 6, momentum faded, targeting long positions with roughly $4 million in liquidations, including $1 million on Binance.

Liquidation heatmaps show pressure on newly opened long positions as short-side liquidity was cleared. Binance continues to lead XRP derivatives activity, with these events often preceding reversals. Price volatility is expected as the market recalibrates.

XRP Faces Key Resistance

- XRP rebounded from $1.80–$1.90 demand zone, indicating weakened downside momentum.

- Resistance around $2.25–$2.30 aligns with declining moving averages, signaling ongoing corrective structure.

Despite the impulsive rebound, volume remains low compared to previous distribution phases. For a decisive momentum shift, XRP needs to hold above $2.20 and reclaim the $2.40–$2.60 region. Otherwise, another consolidation or lower support retest is possible. Currently, XRP shows relief strength, but confirmation is pending.