7 1

XRP ETFs Absorb $756M Amid Price Fall, Traders Shift to Maxi Doge

Summary:

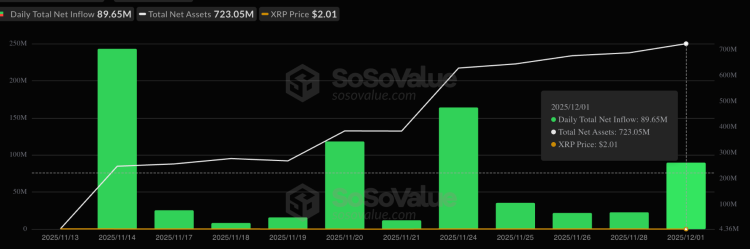

- XRP ETFs have absorbed approximately $756 million in inflows, indicating institutional interest as the token nears $2. This suggests a shift of supply from retail to institutional investors.

- The divergence between ETF inflows and spot price leads smaller traders to pursue high-risk meme tokens for potential high returns.

- Meme tokens are evolving into active trading communities offering games, leaderboards, and incentives, moving beyond static symbols.

- Maxi Doge targets retail traders with a focus on leverage, community-driven trading tournaments, and aggressive trading culture.

Institutional participation in XRP via ETFs reflects long-term confidence despite a declining spot price, pushing retail investors towards high-volatility meme markets. Meme tokens like Maxi Doge capitalize on this trend by creating dynamic, engaging ecosystems that reward risk-taking and community participation.

Meme markets are no longer just about branding; they're about cultivating communities with real utility and competition. Projects like Maxi Doge appeal to those seeking significant gains through leverage, integrating features like staking with high APYs and strategic treasury management to sustain engagement.