8 0

XRP ETFs Begin First Full Week Together Amidst $687 Million Holdings

This week could be pivotal for XRP as five spot ETFs, including 21Shares' new fund, trade concurrently for the first full week. The combined ETF inflows have surpassed $660 million in less than a month with consistent trading days and no outflows. Bitwise has increased its XRP holdings to 80 million tokens, with ETF managers holding over $687 million in assets.

ETF Activity and Demand

- 21Shares launched with a $500,000 seed basket and a 0.50% management fee.

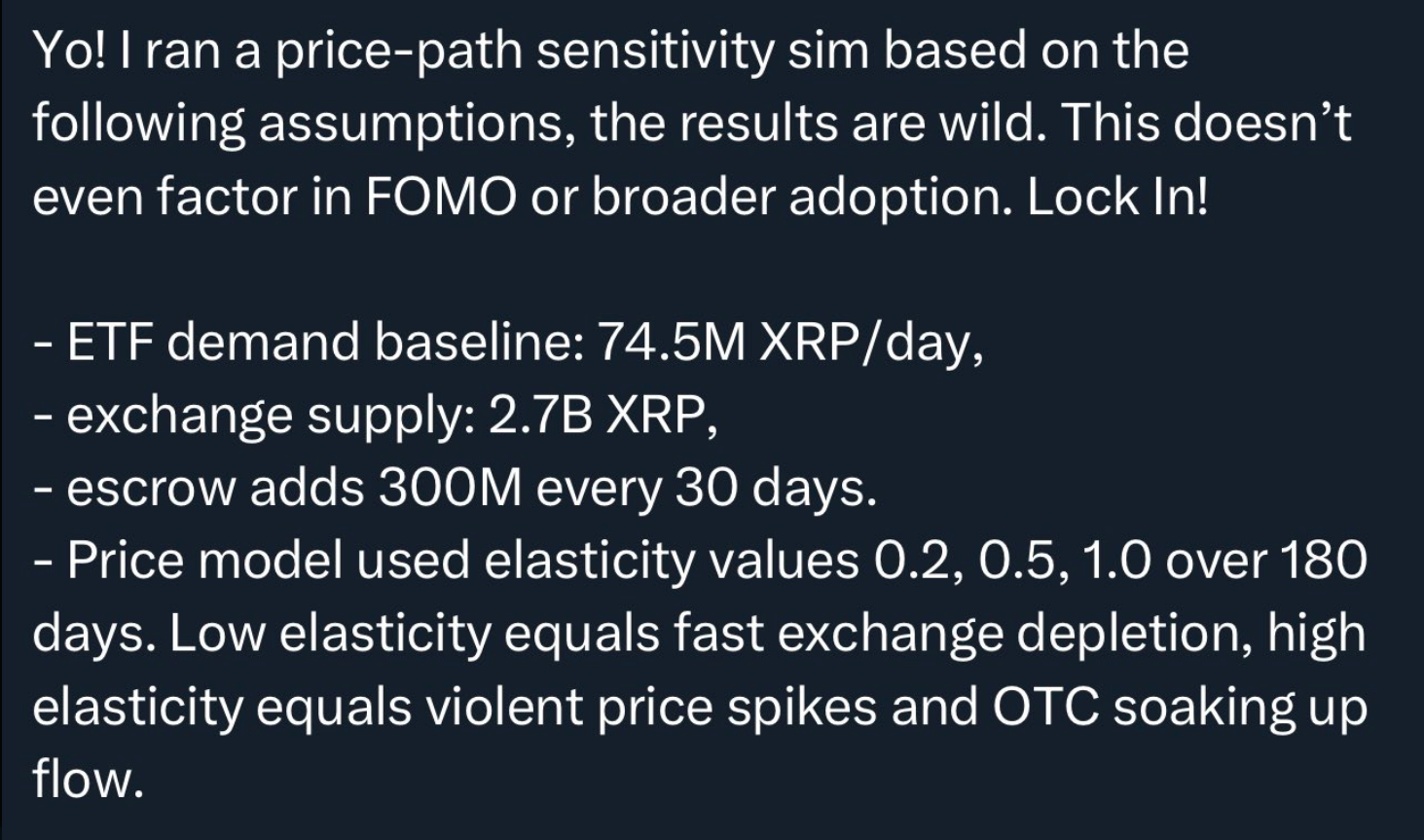

- A price-path sensitivity simulation predicts varying impacts on liquidity depending on elasticity values.

- Low elasticity could rapidly deplete exchange-held supply, while high elasticity might cause significant price changes.

Liquidity Concerns

- CEO of Digital Ascension Group warns about private OTC and dark-pool channels potentially running thin.

- 800 million XRP of private liquidity may have been absorbed in the first week of ETF activity.

- If ETFs need to buy from public exchanges due to dried-up OTC channels, market volatility could increase.

Whale Movements

- The top 10,000 wallets control 51.39 billion XRP, equating to roughly 85% of the circulating supply.

- 78 new wallets acquired over 77 million XRP in one day, with notable single acquisitions of up to 35 million XRP.

- 44 new wallets amassed over 300 million XRP each, indicating quiet accumulation during market weakness.

Future Implications

- The situation is more about testing liquidity than just demand.

- Current ETF holdings are substantial but small compared to potential daily demand if inflows continue.

- Traders will monitor order books, OTC reports, and ETF filings to assess future supply dynamics.

Featured image from Trading News, chart from TradingView