6 0

XRP ETFs Inflows Near $1 Billion Amid Price Decline

The US spot XRP ETFs have recorded inflows for thirteen consecutive days, accumulating a total of $895 million by December 3. On that day alone, inflows were $50.27 million, with Grayscale’s GXRP contributing $39.26 million.

- The rapid increase in inflows approaches the $1 billion mark, considered key for attracting long-term institutional interest.

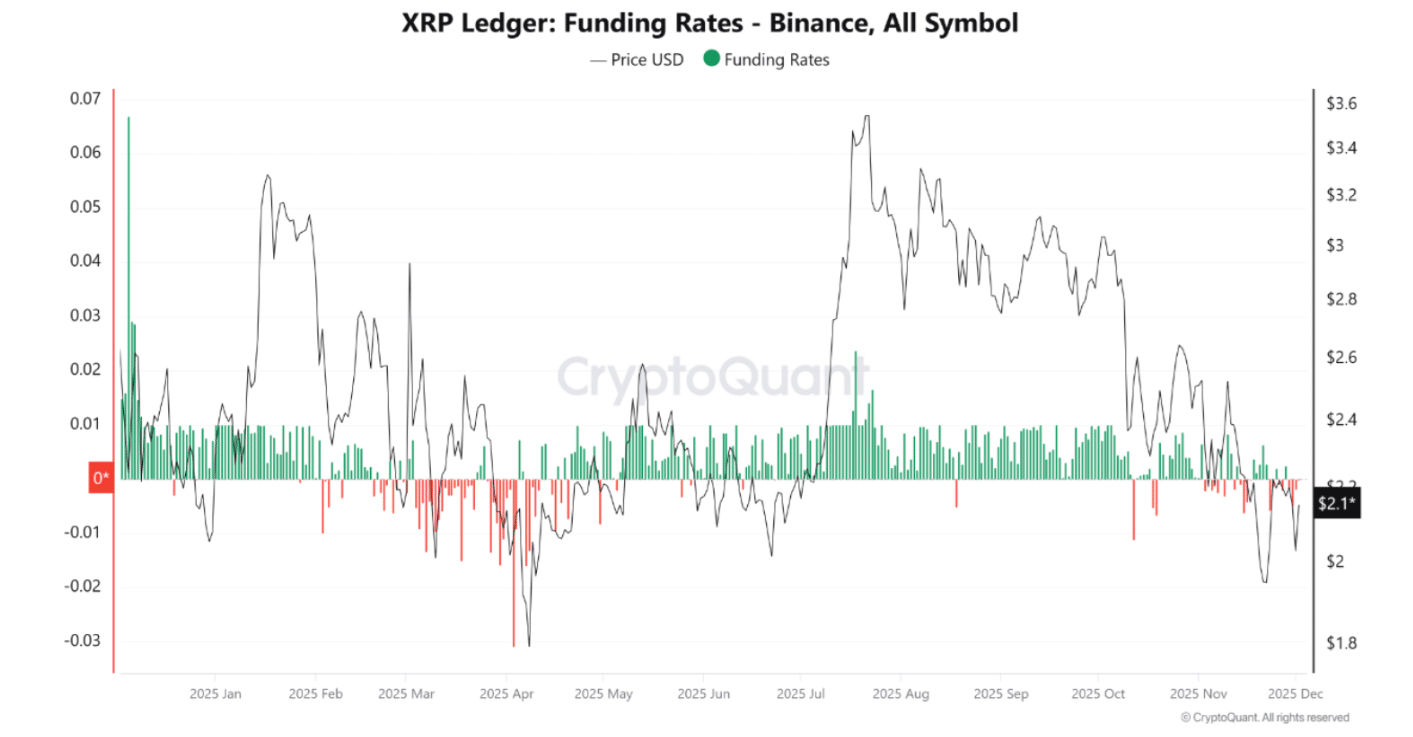

Short Pressure in Derivatives Markets

- XRP is trading near $2.16, experiencing a 1.11% decline in the last 24 hours.

- Futures data indicates persistent negative funding, suggesting dominance of short positions over long positions.

- The market sentiment remains weak, correlating with recent price declines.

- Increased short positions may pressure the price to revisit the $2.0 to $1.9 range.

- A CryptoQuant analyst suggests a potential sideways drift if negative funding persists.

- Closure of short positions could push XRP towards the $2.25 to $2.35 range.

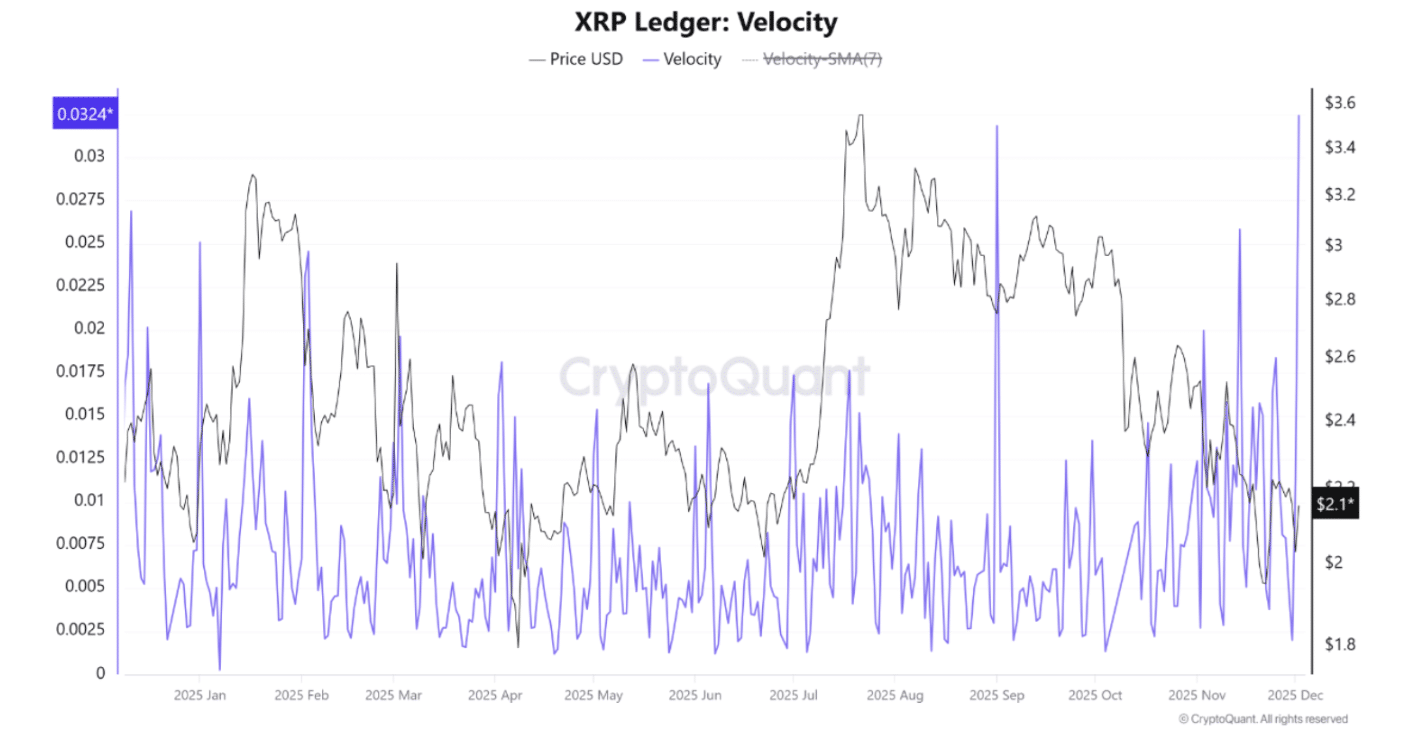

XRP Price Outlook

- The XRP ledger witnessed heightened activity on December 2, with circulation speed reaching a yearly high of 0.0324.

- Analyst Ali Martinez noted XRP's trading within a downward parallel channel on the 4-hour chart, with resistance near $2.28.

- If XRP surpasses $2.28, it might target $2.75 as buyers aim to regain control.

This analysis highlights the current trends and market pressures affecting XRP, providing insights into potential future movements based on existing data and market behavior.