6 0

XRP Early Holders Cash Out as Token Tests Key Resistance Levels

XRP has experienced a significant rally, trading above $2, more than three times its pre-rally base from October 2024. Early retail holders are now cashing out, leading to increased profit-taking.

- Investors who bought below 60 cents are realizing gains of over 300%.

- The 7-day simple moving average of realized profits reached $68.8 million, the highest in over a year, indicating distribution pressure.

- XRP struggled to break above $2.20 recently due to this profit-taking despite positive market sentiment.

While regulatory clarity in the U.S. and Ripple's advancements in tokenized assets support a positive long-term outlook, current price action reflects supply overhang from long-term holders.

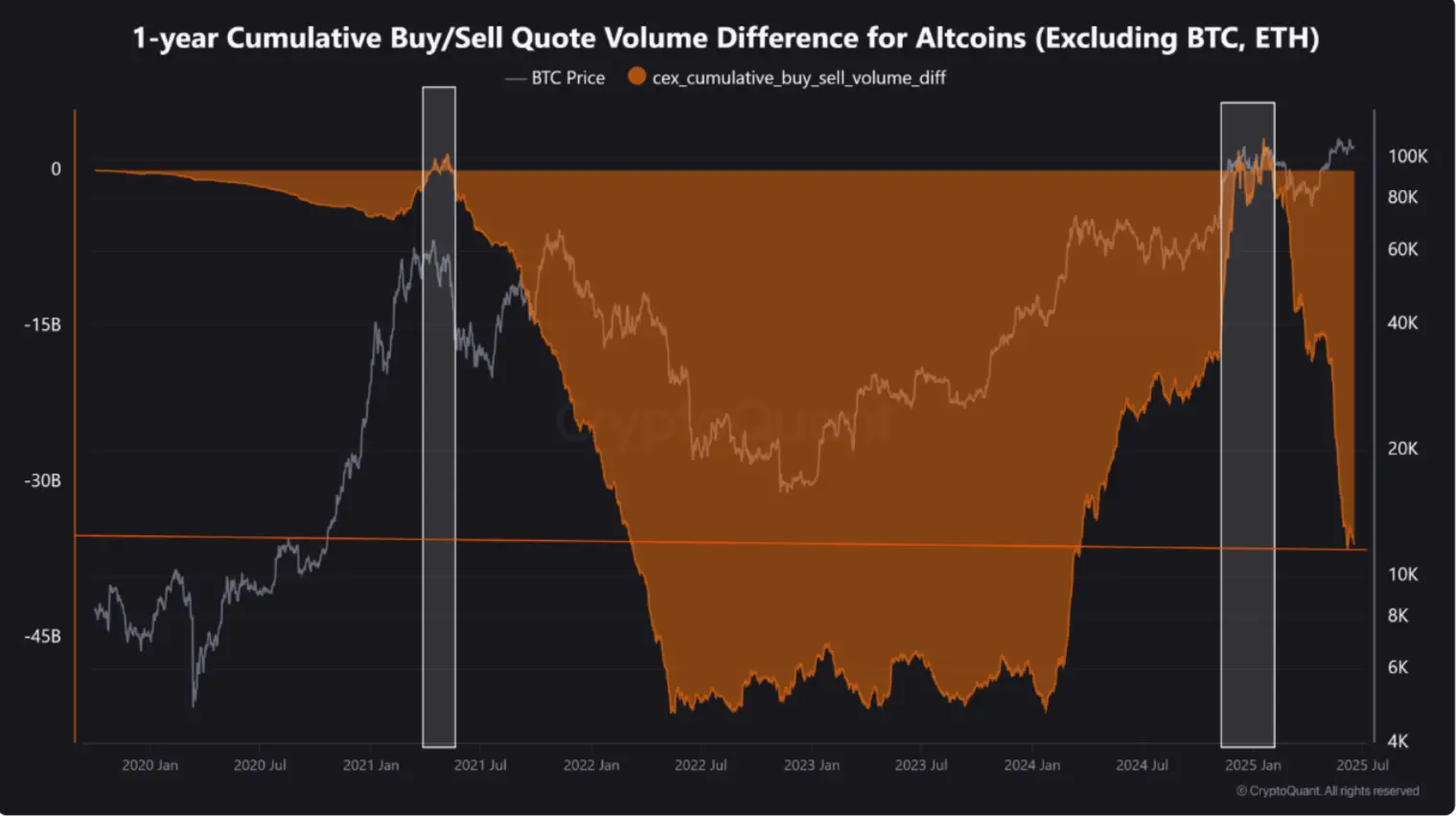

- The net investor flow for altcoins is negative $36 billion, indicating a sharp decline since December 2024.

- The overall altcoin market remains bearish, with limited strength outside of specific tokens like XRP and SOL.

- Future prospects for an "altseason" depend on renewed risk appetite and capital flow into Layer 1s, DeFi, and gaming sectors.