1 0

BEARISH 📉 : XRP holders face losses as SOPR falls below 1

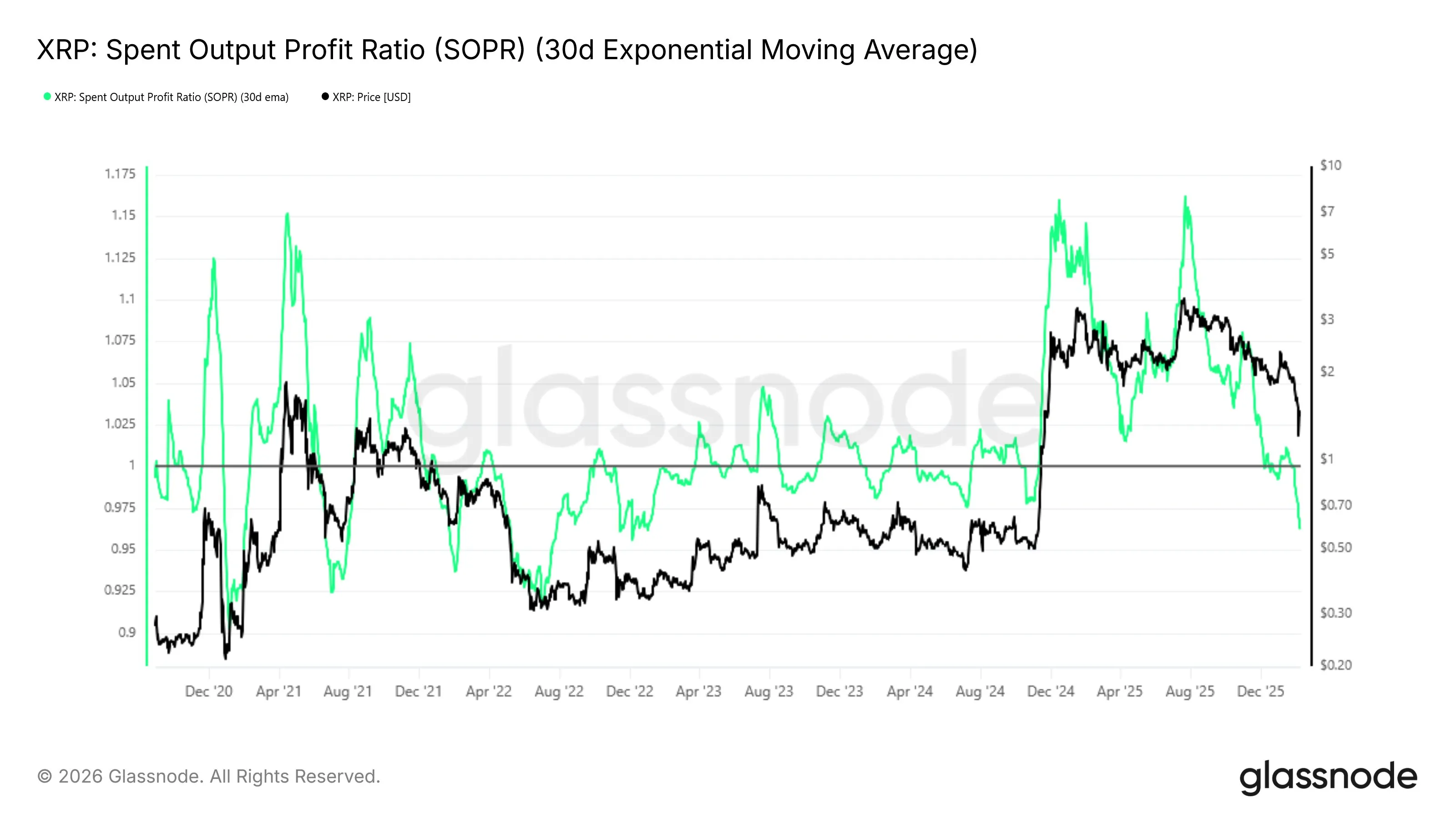

XRP has fallen below its aggregate holder cost basis, suggesting potential capitulation and loss realization. Glassnode noted this pattern could indicate a slow grind toward stabilization rather than an immediate rebound.

- Glassnode observed a decline in the Spent Output Profit Ratio (SOPR) from 1.16 to 0.96, indicating significant losses for holders and negative on-chain profitability.

- SOPR below 1 suggests coins are being sold at a loss, similar to trends seen between September 2021 and May 2022, which involved prolonged consolidation before stabilization.

- On February 9, Glassnode highlighted XRP's market structure resembling April 2022, with newer buyers accumulating below the cost basis of longer-held supply.

- Some market participants see the sub-1 SOPR as a signal of transferring supply from weaker to stronger hands, potentially forming a durable base.

If the current trend continues, XRP might remain in a loss-realization phase until marginal sellers are exhausted, setting the stage for stability once profitability metrics improve and SOPR returns above the break-even point.

At present, XRP is trading at $1.4225.