4 0

XRP Tests Key Inflection Zone with Potential Reversal at $2.50

XRP is currently testing a significant resistance zone above $2.00, with analysts Dom and Osemka identifying key levels at $2.00, $2.22, and $2.50.

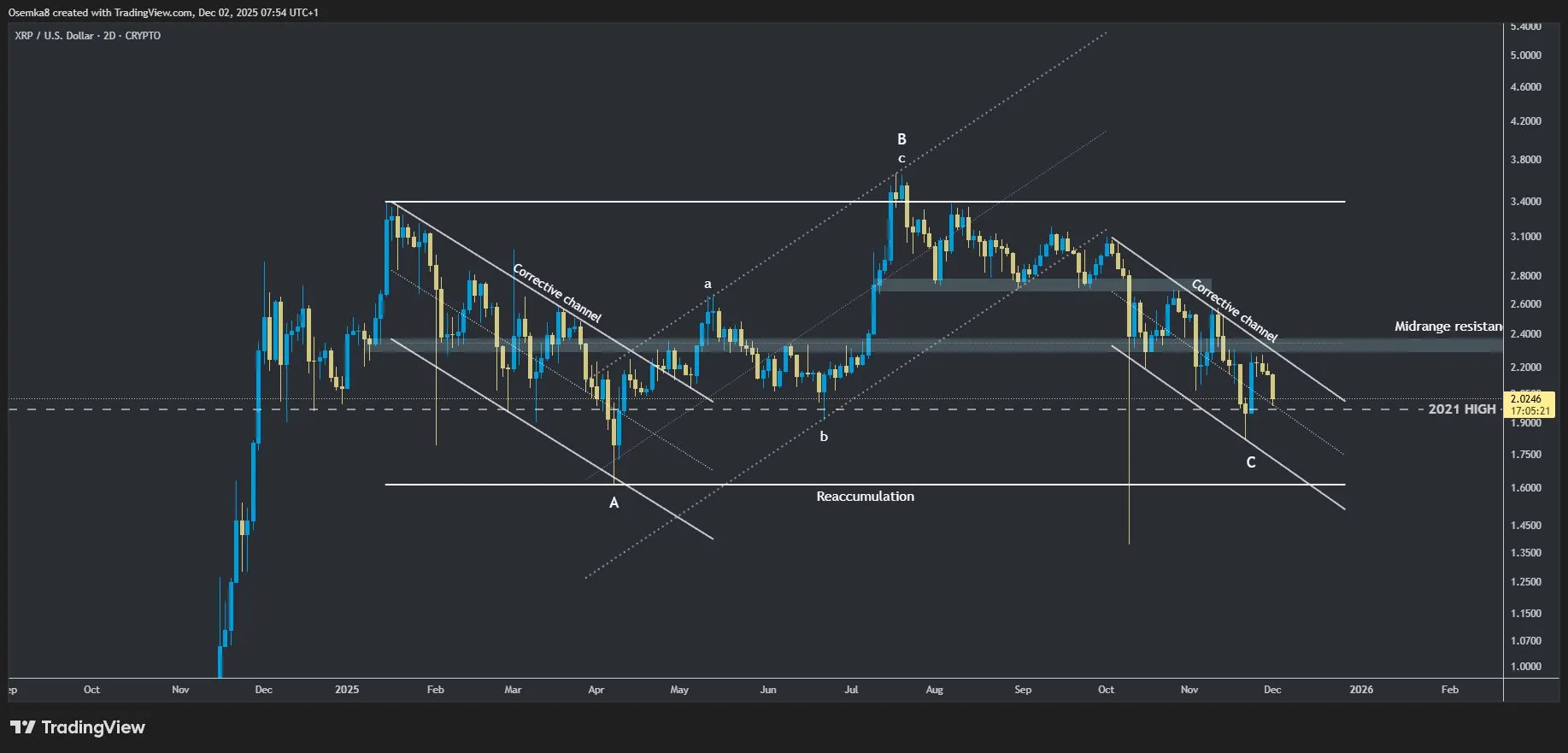

XRP Price Analysis

- Osemka views the current structure as a flat correction based on the 2021 high, suggesting this is an accumulation range.

- XRP oscillates in a horizontal band with support aligning with the 2021 high.

- An A–B–C corrective sequence is observed, with the C leg in a downward channel.

- A deeper test of support might present a buying opportunity if the lower range is breached.

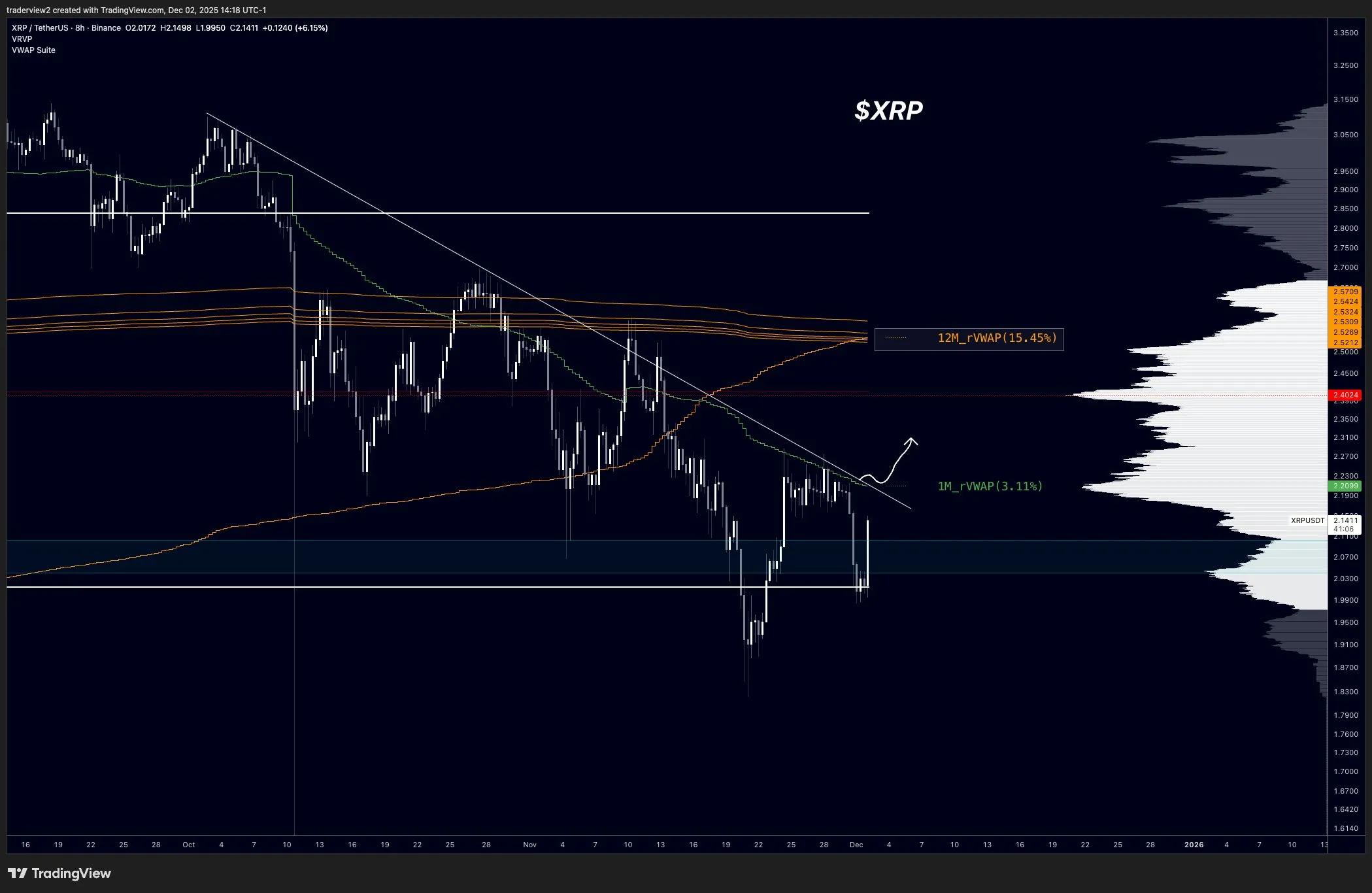

Potential Reversal Indicators

- Dom highlights a three-drive pattern over the last six weeks as a potential reversal setup.

- A higher low has formed, suggesting a possible trend change.

- The monthly rolling VWAP at $2.22 is a critical pivot for a rally towards ~$2.50.

- Order-book data suggests favorable conditions for a trend shift if buyers step in.

If XRP fails to hold above $2.00, it risks dropping below this long-defended support level, potentially completing the C leg in the flat-correction structure.

Currently, XRP is trading at $2.1798, situated between crucial support at $2.00 and resistance at $2.22, with $2.50 as a potential upside target.