4 0

XRP Leverage Drops 59% Amid Speculative Market Retreat

The XRP derivatives market has experienced a significant shift, with leverage decreasing and funding rates normalizing. This indicates a reduction in speculative positions.

XRP Derivatives Market Update

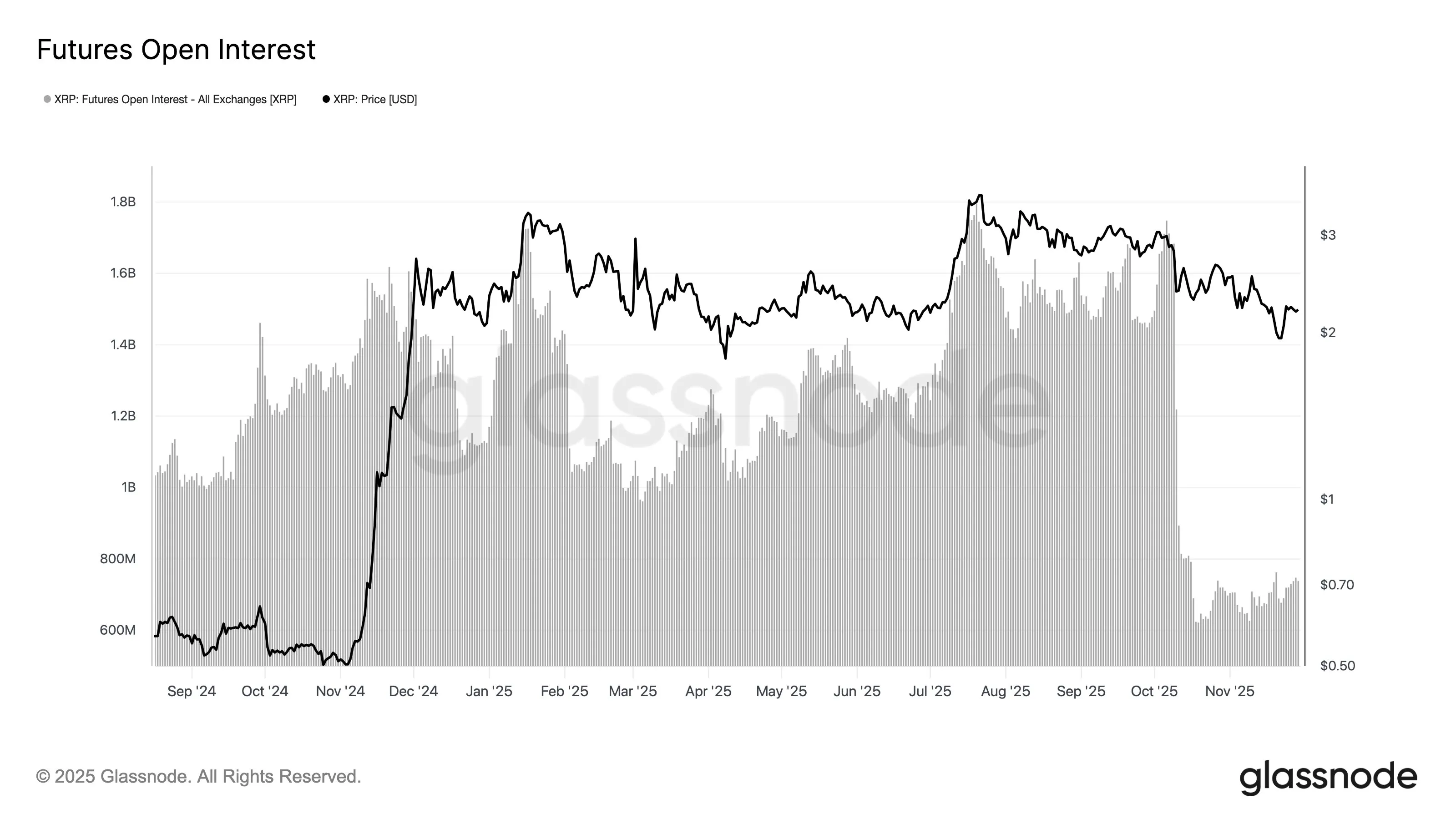

- Open interest for XRP futures dropped from 1.7 billion XRP in October to 0.7 billion XRP, indicating a 59% decrease in leveraged positions.

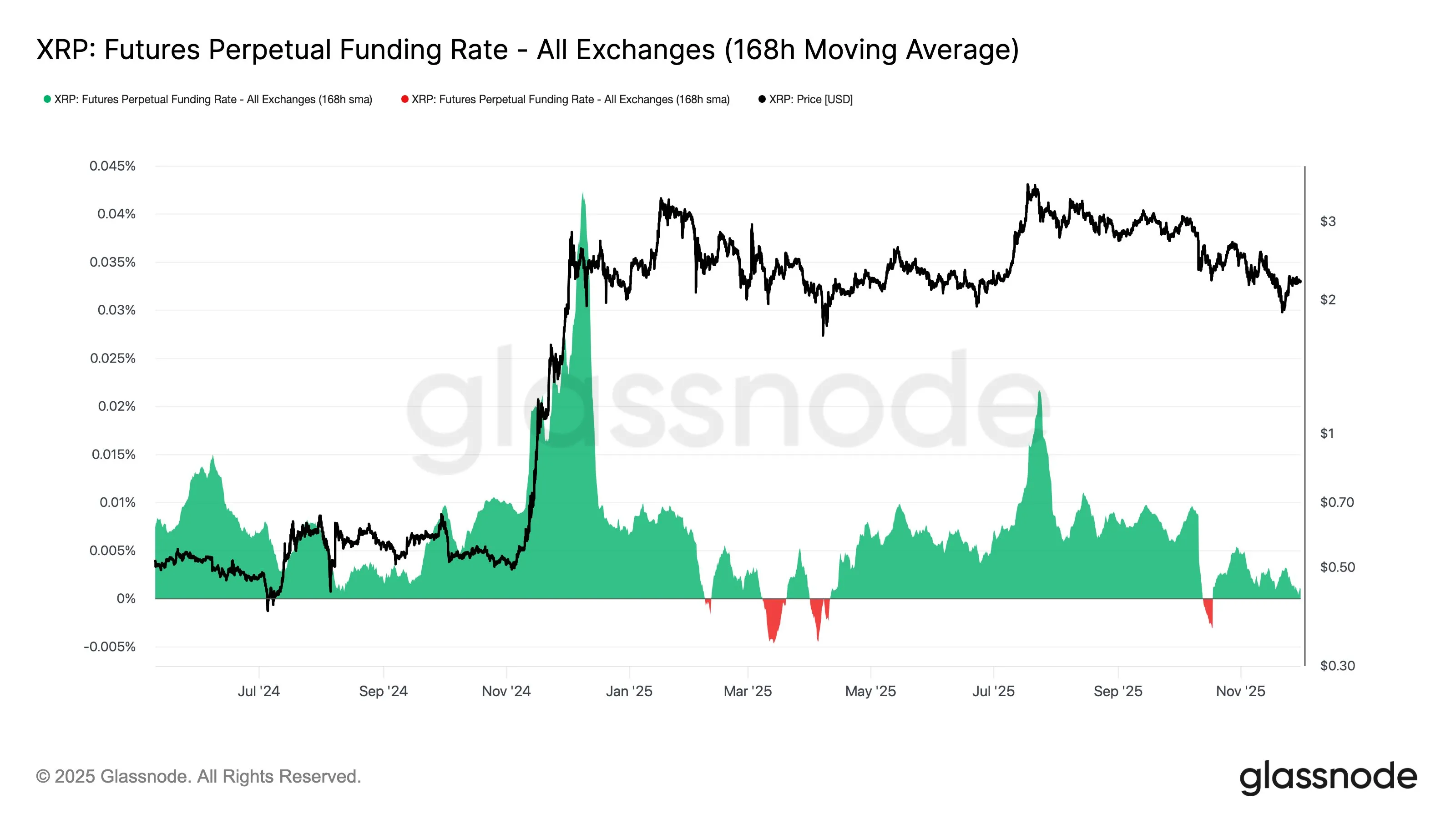

- Funding rates decreased from approximately 0.01% to 0.001%, suggesting reduced demand for leveraged long positions.

- This shift is described as a structural pause, moving from aggressive speculation to a more balanced market stance.

- Profit realization surged by about 240% during a price decline from $3.09 to $2.30, indicating profit-taking during weakness rather than strength.

- As of November 17, 41.5% of the XRP supply sits at a loss, despite higher trading prices, highlighting a fragile market dominated by late buyers.

Overall, Glassnode's data reflects a substantial deleveraging in the XRP market, with a transition to near-neutral funding rates and a cautious investor approach.

At press time, XRP was trading at $2.04.