8 0

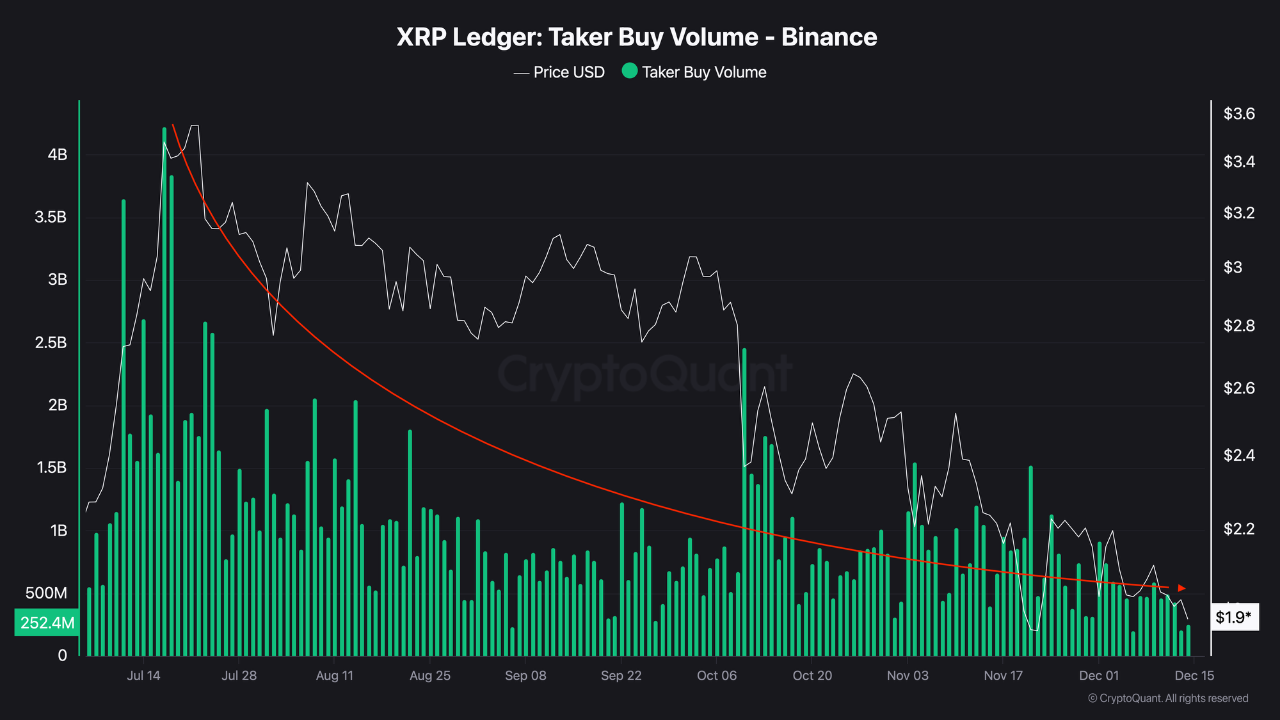

XRP Liquidity Dries Up: Futures Buy Volume Plummets 95.7% on Binance

XRP has dropped below $2, reflecting broader market deterioration and altcoin struggles. Key points include:

- Market conditions are challenging for altcoins as Bitcoin captures liquidity and attention.

- XRP's trading activity, both spot and derivatives, has significantly decreased, indicating reduced investor risk appetite.

- The Taker Buy Volume on Binance plummeted from over $5.8 billion in July to about $250 million, a 95.7% decline.

- This reduction highlights dwindling buying pressure and low trader confidence.

XRP Liquidity Compression and Market Context

- Broader market stress continues, with liquidations and fragile confidence impacting XRP negatively.

- Bitcoin absorbs most capital, limiting altcoin recovery potential, including XRP.

- Sustained drop in aggressive buying on Binance shows depth of demand erosion.

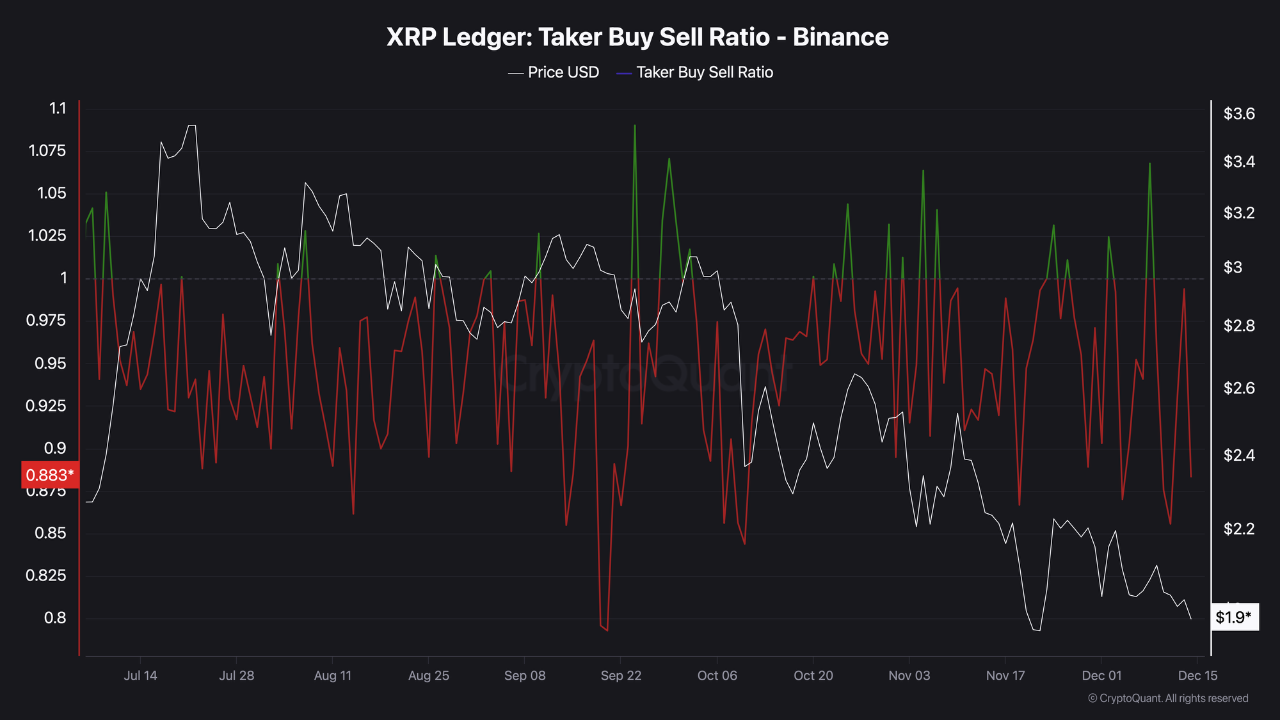

- The Taker Buy Sell Ratio remains negative, indicating seller dominance in the derivatives market.

XRP Price Movement

- XRP is below its key moving averages, reinforcing bearish momentum.

- The price has formed lower highs and lows, confirming a medium-term downtrend.

- The $1.70–$1.80 area represents the next major support level if selling pressure continues.

- Volume has decreased since August, showing weak participation and dip-buying interest.

For a trend reversal, XRP needs to reclaim the $2.30–$2.50 range with increasing volume, indicating renewed demand.