6 0

XRP Corrective Path Clears: Market Poised for Drop Toward $2.03

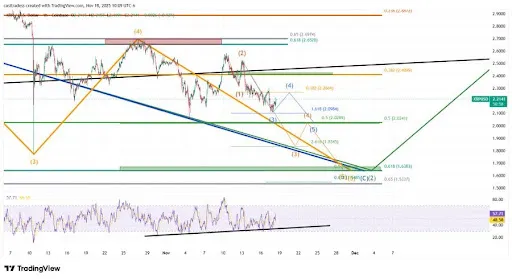

XRP is displaying a corrective price structure, with a potential decline toward the $2.03 support level. The current market behavior indicates that XRP is in a Wave 2 correction phase, characterized by a slow and choppy pullback.

Key Points from CasiTrades Analysis:

- XRP may reach the macro 0.5 Fibonacci retracement level at $2.03 unless it breaks above the macro 0.382 Fibonacci resistance at $2.41.

- If XRP fails to surpass $2.41, the chart suggests a downward movement to $2.03 is likely.

- Another possible target is $1.65, aligning with the 0.618 Fibonacci level. This would not indicate weakness but could serve as a foundation for a significant upward move.

Market Dynamics:

- Accumulation tends to occur at key Fibonacci levels ($2.41, $2.03, $1.65) before any breakout.

- Several micro-cap tokens have shown strong movements, indicating an upcoming trend phase in the broader market.

The current corrective phase is seen as normal for XRP, which is expected to align with the overall market momentum after completing its structure. Investors are advised to maintain patience and discipline during this period.