5 0

XRP Ends May Showing Market Indecision Amid Bullish Options Activity

XRP, utilized by Ripple for cross-border transactions, showed market indecision at the end of May. Key insights include:

- A "doji" candlestick pattern formed, indicating indecision. Prices peaked at $2.65 but fell to levels near the month's start.

- Recent activity included purchases of $2.40 strike put options, providing protection against price declines.

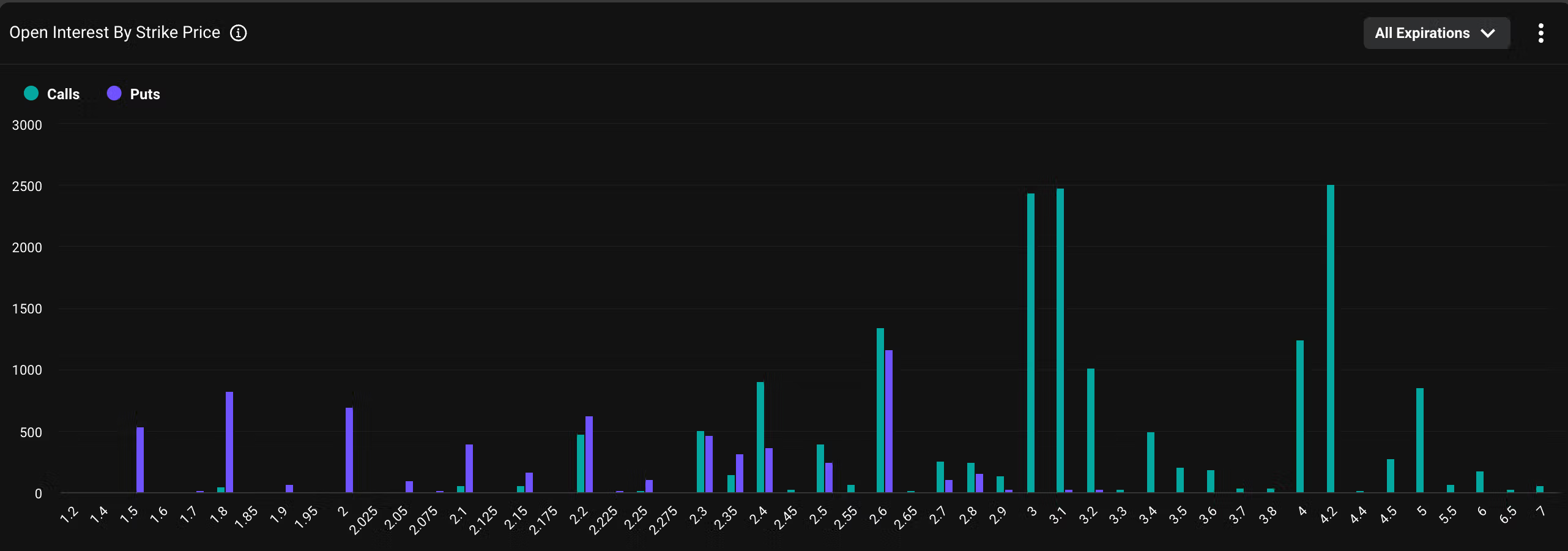

- Despite the doji signal, overall options open interest remains bullish, particularly for higher-strike calls between $2.60 and $3.0+, reflecting positive sentiment.

- Deribit CEO Luuk Strijers noted rising open interest with $4 call options leading at $5.39 million, followed closely by $3 and $3.10 strike options, each over $5 million.

- Monthly notional volumes are estimated at $65–$70 million, primarily on Deribit.

- Positive sentiment is driven by XRP's role in cross-border payments and expectations of a potential spot XRP ETF listing in the U.S.

- The B2B cross-border payments market is projected to grow to $50 trillion by 2031, up from $31.6 trillion in 2024.