1 0

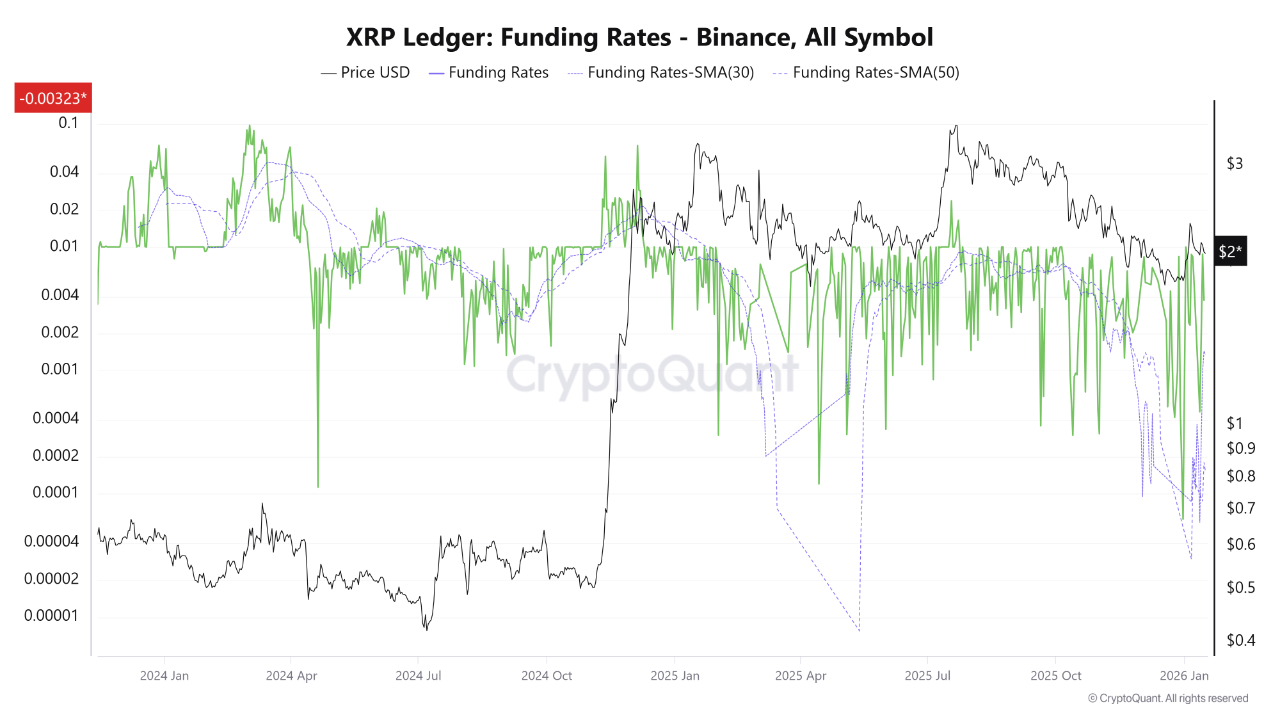

XRP Negative Funding Rates Suggest Potential Price Breakout After Consolidation

The XRP market experienced a 1% price decline over the past week, slipping below the $2.10 resistance after reaching a high of $2.17.

XRP Negative Funding Rates and Market Dynamics

- Funding rates in perpetual futures markets help align futures prices with spot prices.

- A positive funding rate often leads to price consolidation or correction due to long traders paying premiums to short traders.

- Negative funding rates can indicate a price bottom and potential short-term rebound.

- Currently, XRP's funding rate is around -0.00323, with SMA50 and SMA30 trending downwards, suggesting low chances of a significant sell-off.

- Historical data implies potential for a positive price breakout after consolidation, though not a major rally.

XRP Price Overview

- XRP currently trades at $2.06, marking losses of 0.24% over one day and 0.99% over seven days.

- Despite the decline, XRP shows a monthly gain of 13.45%, with many new entrants profiting.

- To establish bullish momentum, XRP must overcome the $2.10 resistance, targeting $2.60 and $3.00 subsequently.