XRP NVT Ratio Reached High of 1,162 Earlier This Month

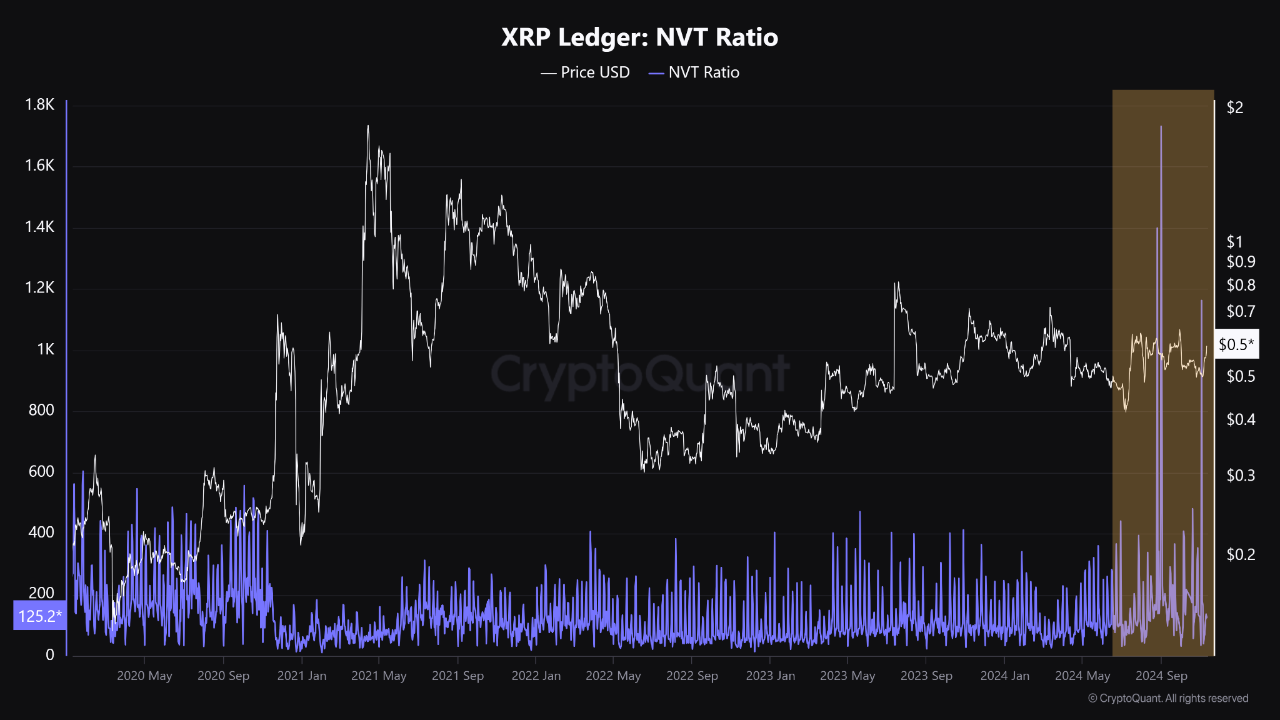

On-chain data indicates recent spikes in the XRP Network Value to Transactions (NVT) Ratio, which reflects the asset's market cap relative to its transaction volume.

XRP NVT Ratio Reached A High Of 1,162 Earlier In The Month

Analyst Maartunn from CryptoQuant discussed the XRP NVT Ratio, an indicator that compares market capitalization with transaction volume in USD. A high NVT Ratio suggests the asset may be overvalued, while a low ratio indicates potential undervaluation and a possible price rebound.

The following chart illustrates the XRP NVT Ratio trends over the past few years:

The graph shows significant spikes in the XRP NVT Ratio, particularly on the 2nd of this month, indicating that the market cap is not justified by transaction volume. Recently, the asset experienced a price increase of over 25%. However, if transaction volume does not increase, the rally may lose momentum.

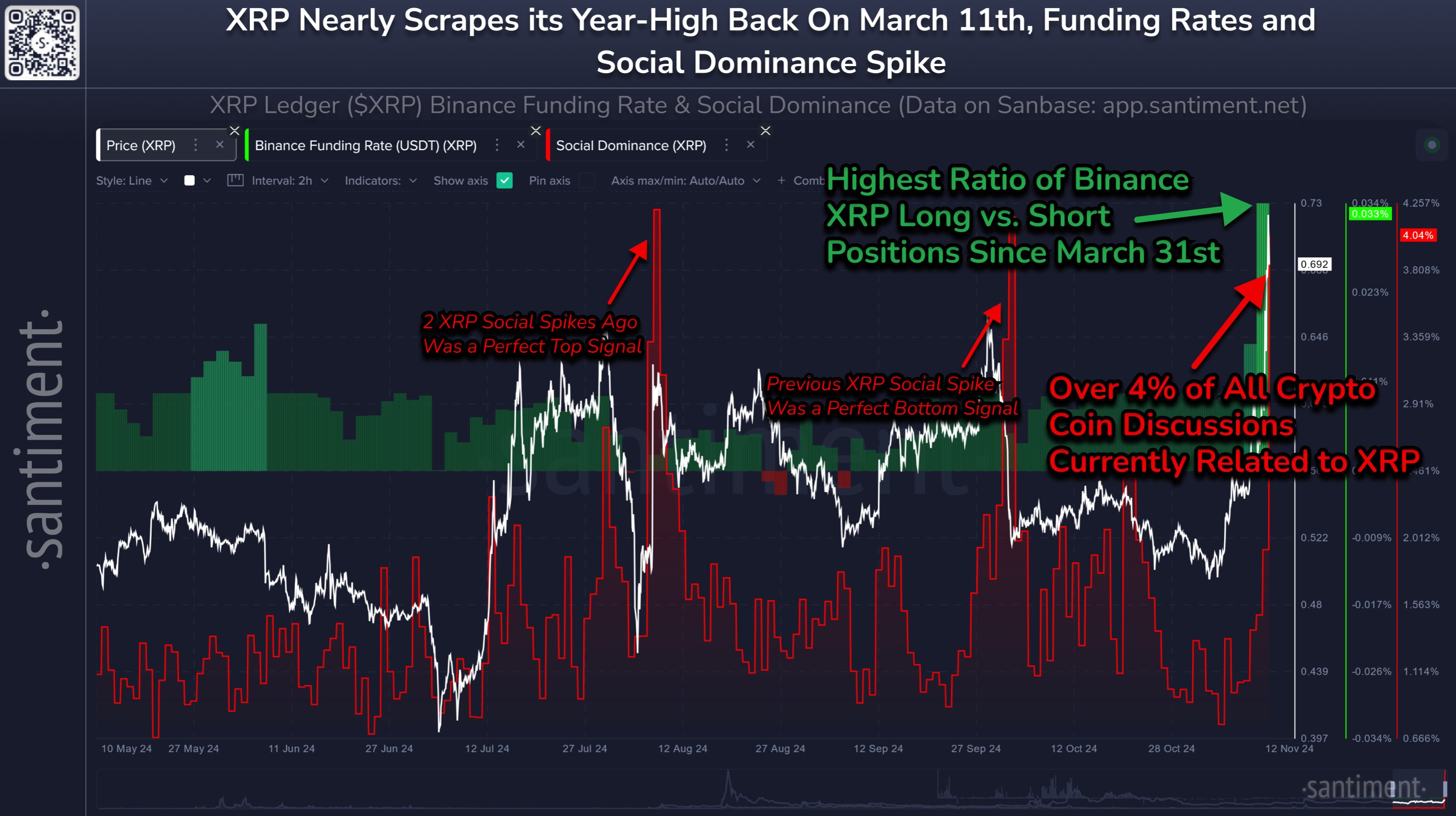

Additionally, signs of Fear Of Missing Out (FOMO) among investors could impact XRP's performance. Data from Santiment reveals increased FOMO indicators, such as the Binance Funding Rate and Social Dominance. The Funding Rate measures long versus short positions on Binance, while Social Dominance tracks XRP's share of discussions among the top 100 cryptocurrencies.

The chart below illustrates changes in these metrics for XRP:

The chart indicates a surge in long positions alongside the price increase, with the Funding Rate becoming highly positive. Social Dominance also rose, with XRP-related discussions accounting for over 4% of cryptocurrency sector conversations. This excessive hype may signal a market peak for the asset.

XRP Price

XRP peaked at $0.74 yesterday but has since pulled back to approximately $0.67.