6 0

XRP Open Interest Hits Lowest Since Nov 2024 Amid Liquidity Drain

XRP is experiencing significant selling pressure amid market uncertainty and risk aversion. Liquidity conditions are tightening, impacting assets like XRP that previously showed strength.

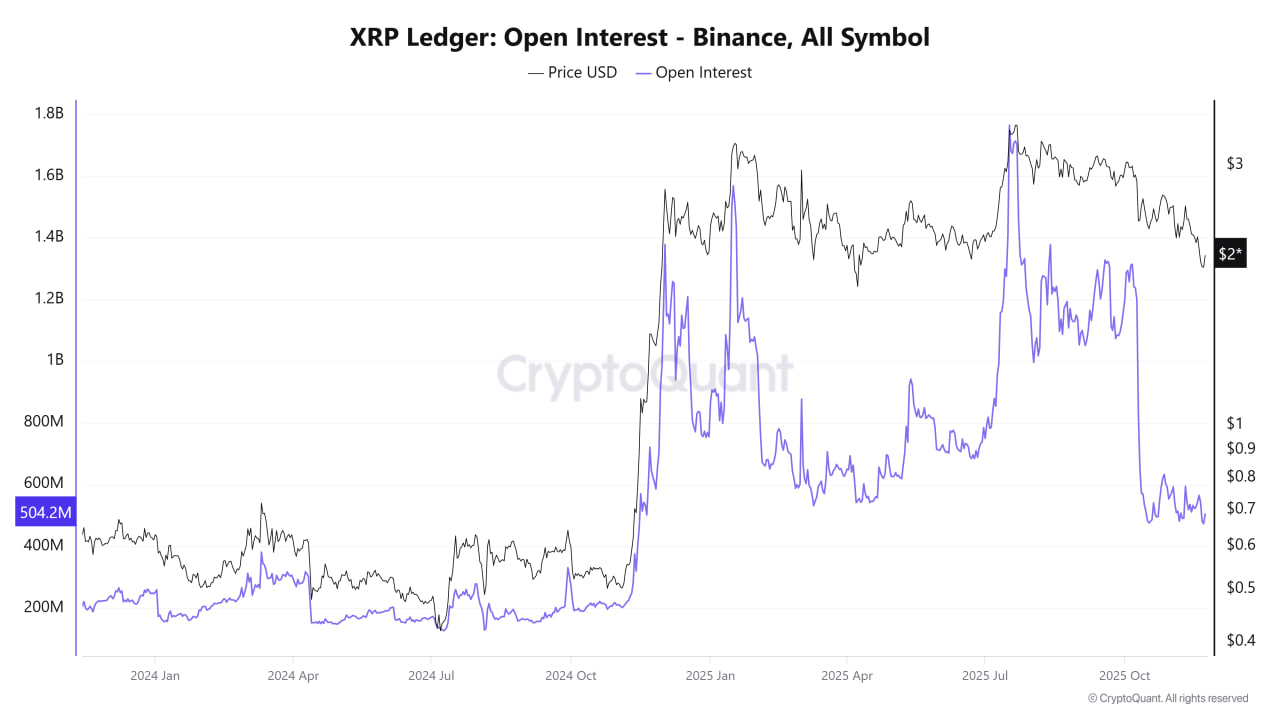

- XRP Open Interest on Binance has reached its lowest level since November 2024, indicating a decline in speculative activity and leverage in the market.

- Derivatives metrics show weakening sentiment and momentum for XRP, with reduced participation from both long and short traders.

- The CryptoQuant report highlights a sharp decline in XRP derivatives, with Open Interest falling from over $1.7 billion to about $504 million, further dipping to $473 million.

- This decrease reflects a major outflow of liquidity, with traders hesitant to sustain a clear trend. XRP's price fell to $2 after recently trading above $2.5–$3.

- Funding rates have been negative, suggesting persistent selling pressure as short sellers pay to maintain positions.

Overall, the data indicates fragility, with no signs of accumulation from large investors or institutions. Without a change in derivatives behavior, XRP remains under seller control.

XRP Price Shows Weak Rebound After Breakdown

- XRP failed to hold above the $2.50–$2.70 range, dropping to lows near $1.90 before attempting a modest rebound.

- Rejection from the 50-day and 100-day moving averages shows continued seller dominance, with both averages trending downward.

- The volume during selloffs indicates capitulation rather than accumulation, with weaker volume on recovery attempts.

XRP needs to reclaim the $2.40 level to shift sentiment; otherwise, it risks retesting $1.90 or even dropping to $1.70.