6 1

XRP Exchange Outflows Indicate Rising Long-Term Demand and Institutional Interest

The crypto market is experiencing heightened volatility, with XRP facing strong selling pressure. Despite this, significant developments are reshaping its ecosystem:

- XRP has seen unusual institutional activity with the launch of new US spot XRP ETFs by Canary Capital, Franklin Templeton, Bitwise, and Grayscale.

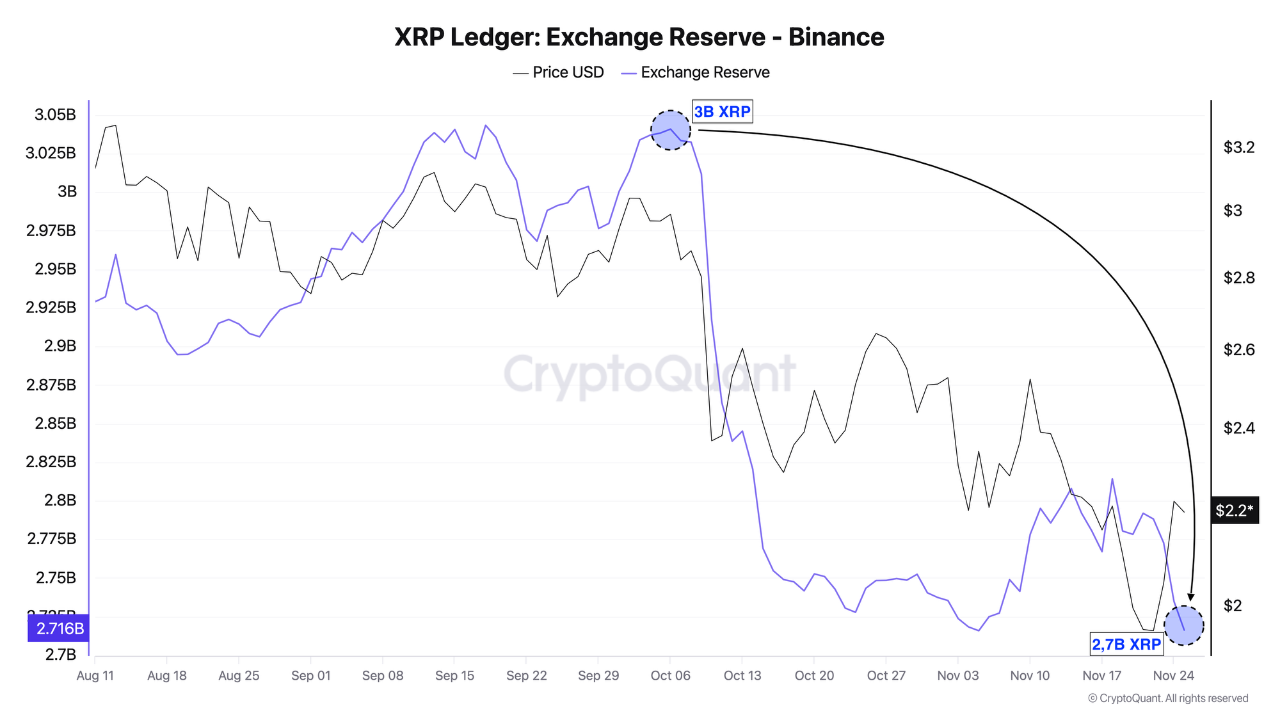

- XRP reserves on Binance have dropped to approximately 2.7 billion, indicating increased self-custody demand.

- A CryptoQuant report highlights a significant exchange outflow trend since October 6, with 300 million XRP leaving Binance, suggesting long-term bullish sentiment.

XRP's price action remains bearish, struggling to stabilize despite temporary support near the $2 psychological zone, aligning with the 200-day moving average. Key resistance levels at $2.40–$2.50 remain intact, with muted trading volume indicating a lack of strong buying conviction.

Overall, while there are signs of potential long-term accumulation due to institutional interest and declining exchange reserves, XRP's immediate outlook is hindered by prevailing bearish trends and weak volume.