XRP Price Consolidates After Breaking Resistance Levels Amid Analyst Warning

Recent technical analysis indicates that the XRP price is consolidating after surpassing key resistance levels. A crypto analyst has warned of a potential XRP price crash, advising investors to remain vigilant as the RSI remains significantly above 50%. The analyst's predictions through short and long-term XRP price charts suggest that despite possible corrections, the cryptocurrency remains in a bullish trend.

XRP Price RSI Indicates Potential Crash

The 4-hour XRP chart highlights a double tap structure in the Relative Strength Index (RSI), which measures momentum. This pattern often suggests further downward movement before a price stabilization.

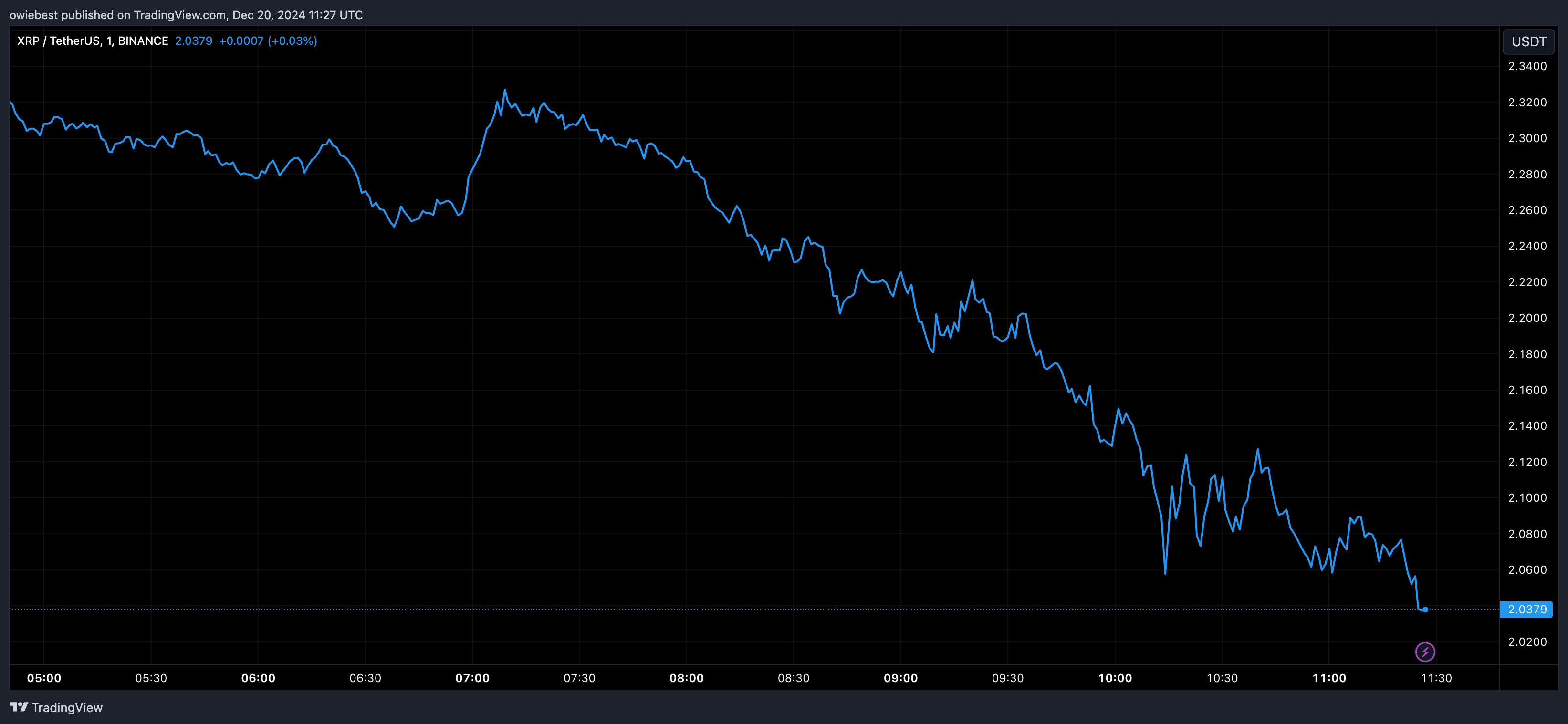

According to Dark Defender, a crypto analyst on X (formerly Twitter), recurrent dips in the RSI into oversold territory suggest that XRP may face a price drop to new lows. The XRP price previously found strong support at $2.17 but bounced back upwards. Currently, the XRP price is consolidating, which typically precedes an uptrend following a correction. Despite slight market recovery, the analyst cautions of another price decline as the RSI approaches oversold levels again.

Earlier in December, the RSI dipped below 30%; it is now above 50%, indicating a potential price correction between support levels at $2.17 and $2.18. Dark Defender predicts this crash could occur soon, with XRP expected to enter oversold conditions within a day.

Despite the anticipated correction, the broader outlook for XRP remains bullish, with expectations of an uptrend resuming post-correction. Dark Defender projects that XRP’s next target after the correction could exceed $3, representing nearly a 40% increase from the $2.17 support level.

XRP 3-Month Chart Suggests Strong Bullish Setup

Following warnings of a potential price crash, Dark Defender shared a 3-month chart analysis revealing a positive outlook for XRP. The chart indicates that XRP recently broke through a multi-year resistance level for the first time in over five years, suggesting a strong bullish shift.

The three-month green candle structure from October to December confirms strong buying pressure, positioning XRP favorably for a potentially bullish Q1 2025. A rounded bottom pattern appears on the 3-month chart, indicating a transition from downtrend to uptrend.

Dark Defender highlighted several Fibonacci levels as potential targets for XRP, predicting a rise of 261.80% to the 5.8563 Fibonacci level, translating to values between $5 to $9. Following that, an anticipated surge of 361.80% to the 18.2275 Fibonacci level could push prices between $16 to $28. Support levels at the 0.6649 Fibonacci level at $0.9 serve as a safety net during corrections.