3 0

XRP Price Weakens Amid Largest ETF Outflows and Declining Interest

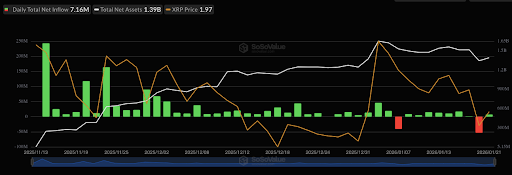

The market remains weak with concerns over another XRP price crash due to increased selling pressure and no signs of bullish reversal. Both retail and institutional activities are declining, reflecting weakened market confidence.

XRP Price and Market Dynamics

- XRP attempted to break above $2 but failed, stabilizing around $1.95 after a brief rally.

- Selling pressure persists with Spot XRP ETFs experiencing significant outflows, marking the largest since their launch in November 2025.

- Recent data show an outflow of approximately $53.32 million on January 20, primarily from Grayscale's GXRP ETF.

- Despite these losses, Franklin Templeton’s XRPZ recorded minor inflows of $2.07 million.

Continued outflows and decreased institutional activity could further lower XRP's price, despite a recent 1.62% rise over 24 hours.

XRP Open Interest Decline

- XRP’s Open Interest (OI) has dropped to new lows, indicating reduced trading activity and interest.

- Coinglass data shows futures OI fell to $3.35 billion, the lowest since January 1, 2026.

This decline suggests traders' diminishing optimism towards XRP's potential, possibly affected by geopolitical and regulatory uncertainties. The crypto Fear and Greed Index reflects extreme fear among investors.