11 1

XRP Price Faces Pressure Despite ETF Success and Whale Activity

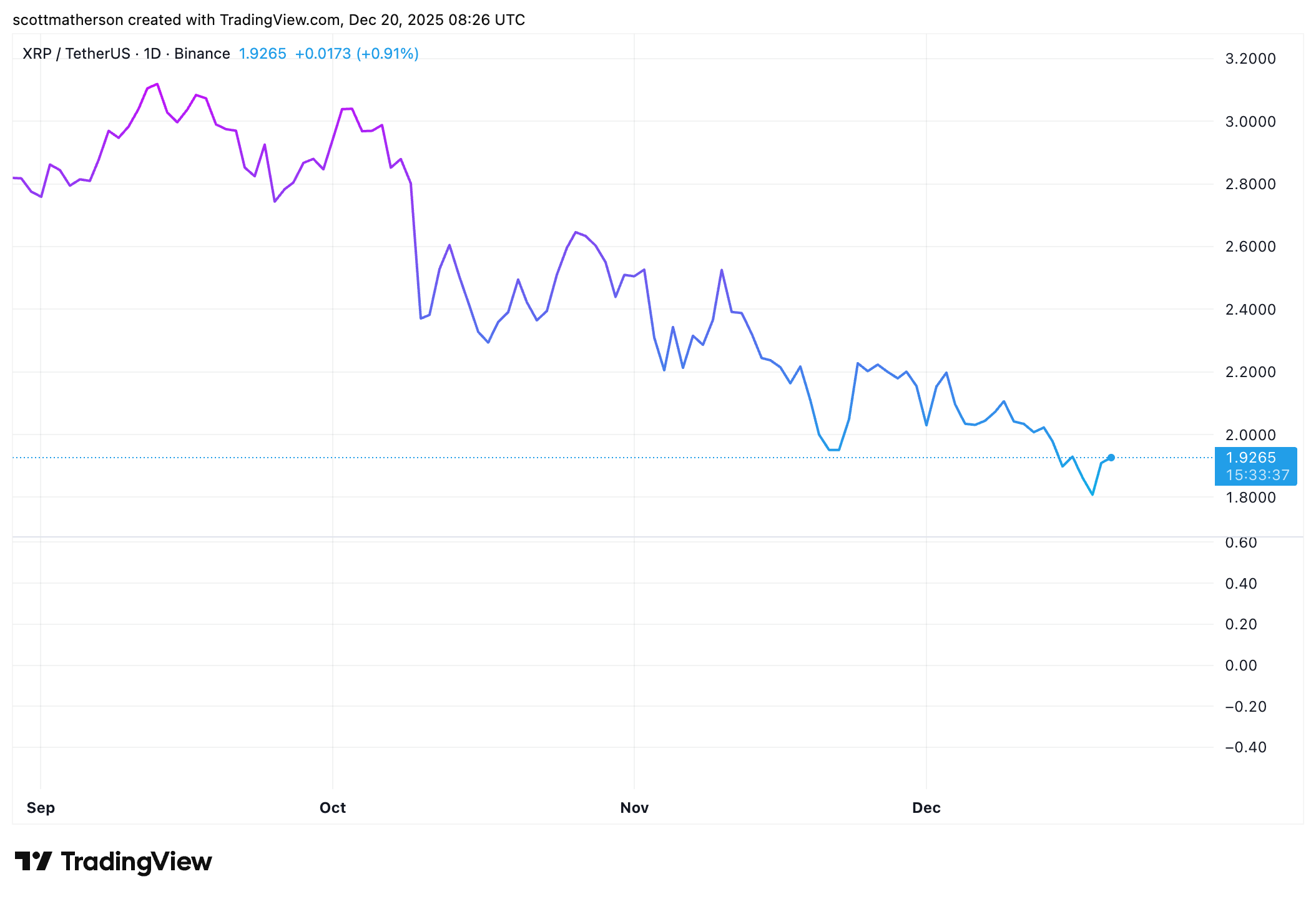

CryptoQuant's analysis highlights reasons for the recent decline in XRP price, which fell below $2 despite the XRP ETF approval.

Key Points

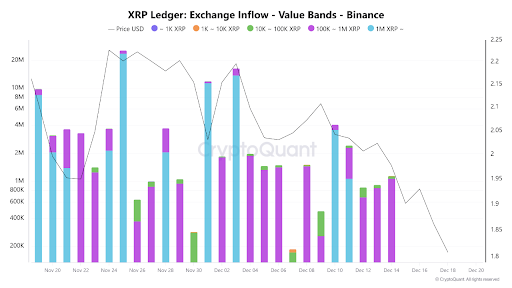

- Significant selling pressure is exerted by whales holding between 100,000 and over 1 million XRP.

- These whale movements contribute to major inflows into Binance, indicating a desire to sell.

- The resulting oversupply leads to lower highs and lows in price patterns, with no strong new spot buyers present.

- Major support levels are identified between $1.82 and $1.87, with potential further declines to $1.50-$1.66 if outflows continue.

ETF and Whale Strategy

- The XRP ETF process was expected to increase institutional demand but resulted in high-volume inflows to Binance instead.

- Whales used the ETF narrative to offload holdings as sell-side liquidity, impacting price stability.

- XRP ETFs have accumulated over $1 billion in net assets since launch, highlighting some success despite pricing challenges.

Currently, XRP trades around $1.90, marking a 4% increase in the last 24 hours.