XRP Price Soars 380% in 23 Days Amid Whale Activity

XRP has surged by 380% over the past 23 days, with a notable 75% increase in just four days, peaking at $2.87 on December 2. This rise is attributed to significant buying activity from large investors, known as "whales."

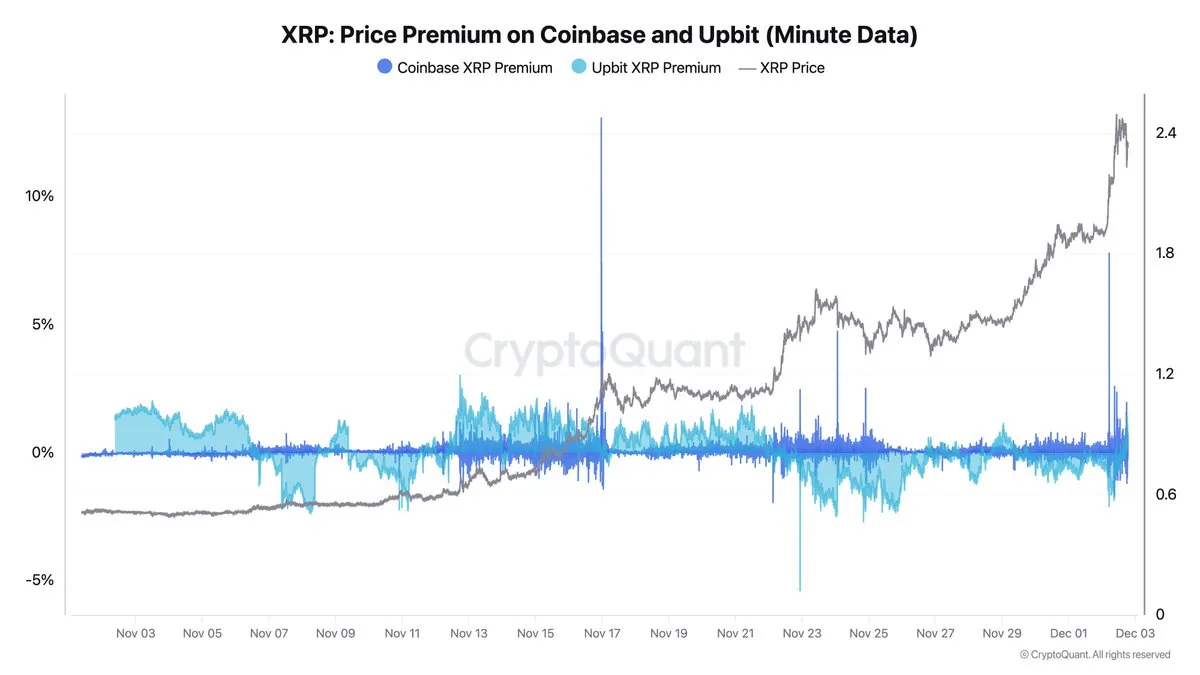

Ki Young Ju, CEO of CryptoQuant, stated that these whales are primarily trading on Coinbase. On December 2, he noted that "Coinbase whales are driving this XRP rally," with premiums ranging from 3% to 13% during the surge. In contrast, Upbit, a Korean exchange, showed no significant premium, indicating the buying pressure is mainly from the U.S.

Ju also suggested possible insider activity affecting market dynamics, stating, "Someone knew something." He cautioned against shorting XRP, as a $25 billion deposit before the pump could indicate market manipulation or front-running. This whale may possess information about potential bullish developments, such as spot ETF approval.

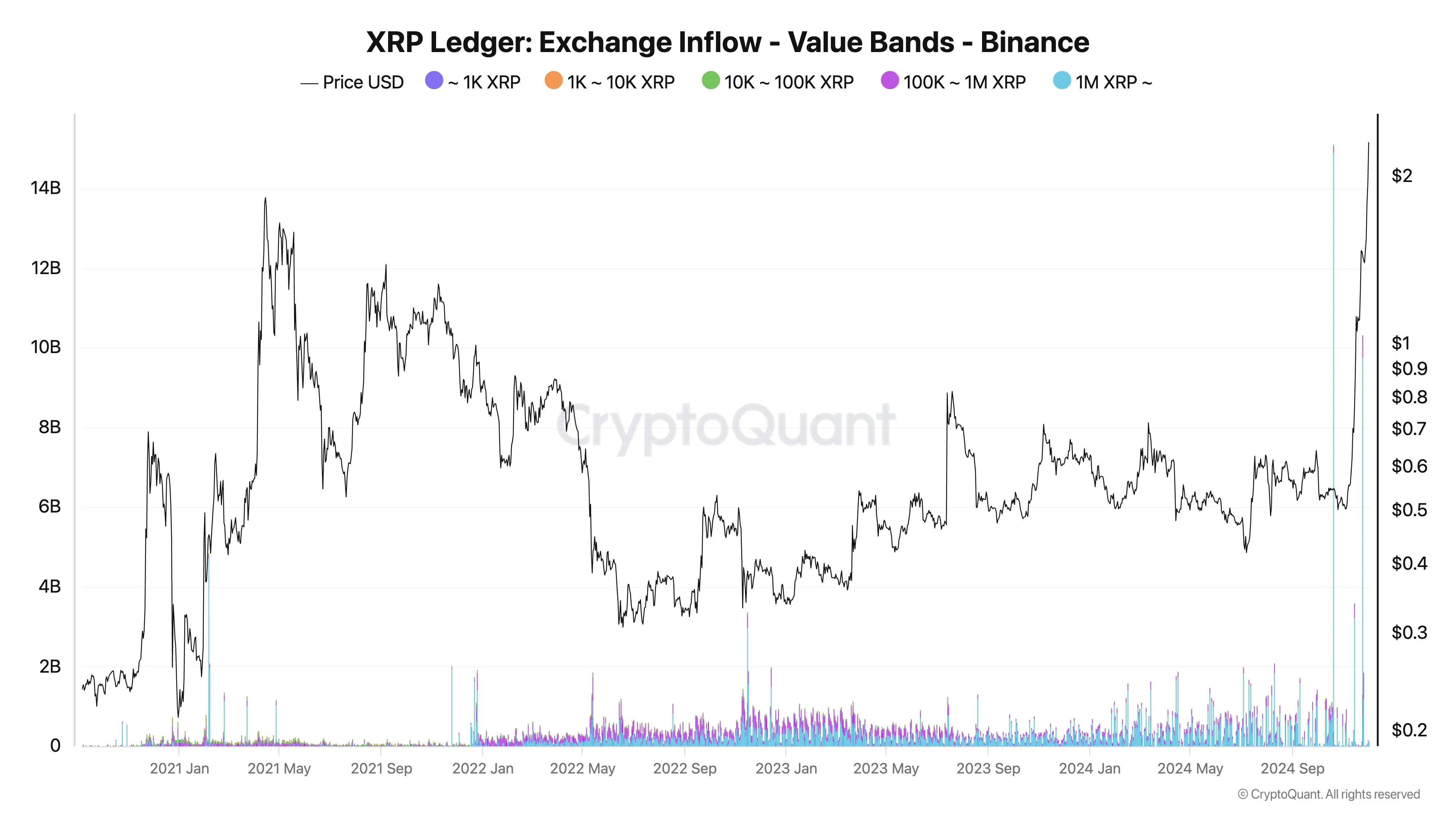

Ju shared a chart showing that retail trading activity for XRP has exceeded 2021 highs and is approaching levels last seen in January 2018, when XRP reached an all-time high of $3.92. The one-year cumulative volume delta (CVD) indicates aggressive market orders from whales, creating significant demand.

A 700% Rally Incoming For XRP Against BTC?

Crypto analyst Jacob Canfield highlighted the importance of the XRP/BTC pairing, noting it is at a critical resistance zone. XRP recently reached the $2.75 level on the USDT pair, a resistance point since December 2019. Canfield suggested that a breakout could lead to a 240% move back to key resistance zones from 2017 to 2019. He speculated that if FOMO occurs, XRP could see a 700% move to its all-time high against Bitcoin.

Canfield emphasized using support and resistance levels in shorter time frames to identify entry points, particularly in bull markets. He indicated that $2.20 serves as a key support/resistance level for re-entering trades.

At press time, XRP traded at $2.63.